FruitTrop Magazine n°244

- Publication date : 3/11/2016

- Price : Free

- Detailled summary

- Articles from this magazine

Can we really talk about a miracle when a situation repeats itself twice in succession? Is it not simply a trend that all sectors should follow? The European pineapple market is fuelling this debate, so exceptional have been the prices charged over the past twelve months, once more. And yet again, it was the extreme paucity of the Sweet supply that enabled them to scale the heights, while in addition, the periods of high rates lasted for longer. However, the majority of operators were not involved in cutting the supply, actually increasing their volumes. It was only a few key players, in Africa or Costa Rica, which opted to considerably scale back their production, and consequently strengthen their prices. Yet nothing seems to indicate that others want to follow in their footsteps; though it seems to be the only way of continuing to create value on the fresh pineapple market.

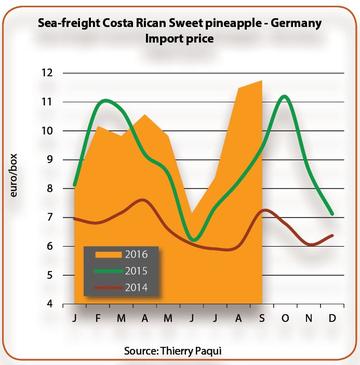

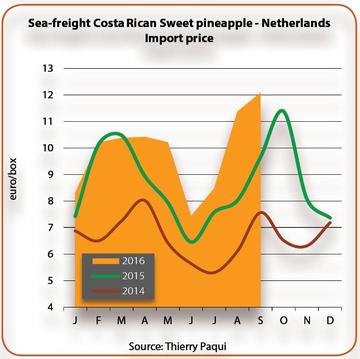

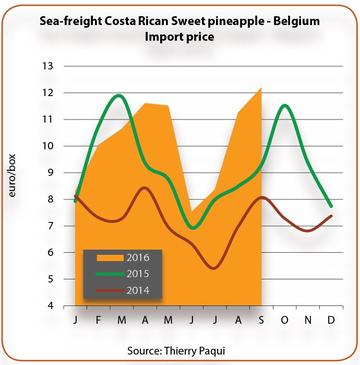

With the exception of the previous campaign (December 2014 to September 2015), during which average import prices were between 7.00 and 9.00 euros/box, average rates over the past ten years have actually fluctuated between 6.00 and 8.00 euros, depending on the size. Of course, there were periods when prices were higher, though they were fairly short-lived. During the last campaign (week 41 2015 to week 39 2016), average rates fluctuated between 8.00 and 11.00 euros/box, with occasional peak periods when they reached and even exceeded 13.00 euros. The small brands were able to take advantage of these rates since the big brands often sold at distinctly higher prices, depending on the markets.

Costa Rica once more confirmed its role as the main player on the pineapple market. Despite a fall of nearly 12 % in its exports to the EU-28, it remained the number one supplier to the European market in 2015 with more than 720 000 tonnes, maintaining its market share at 86 %. This fall is due to several factors. First there were the heavy rains and flooding which hit the country between late 2014 and early 2015, which also affected fruit availability for the canning industry. Hence on several occasions, the processing industry paid up to 1 dollar per kilo more than the market price to ensure the supply. This aggressive policy had the consequence of limiting fresh fruit availability for the European market even further. In addition, the attractiveness of the North American market was high, fuelled by a demand slightly more dynamic than in Europe.

The good prices obtained in 2014-15, a campaign when the supply was very considerably scaled down, would therefore seem to indicate a path to follow. Hence the brands which deliberately cut back their production, and whose produce exhibited a high quality level, were able to enjoy stable prices. This seems to justify their choice, with a view to regaining some profitability on the pineapple market.

However, there is a cloud looming over the scene. While the Costa Rican pineapple supply underwent an unprecedented fall, demand had never been so uninterested in the fruit. It is evident that the price increases were more due to the extreme paucity of the supply at certain times in the campaign, rather than to genuinely lively demand.

What can be done to revitalise demand? Certain brands have already asked themselves the question, and are opting to offer more coloured fruits, which can earn more value from customers. Outside of these rare cases, the general and increasing flatness in demand for Sweet on the market must be recognised. Due to this weak overall demand, operators are nearly all coming to fear the irregular arrival of big volumes, which practically every time force them to lower their prices to prevent stocks from forming.

The past campaign also confirmed the increasingly dominant role played by the supermarket sector in selling imported pineapples. The operators under contracts with the supermarket sector are those which had the steadiest sales. Yet they also suffered more from the fruit shortage, often forced to purchase batches at high prices in order to meet their contractual obligations and retain their listing with the supermarkets.

Over the past two campaigns, the duration of the natural flowering phenomenon has constantly decreased. During the last campaign, it lasted less than four weeks, with smaller volumes reaching the market. Nonetheless this burdened the market, forcing rates down fairly steeply. All the operators are wondering whether the fall in volumes due to natural flowering will persist, or whether it is just a calm before the storm. Furthermore, the reduction in surface areas in Costa Rica should also affect availability during natural flowering periods.

From early October to early November 2015 (weeks 41 to 45), the pineapple market followed a very positive trend. The Costa Rican supply, which was limited, remained below demand for a long time. The long-planned promotions struggled to be implemented, because of the restricted nature of the supply. Operators not signed up with purchasing centres took advantage of this to sell their fruit to those which were, which often gave rise to speculative sales. The lean supply was unable to satisfy all customers, and average rates very quickly climbed, before stabilising at between 11.00 and 12.00 euros/box.

As is often the case, November was a fairly complicated month for pineapple sales. The abrupt increase in supply, at a time when demand had little interest in the fruit, resulted in an increase in stocks. It should be recognised that the general context was fairly unfavourable at the end of 2015. Between the attacks in France and the cancellation of sales to the Russian market, sales in general were very quiet. The situation was especially critical since the market was expecting a slump in the Costa Rican supply and the opposite happened. Though not excessive, it was nonetheless substantial. Only the operators implementing promotions managed to sell off their fruit with a bit less difficulty. Average rates were between 6.00 and 9.00 euros/box from November to late December, leaving the market saturated at the end of the year, and raising fears of the worst for early 2016.

From the beginning of the year until the end of May (weeks 1 to 21 2016), Latin American and African volumes decreased. This fall, which occurred very rapidly at the beginning of the year, helped clear up the situation sooner by facilitating the clearance of the stored batches which were weighing down the market at the end of the year. Hence the market became under-supplied again, with the supply well below demand. The difficulties in obtaining fruit from Latin America were the consequence of rains in production zones and of a higher demand from the processing industry, which also due to the fruit shortage, purchased all the available pineapples it could get its hands on. So the market remained buoyant, with average rates of between 7.00 and 11.00 euros/box.

With the arrival of the first summer fruits in early June, consumers abandoned the pineapple. In addition, the Latin American supply saw an unforeseen increase. In early June the US phytosanitary authorities stepped up their scale insect inspections (a quarantine organism in the USA but not in Europe), resulting in a transfer to the European market of large and unexpected volumes. Although this situation did not last long, the operators complained of the weakness of sales and low prices. However, average rates remained fairly stable, at between 6.00 and 8.00 euros/box.

From mid-July to late September, the supply was on a distinct slide. So limited were the volumes available that despite its lifelessness, demand managed to stay ahead. To provide a rough idea, when the supply was lowest, certain operators received just under 20 % of their usual quantities for the time of year. The increase in volumes in late September marked the end of a ten-week period during which average rates fluctuated between 9.00 and 12.00 euros/box, with peaks of 14.00 euros/box or more!

The considerable fall in rates in late September, with average prices going within one week from 12.00 to 9.00 euros/box, hinted at more complicated weeks ahead for the pineapple market

Click "Continue" to continue shopping or "See your basket" to complete the order.