FruitTrop Magazine n°254

- Number of pages : 96

- Publication date : 24/01/2018

- Price : Free

- Articles from this magazine

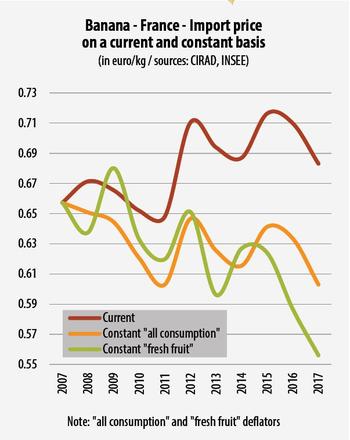

An overly hasty calculation told us that the import price of the banana in Europe increased by 4 % between 2007 and 2017. We should bear in mind that for decades Western societies have enjoyed low or even very low inflation. With the European economy actually verging on deflation, the central banks have reinjected liquidity into the system on a massive scale. Since 2013, in France, the general inflation rate has varied between 0.09 % (2015) and 1.11 % (2017 provisional). To at least offset this inflation over ten years and therefore retain the same value for a product, its price must increase by at least 13.3 %. Otherwise, the sale price obtained for the product in question, a kilo of bananas in our case, means that the same quantity of goods as previously cannot be bought (all other things being equal). That is the difference between a price in current euros (deflated) and a price in constant euros (deflated).

In other words, the purchasing power of a kilo of bananas falls if its price does not increase at the same rate as inflation. If we now factor in inflation in the fresh fruit sector alone, the hit is even harder, since this consumption segment has registered a much greater inflation than elsewhere. Between 2013 and 2017 (provisional), fresh fruit prices have slipped by 5.5 % and since 2007 by 22.8 %.

So now let’s compare the price of a kilo of bananas at the import and retail stages in France, with and without inflation. The conclusion is indisputable. The purchasing power of a kilo of bananas at the import stage has come undone in ten years by 8 % in relation to inflation across all sectors, and by 15 % in relation to the fresh fruit sector only.

The situation is different for the retail price. Based on the price surveys of the RNM (French Ministry of Agriculture market news network), we are able to monitor the average non-weighted retail price in France. Again over the period 2007-2017, the retail price in current euros climbed by 15 %. It fell in constant euros by 6 % compared to other fresh fruits, but was up by 2 % in relation to the general consumption index.

So we can easily conclude that a kilo of bananas has lost its value less quickly at the retail stage than at the import stage. It has even gained a little (+ 2 %) in terms of the general index. From there to believing that the distribution link has protected its margins would be no giant leap. The cost and productivity gain and losses structures vary according to whether we look at the import stage or end distribution stage. So we should look past price alone. This is an arduous task and there is little open-access information. So let’s look at evolution of production cost. Over the past few years CIRAD has developed an index which remains incomplete (salaries not yet factored in), but which nonetheless provides some precious clues. In recent years, while prices in current euros have increased only very moderately (and fallen in constant euro), the cost index remained very high until 2014 before the sudden ebb of oil prices. The index hit a low point in 2016 at 91 (base 100 in 2007) before climbing by 7 points in 2017. Ultimately over ten years between 2007 and 2017, the cost index went up by 3 %. As a reminder, over that period the import price in France decreased by 8 to 15 %, depending on the adopted price index.

Although the indices converge toward a loss of added value in the industry, at least at the import stage, we cannot draw definitive conclusions. Grey areas remain, such as evolution of labour cost, which in no case has fallen in any production zone, or productivity which does seem to have increased, but by how much?

The forthcoming period of negotiations over the renewed reduction in Customs duty on entering the EU will trigger a plethora of new studies. Let’s hope that they can answer the questions that we have just raised

Click "Continue" to continue shopping or "See your basket" to complete the order.