Q3 2020 roots & tubers review

- Published on 21/10/2020 - Published by GERBAUD Pierre

- Free

Q3 2020 was a commercially quiet period for roots & tubers, with summer traditionally a slow time for these products. Sale prices saw rather a downward trend, except for ginger, the relative under-supply of which led to a considerable recovery in rates during September.

Informations

- Product(s) : Eddoe , Ginger , Yam , Cassava , Sweet Potato

- Rubrique / Thématique : Review and Forecasts

- Country : South africa , Brazil , China , Costa rica , Egypt , United States , Ghana , Guatemala , Honduras , Martinique , Portugal , Saint Vincent

- Keywords : Export , Import , Price , Production

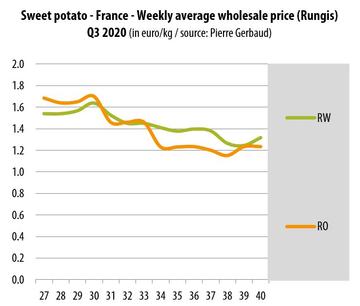

Sweet potato

White-fleshed sweet potato prices were relatively stable during Q3 for produce from Honduras and South Africa, albeit with a dip in August followed by a quieter period. The South African campaign wound down in mid-September, just as Egyptian shipments were resuming, trading at lower prices. Brazilian sweet potatoes, present throughout the period, sold at slightly lower prices than produce from Honduras and South Africa. In any event, rates were considerably lower than at the same period in 2019, when they reached particularly high levels (2.50-2.70 euros/kg).

Orange-fleshed sweet potatoes, which account for a big market share, saw prices fall in stages over Q3. The increase in volumes of this type of potato seems to be one of the reasons. The more variable quality of the produce from certain origins has also been pointed to as an explanation for this downward trend, especially from Honduras and Guatemala. The latter origin also seems to have a smaller presence on the markets than in previous seasons. Conversely, we can note a growth in volumes from Egypt, traditionally more focused on white-fleshed tubers. Apparently this origin is undertaking a varietal switch, favouring orange-fleshed varieties such as “Beauregard”. US produce (Covington), available at the same time, sold on the same footing as its competitors. Sweet potatoes from Portugal (Beauregard), conversely, were valued at around 1.00 euro/kg, given their more variable quality.

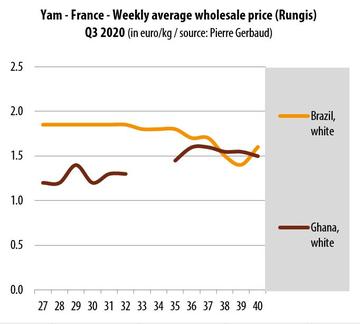

Yam

Ghanaian shipments continued throughout the summer period at a more moderate tempo. In July, tubers from this origin sold at between 1.20 and 1.40 euro/kg, while stocks from the last harvest finished. For several weeks, the overlap between produce from the old and new harvests caused some trade disruption. As asking prices for tubers from the new harvest were high, many operators temporarily suspended their procurement. More normal trading resumed in late August-early September, with higher sale prices (1.50-1.60 euro/kg). Brazil also supplied Cuscus yams, selling at stable prices in July-August, though they fell in September due in particular to a more substantial and competitive supply from Ghana.

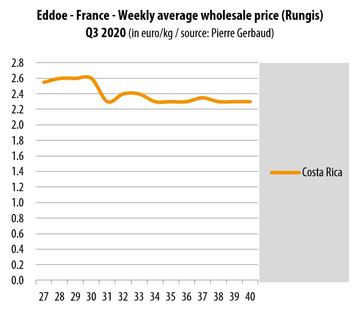

Eddoe

Costa Rican eddoe sale prices underwent a marked fall in late July, losing 0.20 to 0.30 euro/kg. They then held up at around 2.30 euros/kg on average, with some variations according to tuber size.

Dasheen

Martinique sent regular small batches of dasheen, selling at a fixed, unchanging rate of 4.20 euros/kg. Shipments from Saint Vincent resumed in mid-July, after a two-month interruption for reasons of insufficient production. This produce sold at high prices given the limited quantities available (4.00-4.50 euros/kg). This price level, matching or even exceeding the price for air-freight merchandise from Martinique, clearly illustrates the shortage of produce. In the second half of September, Saint Vincent suspended its shipments again, once more due to a production shortage.

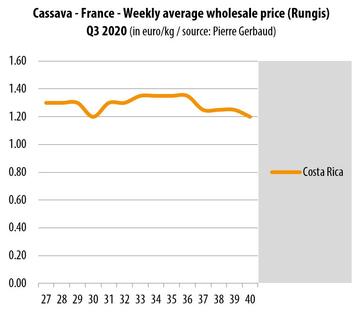

Cassava

The price of Costa Rican cassava saw variations with an amplitude of 0.10 to 0.15 euro/kg. The highest rates were registered in August, when volumes were more restrained. Prices were weighed down by the more substantial resumption of shipments at the end of the period.

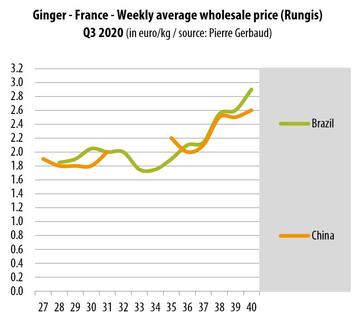

Ginger

Ginger prices saw a distinct rise during Q3 2020. After selling at strong prices of around 1.80-2.00 euros/kg in July and August, while the Chinese supply was in a dip, ginger rates took an upturn in September, reaching 2.80-3.00 euros/kg at the end of the period. The more limited volumes, in spite of the resumption of Chinese exports, together with stronger demand, seem to have driven this increase in sale prices.