Mediterranean berries

- Published on 14/02/2019 - Published by BENOIT-CELEYRETTE Cécilia

- Free

A market showing its true colours

The Mediterranean berries range has really blossomed, with exponential growth in surface areas for species such as the blueberry, highly rated for its health assets in particular on the North European markets. The strawberry however remains the key player in this group.

Informations

- Product(s) : Strawberry , Red Fruits , Blueberry

- Rubrique / Thématique : Review and Forecasts

- Country : Spain , Europe , Morocco

- Keywords : Export , Import , Production

Spain making its presence felt

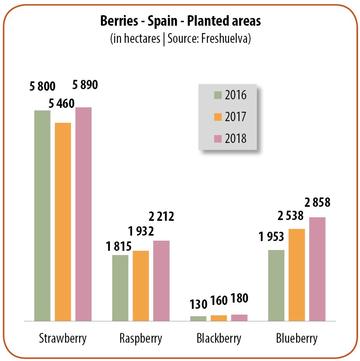

The Spanish berries campaign was a little behind schedule this year, due to the heavy autumn rains. Hence volumes were only significant in late November for the raspberry and mid-December for the strawberry. Surface areas are continuing to expand overall, and should reach 11 464 ha this campaign for the berries range as a whole (+ 2.8 % on 2017-18).

This increase is a result of a resurgence for the strawberry (6 095 ha, i.e. + 3 %) and the well-founded hopes of the Spanish producers. The creation of local varieties by FNM (which brings together Huelva’s big production companies and the FID research centre), and diversification of packaging (basket, punnet, tray) are already bearing fruits and making a big contribution to revamping the quality image of the Spanish strawberry. Planting ultra-early varieties such as San Andreas (7 % of surface areas in 2018) has enabled the origin to establish a firm presence in December, by extending the calendar. The supply has also seen considerable expansion in the mid-season with the ever-present Fortuna (37 %), backed up by Primoris (8 %) or more recently Radiba (6 %) to launch the campaign with a traditional Valentine’s date. At present, growth is mostly being provided by Rociera (19 %), and should be stepped up further by the Victory club variety. New varieties, such as Savana or even Calinda, are already taking their marks.

There is also very marked innovation with the raspberry, which should be boosted in Spain with the arrival of the first variety from FNM, which is still in test phase under the name R15-21-5. Raspberry surface areas are however shrinking a little, and are set to drop back to 2 150 ha (- 3 %). This is the consequence of a shift toward the blueberry, very much in demand, surface areas of which are still on the rise, and which should this year reach the 3 000-ha mark (+ 7 %), with early varieties being planted. Conversely, a fall of 11 % has been registered for the blackberry (160 ha). Note that Spanish producers are worried about a Brexit effect, since while the United Kingdom represents just 13 % of strawberry outlets, its share for the blueberry is 23 %, and for the raspberry 29 %.

Morocco not yet with the blues

After a slight dip in 2017, strawberry planting resumed in Morocco in 2018 (3 300 ha), albeit without returning to the peak of 3 500 ha. The profitability of this crop is not yet assured, in spite of the distinct improvement in yields in recent years, reaching more than 40 t/ha. The bulk of production is aimed at processing (45 %), with just 20 % exported and 35 % remaining on the domestic market. Hence growth is currently being achieved mainly with the raspberry and blueberry, as well as some dual-purpose varieties. Surface areas are rapidly expanding, already reaching nearly 1 900 ha for each of these products. The objectives of the “Maroc Vert” plan, with a massive expansion campaign of 3 100 ha for the blueberry and 3 500 ha for the raspberry by 2020, may be slightly deferred. The bulk of volumes are exported fresh: 13 300 t of raspberry and 15 300 t of blueberry, and 1 000 t and 620 t respectively in frozen form in 2016-17. Raspberry tonnages imported into Europe have seen a considerable increase (19 000 t), outstripping even the strawberry if we go by the provisional figures from the European Customs, and with the blueberry hot on its heels (16 200 t). Two-thirds of these volumes enter via Spain (11 000 t as opposed to 7 500 t in 2014-15), followed by France (2 600 t as opposed to 4 500 t) and then the United Kingdom (1 100 t as opposed to 3 500 t). This percentage rises to 77 % for the blueberry, and 90 % for the raspberry.

A potentially well-laden market

The market could be fairly heavily laden. The supply is only starting to progress, between the delay in planting and the cold weather. In late January, it was already well-developed for the raspberry, but the strawberry shortfall was still ongoing, enough for just a few Valentine’s promotions. The campaign could rapidly get back on schedule in February, with the improvement in climate conditions. Full production could be reached in March for Morocco, and in April for Spain. So uncertainty remains over the market, bearing in mind that the Easter holidays are very late this year.