Roots and tubers - Q2 2019

- Published on 15/07/2019 - Published by GERBAUD Pierre

- Free

Quarterly Market Review

Informations

- Product(s) : Eddoe , Ginger , Yam , Cassava , Sweet Potato , Roots & tubers

- Rubrique / Thématique : Review and Forecasts

- Country : South africa , Brazil , China , Costa rica , Egypt , United States , France , Ghana , Guatemala , Honduras , Israel , Thailand

- Keywords : Import , Price , Sales

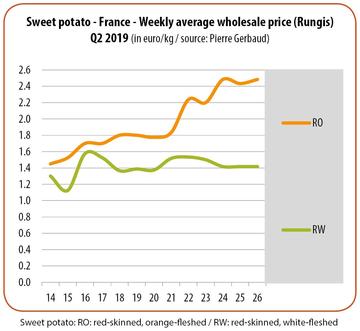

Sweet potato

White-fleshed sweet potato shipments from Egypt saw a big reduction at the start of Q2 2019, with erratic arrivals and less dependable quality of the produce. The relative lack of merchandise nonetheless helped keep prices at around 1.00 euro/kg. This origin’s campaign finally wound down during May. South Africa and Honduras took over with produce obtaining prices of around 1.50 euro/kg, with South African produce falling in June to 1.30 euro/kg. Brazil joined South Africa at the beginning of May, with prices slightly higher but following the same downward trend in June. While the white-fleshed sweet potato market remained relatively stable during the period in question, the same was not true for the orange-fleshed sweet potato, for which a supply shortfall quickly became apparent. Guatemala and Honduras, which continued their shipments, saw their sale prices take an upturn. From a level of 1.50-1.60 euro/kg at the beginning of the period, rates took off, reaching 2.00 euros/kg in May. They continued to rise up to 2.50 euros/kg on average in June. The other origins supplying this product (South Africa and Israel) took advantage of these good market conditions. This exceptional price trend generated by a considerable reduction in the supply was seemingly down to a fall in production in Israel, but above all in the USA. The production of the number one sweet potato exporter was apparently hard hit by hurricanes in the cultivation zones, especially in Carolina, causing production falls of more than 30 %. Hence the USA drastically scaled back its exports. Deprived of their supply from the US, operators tuned to other origins, where availability proved to be lower.

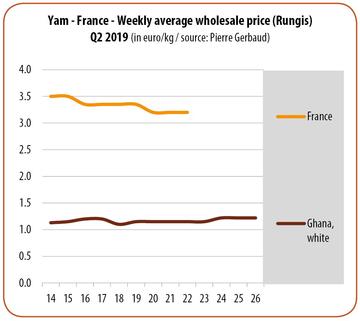

Yam

The yam market was fairly stable during Q2 2019. It was marked by the end of the French produce campaign in mid-May, in a context of lower demand because of its deteriorating quality. Hence its rates took a downturn from April onwards. In parallel, Ghanaian yams sold steadily at fairly stable, unvarying prices, which strengthened slightly at the end of the period given the gradual end of marketing of produce out of storage. The start of the new Ghanaian harvest’s trading campaign, expected in early July, should enable prices to be revised.

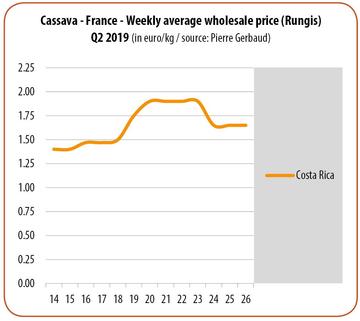

Cassava

Costa Rican cassava prices increased from May, at a time when the supply saw a big decline. Some sales were made temporarily in excess of 2.00 euros/kg. The Ramadan period too contributed to the rise in prices, boosting demand. In June, rates dipped, not due to a rise in the supply, but rather to a downturn in demand.

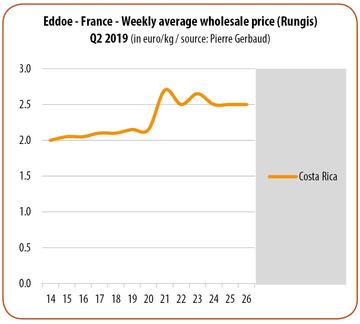

Eddoe

Costa Rican eddoes sold fluidly at around 2.00 euros/kg, a usual price level for this product. In the middle of the period, rates soared, increasing by more than 0.50 euro/kg until the end of the quarter. Certain sales were even made at up to 3.00 euros/kg. It seems that a drought affecting the production zones had limited the volumes available. The supply dipped while demand remained stable, leading to this price rise. In the absence of competition, Costa Rican produce took full advantage of this market situation.

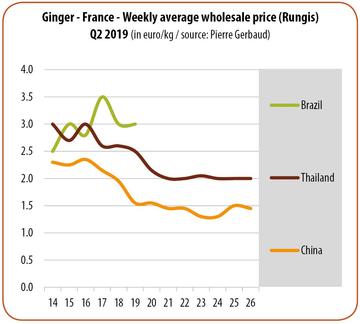

Ginger

The still moderate supply from China in April helped keep prices high for all the origins present. The more substantial acceleration in Chinese shipments from May sent the market into a downturn. Brazil, a less competitive origin, suspended its shipments in the first half of May. China and Thailand remained the market suppliers until the end of the period. The increase in shipments from these two origins led to a considerable fall in rates, more marked for Chinese than Thai produce.