FruitTrop Magazine n°246

- Publication date : 24/01/2017

- Price : Free

- Detailled summary

- Articles from this magazine

A good month for specialized reefer owners and operators of large tonnage has come to be defined in terms of fleet capacity optimization levels, and no longer the average TCE rate. In this context, much of the second half of 2016 fell into this category. While the spot market has not completely disappeared, activity levels have fallen dramatically - the factors and variables that impact on the demand for tonnage have changed now that the carriers have invested heavily in slot capacity and therefore have greater flexibility at their disposal.

It is unlikely that this new dynamic will change. Within the new environment there is scope for spot market excitement, but it is limited: going forward, a good squid catch in the South Atlantic, when it happens, is realistically the only success determining factor of what used to be the seasonal February through April peak season. Otherwise, the annual banana surplus east of the Andes between September and November, which brings some life to the charter market in the second half of the year, brought more misery to banana charterers than it did opportunity for the second successive year. This will change - but only once the economies of the principal Black Sea and North African receivers recover and their ports re-open!

The short-term chances of this happening are slim indeed and this autumn saw something of a reverse – or, put another way, another nail driven into the coffin of the charter market! The Algerian government has taking a more active role in what the country imports and has imposed quotas on bananas and seed potatoes in much the same way Nigeria has imposed controls on certain import items. Both trades rely heavily on the reefer. The reason behind the new restrictions is the combination of the low price for oil and the currency (US$) required to pay for the cargo. The Algerian Dinar is weak – it has lost 23% of its value against the greenback over the course of the past 24 months.

The Algerian intervention is a double whammy for the reefer business. Firstly, quotas and licences tend to favour smaller container-friendly consignments and stem the outflow of funds - the number of reefer vessels discharging bananas into Algerian ports in the second half of 2016 fell dramatically when compared to the corresponding period in 2015. Secondly, the loss of Algeria as a market has put greater pressure on Mersin, as the Turkish port is now the only destination in the eastern Mediterranean in which reefer vessels can discharge spot traded bananas. The general volatility and low CIF value achieved between September and December discouraged speculation, despite the low exit price for bananas in Ecuador and competitive rates on offer from both carriers and reefer operators. A lot of fruit was left behind!

From the Period business perspective, what was good news for owner/operator Maestro was the opposite for Chartworld, as the former wrested Chiquita’s 4-vessel Med banana service away from the latter. As it stands, the Seatrade pool will absorb the four vessels re-delivered by Del Monte and Turbana, plus two from De Nadai at a time when the operator is introducing its own high capacity, fully cellular ships. These are to be deployed in the liner service between New Zealand and Europe at the expense of its conventional tonnage.

It will be interesting to see how Seatrade rises to the challenge. The combination of the dismal performance of the spot market, aggressive pricing from the lines, the containerization of core reefer trades and more of the same likely in 2017, when the market will have to absorb the additional ‘inconvenience’ of four specialized reefer newbuilds to be operated by Star Reefers and Baltic Shipping, will surely lead to extensive demolition.

After a strong performance between 2013-2015, owners and operators of small tonnage had a disappointing 12 months in 2016. The principal market-determining variable for the small segment is the health of the Nigerian economy in general and demand for fish in particular. The oil dependent economy continued to suffer from the global glut throughout 2016. The decision to allow the naira to float freely in June was broadly welcomed by the international community, but its overnight loss of value against the US$ in the region of 30% obviated the need for any artificial restrictions on fish imports!

Although interest did strengthen throughout October, there was always enough tonnage to satisfy demand and charterers were able to keep a lid on rates. However the congestion caused by an oversupply of bananas in Mersin eventually took its toll. The number vessels having to wait up to two weeks for a berth from October onwards also affected the supply of small units, some of which had been chartered to cover banana fixtures. This coincided with the start of the citrus shipping season from Morocco and Spain to North America, greater interest at last from Nigeria and the start of the N Cont to N Africa seed potato season. By the end of November the market had tightened significantly and spot rates were on an upwards trajectory.

Details have emerged on how Seatrade, the world’s largest reefer operator, is to deploy its newbuild fully cellular container vessels. The highlights of a customer advisory read as follows: “Seatrade has so far ordered 18 fully containerized vessels of 2,200 TEU, equipped with 750 reefer plugs, water cooled reefer system and 185m length overall. “From January 2017, 8 of the vessels will be deployed in Seatrade’s New Zealand to UK/N Cont service via Peru and the USA.”

Seatrade has been operating a direct service from New Zealand to Europe for the past 17 years. During this time it has carried Zespri kiwifruit to Northern Europe as well as other products such as apples, onions, meat and wine. To the end of 2016 the vessels used on the service were traditional specialized reefer vessels with below deck capacity and 40’ High Cube reefer container capacity on deck.

Up to January 2017, the service has been seasonal and volumes and capacity were restricted due to vessel sizes. The assumption therefore is that the new liner service will operate year round. The service is to call at Paita in Peru and Philadelphia on the US east coast en route from Tauranga to Antwerp, Rotterdam and Tilbury.

While the newbuilds will displace existing reefer tonnage on the route, it remains to be seen how much of an impact the service will have a) on the number of charters kiwifruit marketer Zespri fixes for 2017, and b) on the competitive carrier services from New Zealand, which transship in Asia and/or the US. Reefer operators will be hoping that Seatrade will gain market share from the carriers without cannibalizing demand for specialized reefer capacity.

The scale and duration of the downturn in the container business is reflected in the figures and forecast (see table). Maersk Line, the world’s largest carrier of reefer slot capacity and equipment has not been immune to the general malaise.

In late September the carrier revealed that the number of reefer containers it is to acquire in 2016 is roughly half the number it purchased in 2015. Much can be deduced, infered and extrapolated from the Maersk Line Press Release. Given Maersk’s pre-eminence in reefer, the text provides not only an insight into the aspirations of the Danish carrier, but it also sheds light on the development of the fastest growing and most profitable sector in container shipping.

The Release states: ‘Maersk Line’s 2016 investments in new reefer container equipment are adding 14,800 reefers to the world’s largest reefer fleet of more than 270,000 containers. ‘While part of the reefers replace older equipment, the investment will expand the reefer fleet and cater for Maersk Line’s future growth in the reefer segment. ‘Adding to the 30,000 reefers acquired in 2015, the investments lower the average age of Maersk Line’s reefer fleet to 7.9 years. ‘This is significantly below the industry average of 12 years as recently reported by Drewry [maritime consultancy].’

Given Maersk Line’s current financial position, the gloomy forecasts for container shipping in the short to medium term, and the marginal profitability of reefer for all the carriers, it is not a surprise to see Maersk halving its annual investment. There is significant overcapacity of reefer equipment on the market: voyage rates on many core reefer trades are lower than they were 5 years ago and per diem rates for leased containers are so low as to make any further investment a questionable risk.

If other carriers and lessors adopt a similar level or downsizing strategy to Maersk, there will be consequences: in the short term, cargo interests will have no choice but to accept the risks associated with using ever older containers. The reason why the aged stock held by reefer lessors is lower than that for the stock held by the lines is that after 6 years, a reefer box is that much more difficult to lease out, largely due to damage, and lessors dispose of their stock accordingly.

If the prospects for container shipping remain as bleak as forecasts suggest, there must at some stage be a reefer capacity crunch, given the 2.5% per annum compound rate of growth in reefer to 2020 predicted by Drewry.

Currently it makes more strategic sense than commercial sense for the lines to invest in reefer - the segment is not generating a healthy return, either for the lessors or for the lines. In order just to maintain existing capacity levels, manufacturers will need to produce a minimum 100,000 units this year and for the next several years. With the recent addition of the MCI container manufacturing facility in Chile, there will be huge overcapacity issues in the short to medium term unless the carriers and lessors start ordering more units. There are few prospects of this happening unless the new alliances manage to constrict supply sufficiently to force through General Rate Increases (GRIs).

While the specialised reefer mode may have as little as a 5% share of total reefer capacity, it moves 23% of global reefer seaborne trade, according to Drewry estimates. Realistically, it will only be when the specialised reefer mode disappears that the carriers will be able to make reefer pay. But that may not be for some time if the oil price stays low and the reefers can the for reefer container manufacture in 2016 and 2017 reby continue to compete successfully on cost and therefore on price.

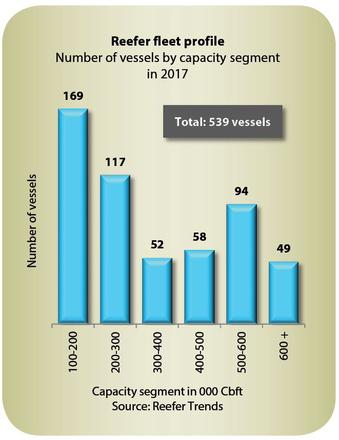

Unless a number of specialized reefer vessels are demolished in the first quarter of next year, it is highly likely that 2017 will be as disappointing for reefer owners and operators as was 2016. There is already too much capacity chasing too little cargo, and with so much more tonnage either being introduced or redelivered to operators at the start of the year, the supply/demand imbalance will be too great to sustain the mode.

The change in structure forced on the specialized reefer modus operandi by the aggressive, loss-leading strategy of the carriers has made the spot market nigh on redundant for banana charterers. With few exceptions, everything moves in liner trades. The challenge for the specialized reefer is to prove that it can add value to customers at either end of the supply chain so that when the oil price, the key component in the cost chain, eventually strengthens, it can still justify its position in the cold chain.

Going forward there are several dangers for operators of smaller units: most immediately, if the Falkland Island squid catch is once again poor there will be a capacity surplus. However the greater fear is that the more fuel-efficient large units are not demolished and instead encroach on the core fish trades that are the staple diet of the small reefer vessel. A large reefer can part-load a fish cargo on the eastern seaboard of the Atlantic at a lower per MT rate than a small unit and still generate a higher TCE yield than a full banana cargo.

Click "Continue" to continue shopping or "See your basket" to complete the order.