FruitTrop Magazine n°255

- Number of pages : 96

- Publication date : 6/04/2018

- Price : Free

- Articles from this magazine

The traditional production variations in the various origins had relatively little impact on the main mango export flows to the European markets in 2017. However, the meteorological vagaries hit production levels more or less hard, though we cannot talk about deep climate modifications (marked heat in West Africa, El Niño phenomenon in Peru and its repercussions in the Caribbean). Conversely, several exogenous factors caused major disruption to certain supplier countries. We will recall in particular the disturbances in Côte d’Ivoire, as well as the logistical malfunctions. The major concern nonetheless remains the intensification of seizures on imports, because of the presence of fruit fly larvae on West African mangos.

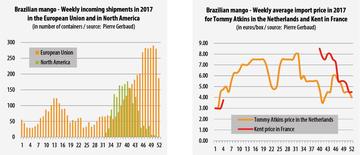

As the number one mango supplier to the European Union, Brazil accounts for one third of Community imports. Present year-round, it represents a solid supply base. 2017 was a year marked by a slight increase of approximately 2 500 tonnes from the previous year. The gap between Brazil and Peru has now come down to around 20 000 tonnes. While Brazil has remained the number one supplier to Europe, it is slipping on the US market, where Peru has achieved a big rise. With extensive and varied production zones enabling uninterrupted production, Brazil offers a wide varietal range, a large part of which is reserved for the domestic market. For the export sector, four varieties are produced and shipped to the European market: Tommy Atkins, Palmer, Keitt and Kent

The Tommy Atkins variety has long remained the spearhead of Brazilian production and exports, because of its productivity, coloration, resistance to certain diseases and transportability. In addition, it lends itself well to scheduled cropping practices, enabling greater adaptability to market demands. Conversely, its middling flavour and its appearance, more or less fibrous, mean that an increasingly well informed public moving away from it. For several years, the proportion of Tommy Atkins exported has decreased. In 2017, it was overtaken for the first time by the Palmer variety, which represented approximately 29 % of shipments to Europe, as opposed to 28.7 % for Tommy Atkins. The latter is being gradually relegated to a top-up role, especially during periods when production of the other varieties is in shortfall.

The Keitt variety, which has also seen a remarkable rise, now accounts for 24.8 % of Brazilian shipments. Finally, Kent, the most popular variety in Europe, represented just 17.5 % of exports, down two points from 2016. Less productive and more delicate, it does nonetheless occupy a particular place in the Brazilian export calendar. It is targeted at the end-of-year market, from October to January. Furthermore, from October to early December, Brazil is the sole supplier of this variety, apart from what tonnages are exported from Spain. Palmer and Keitt, previously available on an occasional basis, are now present year-round, making for a varietal diversity that cannot be found among other suppliers to the European market.

Brazil’s production capacity, as well as its varietal range, have helped exporters adapt to the demands of the market. Despite the inertia arising from the shipping times, Brazilian flows followed the market variations. Hence it manages to cover periods of leaner supply, and scale back its shipments during export peaks. It also ensures an annual volume base through juggling the different varieties available from production. This rather advantageous strategy is not comprehensive, since at the end of the year the confrontation with the Peruvian supply is proving increasingly tricky.

For this last campaign, Kent exports progressed fairly slowly in October, with the other Brazilian varieties remaining in the majority. The Kent campaign got off to a favourable start until November, with prices falling but high (from 8.50 to 6.50 euros/box). Yet this slightly late start shifted the biggest incoming shipments to the second half of November onward, causing a drop in prices accelerated by the early arrival and rapid progress of Peruvian shipments. Volumes from both origins rapidly saturated the market, to well in excess of the demand level, and halving prices from the beginning of the campaign.

Brazil adjusted its shipments to its two main markets, North America and Europe, depending on the better opportunities. Yet at the end of the year, the bulk of exportable volumes was aimed at Europe, leading to oversupply. North American demand was satisfied by the abundance of Ecuadorian mangos, which were more competitive, and the start of the Peruvian campaign. The fairly rapid decline of Brazilian fruits at the beginning of 2018 mitigated the mediocre results from the end of the year.

Over the rest of the year, Brazilian mangos sold fairly steadily, except in May and early June when the West African origins campaign was in full swing with Kent. At this period, Brazil was offering varieties less highly rated on the European market. Yet once the West African shipments ceased, prices took an upturn, with Brazilian mangos making up for the decrease in the overall supply. In September, their rates dipped again, with the European market sufficiently supplied by Israel and Spain. In October, Brazilian Kent, beginning their campaign, competed with the origin’s other varieties, which were less in demand and whose rates dipped, though they bounced back from mid-October to mid-November. Kent prices maintained a high level until the appearance of Peruvian mangos, in late November-early December, when the magnitude of the volumes available dragged the market into long-lasting stagnation.

The air-freight campaign started in mid-September, with restrained volumes which enabled high prices for Kent (5.00-5.50 euros/kg). The other varieties (Haden and Palmer) were valued at approximately 1.00 euro/kg less. The increase in quantities of Kent in November led to the abandonment of these varieties, less highly rated on the European market. Rising incoming shipments, from the second half of November, weighed down on rates, which deteriorated all the more with Peru entering its campaign. In December, they dropped below 4.00 euros/kg under Peruvian pressure, but also due to the receipt of batches of advanced maturity requiring rapid sale, i.e. at lower prices. Apart from during the narrow end-of-year festive period, when demand was invigorated and enabled a pricing readjustment, the Brazilian mango rate was aligned on the Peruvian mango rate until the final shipments in January. Hence the campaign was split between a first phase, accompanied by firm prices with rising tonnages, and a second phase, with low prices yet decreasing volumes.

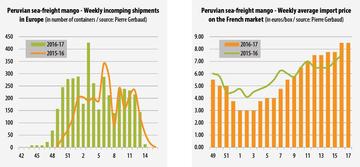

Whereas it exported 10 000 tonnes to Europe in the early 2000s, Peru has developed its mango industry remarkably, to achieve exports of more than 95 500 tonnes in 2017. In less than twenty years, this origin has soared in the international mango trade, starting off from a limited level to hoist itself up to be the long-term number two supplier to the European market behind Brazil, practically the founding mainstay of the mango trade. This year marked a new volumes record, with a rise of 8 000 tonnes on the previous year.

Across all destinations, Peru has become the world number two mango exporter, overhauling Brazil to take position behind Mexico. This expansion has been achieved through increasing shipments to the North American markets, but also through diversification of its outlets, especially Asia (Japan, Korea, etc.). Furthermore, Peru is also processing its fruits into dried or purée form, and making big advances in exports there too.

Yet this growth also has its flip side, judging by the results of the 2016-17 campaign. True, the international mango market is increasing, yet infinitely less rapidly than the potentials of the producer countries and their desire to progress. In this context the expansion of an origin such as Peru could only occur at the detriment of another origin, with the risk of saturating the markets and consequently reducing the economic results. Hence many years ago, Peru emerged through the near-total withdrawal of South Africa, whose export period extended over the first months of the year. It is in this window that Peruvian development has taken root. Furthermore, the increasingly late start to the West African campaigns offered Peru the possibility to extend its campaign until May.

The 2016-17 Peruvian campaign started early, in late November-early December, and was characterised by a very rapid surge in volumes received in Europe, which added to the big incoming shipments from Brazil, whose Kent campaign had started later and more slowly. Hence in December, the European market was choked by weekly incoming shipments of 350 to 400 containers, or even more. This unprecedented tempo extended over several weeks, driving down rates and leading to the formation of large stocks, in a context of high but not outstanding demand. The market was entering a vicious cycle of over-supply: abundant incoming shipments - stocks - qualitative deterioration - low prices. Given the inertia arising from the transport times, stagnation set in for the long haul, in spite of Brazilian Kent shipments stopping during January, and the considerable reduction of its Tommy Atkins, Keitt and Palmer shipments.

In February, the market, practically exclusively supplied by Peru, was slowly recovering, with stronger prices for incoming merchandise. Conversely, they remained very low for fruits out of more or less prolonged storage. On top of that came the gradual predominance of large fruits, harder to sell and obtaining rock-bottom prices. In late February, the change of harvest zones in Peru, going from Piura to Motupe and then Casma, did not help market conditions recover, due to the higher cost prices. European operators struggled to pass on these price increases to their customers, who over a number of weeks had grown accustomed to more attractive prices.

In early March, stocks were being used up, helping prices make a distinct recovery. This positive market trend was especially pronounced since operators anticipated the foreseeable shortfall for the period from mid-March/mid-April, corresponding to the gap between the end of the Peruvian campaign and the start of the West African campaign. Peruvian shipments ended suddenly. In fact in week 11, very heavy storms due to the El Niño phenomenon caused major flooding, accompanied by landslides causing numerous victims. While the production zones do not seem to have been hard hit, the country’s logistical axes were paralysed with roads cut off and bridges uprooted. Despite the qualitative deterioration of the fruits, rates remained high in the run-up to Easter, insofar as there were barely any alternative supplies, barring the Brazilian shipments.

The air-freight campaign extended for longer than the sea-freight campaign, starting from mid-October. Air-freight mango rates dipped gradually in the face of the Brazilian competition, its campaign now in full swing. From nearly 5.50 euros/kg at the start of the campaign, prices reached their lowest level in December at less than 4.00 euros/kg. This average rate, obtained by smoothing large variations according to fruit quality, continued until early March. It then soared until Easter, to 6.50 euros/kg on average, before dipping back to around 5.00 euros/kg in the second half of April, while demand shrank slightly and increasing quantities entered Europe from West Africa. At the end of the month, Peruvian volumes became marginal and marked the end of the season with fruits of increasingly fragile quality.

Peru is consolidating its footing on the European market with shipments rising year on year. Yet is the quantitative saturation that it causes, especially from mid-December to mid-March, proving economically advantageous? As in recent years, the majority of exports sold at prices if not low then at least not very high, and the second part of the campaign was characterised by smaller volumes selling at high prices. For all that, the Peruvian industry is pulling off genuine feats in terms of export volumes. The products proposed are of a satisfactory quality standard, in spite of occasional variations due to sheer mass of shipments. This represents an asset for this origin, the most distant of the mango supplier countries to the European market

Despite its shipments to the European market being 4 000 tonnes down 2017, West Africa remains an essential supply source in spring. Yet besides this dip, the difficulty arose from the logistical and sanitary conditions under which the campaign proceeded.

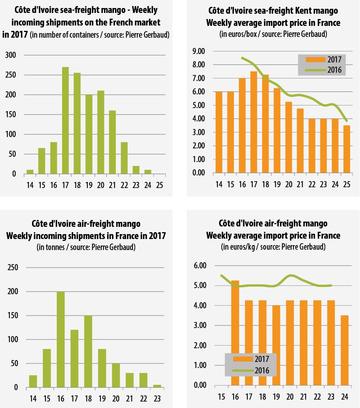

In 2016, Côte d’Ivoire, Africa’s number one mango exporter and the number three supplier to the European Union, had exported just over 30 000 tonnes. In 2017, despite a similar volume, the results have been incomparably less positive. However, market conditions turned out rather well, with the transition from the Peruvian campaign to the West African campaign proceeding fairly harmoniously, with the rapid withdrawal of Latin American fruit, and Ivorian shipments soaring. However, the 2017 campaign proved to be distinctly more complicated and difficult due to a combination of factors.

First of all, production proved to be more modest than in 2016, requiring scattered harvests and a geographically wider search for fruits, particularly damaging to the already fragile quality. The lack of precipitation during fruit growth represented an initial handicap, leading to their dehydration which rapidly led to a creased appearance of their skin. Heatwaves then accentuated this phenomenon. The early harvest at the start of the campaign, driven by demand from markets in shortfall, also aggravated fruit desiccation. Though barely visible during picking, it developed after receipt by the end markets. In addition, the early harvest, for fear of fruit fly infestation, does not seem to have been a good strategy. Fly holing on the rapidly picked fruits, in a context of high parasite pressure, are harder to detect during packing and loading into containers. Conversely, maturing during transport favours egg hatching and development of the larvae, visible on arrival of the merchandise.

On top of these meteorological and parasite problems, from around 10 May onward, came social action which disrupted local logistics. Transport from the production zones to the port of Abidjan was hindered and often delayed, altering the ship loading programmes. To make matters worse, the port handling machinery breakdowns altered the ship docking windows, causing major loading delays. Hence many containers remained in port, with or without refrigeration, leading to accelerated maturation of the fruits, and thereby an increased risk of parasite proliferation. The delays between packing and delivery to the end recipient were occasionally very long, generating numerous disputes. These logistical problems concentrated shipments even more, causing piecemeal delivery of merchandise of disparate quality, which weighed down heavily on fruit sales and sale prices. In addition, they were also highly restrictive for produce from Burkina Faso and Mali using the Abidjan logistics corridor.

The sea-freight campaign started in early April with small volumes of Amélie and Zill, which sold decently given the decreasing Peruvian presence and the preparation of procurement for Easter, always a slightly livelier period. The first Kent containers reached Europe in mid-April and sold rapidly at high prices, in spite of a sometimes borderline maturity and low-intensity external coloration.

In May, seasonal fruit volumes, hitherto scarce because of cold spells in winter and early spring, rapidly intensified and sold at attractive prices, relegating tropical fruits to a secondary role. It was also at this time that Ivorian shipments boomed erratically because of the events mentioned above. The concentration of volumes proved to be detrimental to fluidity of transactions and the quality of produce subjected to more or less long storage. During May alone, Ivorian exporters made 80 % of the campaign total. Rates declined gradually, going from more than 7.00 euros/box to 4.00 euros/box on average at the end of the month. They stabilised at this level over the following weeks, whereas incoming shipments became marginal. At the end of May and the first half of June, Ivorian mangos out of storage underwent clearance sales at low prices.

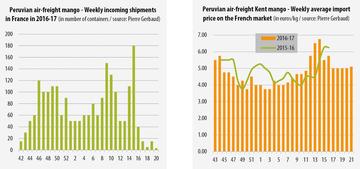

Estimated at nearly one thousand tonnes, the air-freight campaign proved to be very average. The first shipments began late, though they were expected to offset the decrease in Peruvian shipments. The big tonnages received at the beginning of the campaign (mid-April) rapidly saturated the market, especially since they arrived after the more dynamic Easter period. Furthermore, the (justified) fear of merchandise seizures, in case of the presence of fly larvae, encouraged exporters to ship premature fruits with underdeveloped coloration, unsuited to demand. These fruits struggled for the most part, aggravated by the triggering process. Their quality was often akin to sea-freight mangos, immature and with low coloration. Many were creased, exhibiting an unattractive visual appearance. Prices remained relatively stable, at around 4.00 euros/kg for fruits of decent quality, i.e. approximately 1.00 euro/kg less than during the previous campaign. Numerous sales were also made at lower prices for lower-quality fruits.

In mid-May, a lack of air-freight capacity contributed to limiting shipments, but hardly influenced prices given the accumulated volumes already received. On top of the qualitative problems came strong competition from the season fruits, available in quantity and offered at more accessible prices. Hence demand for Ivorian mangos dipped, especially as the Mexican and Senegalese campaigns started.

Average fruit quality, major logistical problems and high parasite pressure contributed to the difficulties experienced by the Ivorian campaign. The Ivorian mango industry will need to quickly find solutions to all these issues, to safeguard its brand image on the European markets.

The 2017 campaign marked a distinct downturn for Mali on the European markets, after the progress of the past two years. The exports tempo, which had held up at between 3 500 and 4 500 tonnes depending on the year since 2007, saw more distinct growth in 2015 (6 425 tonnes), and especially in 2016 (7 450 tonnes). The origin, which exploits various logistical corridors to evacuate its mangos, turned out to be the second supplier to the European Union over the period from April to June. Yet the momentum picked up in the wake of Côte d’Ivoire eased up in 2017, with volumes of 4 850 tonnes. This downturn arose mainly from the fall in production because of unfavourable meteorological conditions, but also other external factors, especially the logistical problems around the port of Abidjan, which usually processes the majority of this country’s shipments. Finally, the high parasite pressure this year played a limiting role due to fears of merchandise seizures on receipt.

Air-freight shipments started two to three weeks later than the previous year, with a shortage of the Amélie variety, generally early and which often kicks off the export period. Fruit fly infestations were observed practically at the start of the campaign, encouraging shippers to rapidly suspend shipments of this particularly fragile variety. The Kent and Valencia campaigns started simultaneously, whereas usually Valencia appears earlier. Mutual competition rapidly set in between the two varieties. From approximately 4.00 euros/kg from mid-April to mid-May, their rates diverged thereafter, with Valencia selling at around 3.00 euros/kg and Kent at 4.00 euros/kg. Valencia seems to have been abandoned by customers due to the parallel presence of Kent, but also because of its often rapid development, and accompanied by qualitative deterioration. In week 24, exports were winding down two weeks earlier than in 2016. The lower fruit availability and appearance of mangos from Senegal and Mexico in the first half of June probably precipitated the closure of the Malian campaign.

Sea-freight shipments started in the second half of May, and were primarily aimed at Northern Europe (Germany, Belgium, the Netherlands). Shipments to the French market were later in June. The abundance of Ivorian mangos on this market, with the fits and starts in the supply already mentioned, explains this difference. The Malian export flow was hard hit by produce transport problems, landlocked as it is and therefore dependent on the neighbouring countries which enjoy a coastline. Nonetheless, without reaching the prices obtained at the beginning and end of the last campaign, Malian mangos sold more steadily at between 4.50 and 5.50 euros/box, with rates strengthening to sometimes in excess of 6.00 euros/box at the end of the campaign (early July). The disappearance of Ivorian mangos in early June left a more favourable niche for Malian produce in the absence of other Kent suppliers. In spite of a considerable downturn in volumes, Mali nonetheless confirmed its trade slot, which remains dependent on the country’s capacity to eliminate the damage caused by the fruit fly, on the rise again this year.

After rising fairly steadily since 2013, Burkina Faso is at a standstill with export volumes to the European markets on the wane. From 6 000 tonnes in 2016, a record level for this country, they went to 3 800 tonnes in 2017. The main reason seems to be smaller production which hit all the fruit trade and processing sectors more or less hard. Only air-freight shipments and processing saw a rise. Air-freight exports totalled approximately 500 tonnes, instead of 420 tonnes in 2016. So exporters logically preferred to ship more fruits by air-freight, a more flexible mode of transport, especially with production dwindling. On top of this, there were nearly 2 500 tonnes shipped to regional or international markets outside of Europe.

The processing sector has also risen, managing to cope with the difficulty in finding sufficient volumes to satisfy the sea-freight sector, more demanding in quantitative terms. Hence, 2 600 tonnes of mango purée and mango juice were produced in 2017, as opposed to 2 330 tonnes in 2016. Conversely, dried mango production, which Burkina Faso has made a speciality for many years, went down to 1 520 tonnes in 2017, whereas it had touched on 2 000 tonnes the previous year. Dried mango exports also collapsed in 2017, with 700 tonnes as opposed to more than 1 700 tonnes in 2016.

The export campaign to the European markets began early, with the first batches on sale in week 10 rather than week 12 in 2016. This primarily involved Amélie, which sold at high prices for this variety. The relative shortage of air-freight mangos at this time of year favoured these sales, aimed more at retailers specialised in sales of exotic products. This variety, formerly widely available, is now to be found in a niche slot.

Week 13 saw the start of the Valencia and Kent campaigns, generally more coloured and more popular among consumers. Prices, high during the weeks before Easter (14 and 15 April), dipped thereafter under the effect of the increasing supply, not only from Burkina Faso, but also the other origins. In early May, prices stabilised at around 3.00-3.50 euros/kg on average, while Amélie and Valencia shipments were suspended. In the first half of June, Kent rates were recovering, due to lower market pressure with the end of the Ivorian campaign. While Amélie and Kent met the market criteria, Valencia were finding it harder to sell. This variety found a market window mainly at the beginning of the West African campaign, when the coloured fruits supply was provided above all by Peru. At this time of the year, Valencia was an alternative to the Peruvian mangos, whose quantity and quality were on the wane, and with higher production costs. Hence Valencia was of interest to retailers, though this vanished upon the appearance of substantial volumes of Kent from the various West African origins. In addition, in late April/early May, the quality of Valencia deteriorated, aggravating lack of interest from the distribution sector. This development is tending to take a firmer hold with each passing campaign. Might it not be desirable for shippers to tailor their shipments more precisely in terms of varieties, so as to avoid excessive price variations? The challenge remains tricky, with the campaigns never following a set course

The 2017 Dominican export campaign totalled 11 360 tonnes to the European Union, a figure down from 2016 (14 730 tonnes). This campaign neared that of 2014, in terms of both volumes and economic results. Dominican shipments began in late May, thereby avoiding the concentration of West African mangos in May. The first phase of the Dominican campaign paralleled that of Puerto Rico. These two origins, which export Keitt, harnessed favourable market conditions with increasing rates, from 5.50 euros/box at the beginning of the campaign to more than 7.00 euros/box in mid-July. They then dropped until mid-August, falling below 4.00 euros/box because of qualitative problems (fungal attacks and poor development). Certain sales were made at low prices during this period, characterised by flat demand. At the end of the campaign, prices recovered partially with more measured incoming shipments. Over three months of the campaign, rates saw very mixed development, with a rather good first half of the season and a distinctly less profitable second half.

In 2017, Senegalese mango exports to Europe totalled 11 124 tonnes, up slightly from 2016 (10 000 tonnes). However, they have remained of the same order of magnitude since 2014, fluctuating between 10 000 and 11 500 tonnes, and consolidating the origin as the number six supplier to the European market. The export calendar generally extends from June to September, a period which does enjoy certain advantages but also has constraints. The beginning of the campaign was marked by the end of West African shipments (Côte d’Ivoire, Mali, Burkina Faso), or at least a considerable dip, thereby leaving a free space for this origin, which in addition is practically the only one to offer Kent until the appearance of Israeli fruits in late July/early August. Senegal only faces competition from Mexico, which exports exclusively by air-freight. In August, the market conditions are complicated due to the parallel shipments from Israel, yet also a recurrent problem of fungal attacks. Furthermore, mango consumption tends to slack off during the summer period. Finally, the parasite pressure affecting Senegal represents a more or less tough obstacle depending on the year, and seems more problematic for air-freight than sea-freight exports.

Sanitary problems seem to have been one of the main causes of the brevity of the air-freight campaign, which started in early June before finishing in the first week of August. It extended for longer in 2016, from the second half of May until the end of September. The high sale prices at the start of the campaign (5.00-5.50 euros/kg) quickly turned around with progressing volumes and the appearance of qualitative problems (3.00-4.00 euros/kg). At the end of the campaign, rates strengthened somewhat as shipments subsided.

Sea-freight shipments started in mid-June and finished in late August, three weeks earlier than the previous year. They sold steadily under the same profile as the previous season. The moderate prices from the beginning of the campaign rapidly picked up with the disappearance of the competing West African supplies (around 4.00 euros/box). They climbed steeply until July, reaching 8.00 euros/box. The absence of genuine competition for Kent favoured these price increases, especially since the mangos were of good quality at this time. From mid-July, rates gradually took a downturn because of weaker demand, less reliable quality and the increasing presence of Israeli produce. They dropped back to their early campaign level in the second half of August.

Senegal’s positioning as the summer turning point, and the fragility of the fruits in the second part of the campaign, remain heavy constraints which can only be eliminated by superior quality in the long term

Since 2014, Mexico has consolidated its position on the European air-freight mango market, aimed at the late spring-early summer period, the turning point in terms of supplier countries, especially for Kent. From June to August, the European market is supplied in succession by Côte d’Ivoire, Mali and Burkina Faso at the end of the campaign, followed by Senegal and finally Israel. The end-of-campaign West African fruits are of less reliable quality, develop rapidly and are often affected by fungal diseases. The Mexican supply represents an alternative, with Senegal as the only real competitor. Israeli produce only appears later in terms of Kent.

The 2017 campaign proceeded, two weeks behind the previous one. Volumes rapidly increased from early June, reaching their maximum in mid-June. They then gradually decreased before a hiatus in mid-August. Mexican exporters took advantage of this period of less lively competition and wound down their shipments in mid-summer, when demand is lowest. It is also during this latter phase of the campaign that the risks of qualitative deterioration of Mexican produce usually develop.

The big Mexican shipments in the second half of June, combined with those out of Senegal, dragged the market down in early July (from 5.00-5.50 euros/kg to 4.00-4.50 euros/kg). Certain batches of advanced maturity actually underwent low-price clearance sales (2.50 euros/kg). Air-freight volumes proved to be much greater than demand in the downturn phase. There were numerous batches passing via Spain on top of the direct imports, especially on the French market, making sales conditions even tougher. In late July, the market remained tight, though the rapid decrease in Mexican shipments enabled prices to be revised for good quality fruits.

Mexico consolidated its place as an air-freight mango supplier in a market slot which remains tricky, between the end of the West African origins campaign and the summer period when demand weakens. The earliness and extent of the seasonal fruit supply also contributed to halting the fluidity of sales from this origin. However, the rise in tonnages attests to an increased desire from the Mexican professionals to establish themselves on the European markets. In 2017, the recipient markets were mainly France, Spain, Belgium and Switzerland. Mexico, an essential supplier to the North American markets, especially for sea-freight or road-freight mangos, is diversifying its outlets to Europe but also Japan, a particularly demanding market in terms of quality.

Meanwhile, Mexico is developing dried mango production, helping it harness fruits not exportable fresh. The country’s large production favours this new niche, which could in future give rise to exports, with these products for now primarily consumed locally. Growth in this segment and the quality of dried Mexican mangos are positives for the development of this sector, less dependent on seasonality than the fresh mango.

The 2017 Puerto Rican campaign was similar to the previous one, with export volumes to Europe falling slightly (11 100 tonnes as opposed to 12 250 tonnes). The calendar was the same, starting in mid-May and with shipments ceasing in late August. Puerto Rico exports Keitt exclusively by sea-freight, the outlet being the North European markets via the supermarket sector circuits. Prices at the beginning of the campaign were restrained, at around 5.50 euros/box, given the abundance of West African fruits which dominated the European supply. From mid-June, they increased gradually, to 8.00 euros/box in mid-July, their highest level of the season. At this period, the supply was smaller and Puerto Rican produce provided a steady supply of standard quality. Rates then took a downturn until early August (5.00 euros/box), because of a larger overall supply with the arrival of Israeli produce, less marked demand and quality problems on certain batches. The campaign continued in August, with prices strengthening to 6.50 euros/box though with distinctly smaller volume. Without causing a sensation, Puerto Rico year on year is establishing its presence on the European markets, providing an alternative to competing produce

With nearly 16 500 tonnes of shipments in 2017, i.e. approximately 1 300 tonnes less than in 2016, Israel was still the main supplier to the European market during the summer period. With a late start on the market, the Israeli fruits wound down in early October, lasting one month less than in 2016. Sea-freight shipments initially comprised the Shelly and Omer (Kasturi) varieties, which sold at high prices (average 7.00 euros/box). After an overlap period of three weeks between August and September, Kent and Keitt easily dominated shipments to the EU. After selling at between 7.00 and 8.00 euros/kg at the beginning of the campaign, they gradually decreased due to the downturn in demand in August. At the end of the campaign, rates were around 5.50 euros/box, a level which was down, yet nonetheless ensured results envied by other origins.

Israel also shipped air-freight mangos, with the campaign starting similarly to the sea-freight mangos, but finishing more rapidly in mid-September. Usually, the campaign begins with shipments of the Maya and Aya varieties, Israel’s early fruits, followed by Shelly and Omer, with the second half of the campaign provided by Kent, and then Keitt, which rounds off exports. In 2017, the first shipments actually comprised Maya and Aya, but also Omer, perhaps due to the lateness of the campaign. Yet the biggest highlight was doubtless the presence of Omer until the end of the campaign, parallel to Kent. Conversely, Keitt shipments were, if not non-existent, at least marginal. Is the Omer variety in the process of supplanting the other varieties for reasons of productivity or greater solidity? Or is it is cyclical development due to natural or market conditions?

Maya and Aya rates gradually declined, going from 4.50 euros/kg on average to 3.50 euros/kg. The Omer rate saw a bigger and more rapid downturn, with the same price as Maya at the end of the availability period. Stable until late August, Omer rates picked up by 0.50 euro/kg in the first half of September. After a marked fall in the second half of August, Kent returned to a level of approximately 4.00 euros/kg for the last shipments of the season. Israel, in addition to substantial volumes, brought a range of varieties to the overall supply, mainly dominated by Kent.

Thanks to production potential which has been constantly increasing for years, Spain has been protected from the meteorological vagaries inherent to its geographic location at the limit of mango growing conditions. Planting is increasing steeply, and production is forecast from 30 000 to 35 000 tonnes for the coming years. True, meteorological variations will still influence production for better or worse, yet recent plantations which will bear fruit in the coming years will guarantee at least a minimum supply capacity.

Another constraints is the water supply in southern Andalusia. Water resources are limited in this part of Spain. The water supply to the population remains the consumption base, on top of which are the needs of the tourist sector, with its high consumption (tourist infrastructures, pools, etc.). Hence, the division of this natural element is the subject of frictions between the various users, marked by the economic weight of each of the sectors. Yet while the mango is fairly undemanding in terms of wager, it still requires some. Since the orchards are irrigated to enable profitable production in terms of quantity and quality, the importance of the subject is easy to see. It is especially crucial since the mango orchards occupy the same region as the avocado, which has even higher water consumption. Gradually, mango orchards have been planted high up, leaving the wetter lowlands to the avocado. To cope with these constraints, orchards need to be set up in zones less dependent on water distribution, such as the Malaga region. Though still limited, this trend is essential in the strategy of Spanish producers for the coming campaigns.

In spite of this problem, Spanish production is on the increase. In 2017 shipments were estimated between 20 000 and 22 000 tonnes, up by approximately 2 000 tonnes from 2016. This figure disregards domestic consumption, which further magnifies this result. Like the previous year, shipments started in mid-August with the Osteen variety. This start was made on a market mainly supplied by Israel and Brazil, as well as by the final deliveries from Senegal. The campaign had a tougher starts than in 2016, with lower penetration prices, which dipped in the same way. The combination of the various origins, especially the later presence of Israeli produce, doubtless weighed down on the rate of Spanish produce, which went down from 10.00 euros/box to 6.50 euros/box in late September. With the disappearance if the Israeli competition, the Osteen rate recovered in October to 8.00 euros/box on average, during the variety’s campaign peak. It even exceeded the previous year’s average, and probably marked the most profitable period of the campaign for this variety. Osteen were available until mid-November, though with volumes well down. Their rates strengthened as quantities waned. The Spanish campaign wound down in late November, with Keitt shipments selling on the same price footing. Bit by bit, Spain overcame the Brazil competition from October. Its essential asset is the more developed fruit maturity stage than that of the Brazilian sea-freight mangos, and a more attractive price than the air-freight mangos. Hence Spanish shippers are successfully diversifying their shipments to other European markets.

While Osteen remains Spain’s flagship variety, there are other varieties enriching its range. In September, a flow of Irwin made itself felt, though more modestly than for Osteen. A variety primarily comprising small-sized fruits, it earned its value though its packing and selection comparable to air-freight mangos. It sold steadily at high prices, aimed at traditional retail. Kent appeared later (mid-September/mid-October), with volumes up on previous years, and obtained high rates due to its superior quality. More fragile, it did see some price variations, especially when Brazilian air-freight Kent made its appearance. Now, Spanish mangos are winning over not only new market share in the European Union, but are also on the rise on the domestic market, which had hitherto proved moderate. The communication efforts of the main marketing agents are proving useful for this industry.

Click "Continue" to continue shopping or "See your basket" to complete the order.