Avocado monthly review: June 2020

- Published on 15/07/2020 - Published by Market News Service / FruiTrop

- Free

Avalanche of Peruvian fruit leading to a major crisis on the avocado market

Informations

- Product(s) : Avocado

- Rubrique / Thématique : Review and Forecasts

- Country : South africa , Colombia , Kenya , Peru

- Keywords : Export , Import , Price , Production

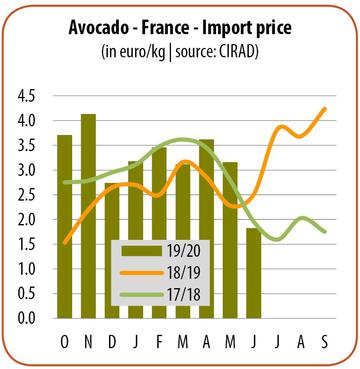

The overall supply reached historic levels, 20 % higher than in 2018, the last record summer supply year. Incoming Peruvian Hass shipments were vast, with the combined total reaching an unprecedented level of nearly 14 million boxes for June! They set new records, 30 % higher than in 2018 and 89 % higher than in 2019. The structural growth of the Peruvian cultivation area, the alternate bearing upswing and the overlap of peak shipments from the Olmos and Chavimochic production zones were the main causes of this oversupply. Furthermore, although the other origins clearly slowed their tempo, they still added to Peru’s shipments. South Africa, heavily affected by the Covid-19 pandemic, saw its volumes slip a long way down on 2019 (- 22 %). Incoming Colombian and Kenyan shipments remained above average, albeit with a downward trend. In this context although supermarket sales were boosted by numerous promotions, the market was greatly unbalanced. The supply proved too big for European demand, and rates literally collapsed. Stocks built up throughout the month across all sizes. The average price on the European barometer dropped to 6.94 euros/box, 18 % lower than in 2018 and 30 % lower than in 2019. At the end of the month, the price for average sizes (16-18) was between 4 and 5 euros/box. In addition, a significant proportion of sales was made on commission, with extremely low levels, indicating a completely saturated market.