Roots & Tubers review: Q3 2021

- Published on 20/10/2021 - Published by GERBAUD Pierre

- Free

Informations

- Product(s) : Eddoe , Ginger , Yam , Cassava , Sweet Potato

- Rubrique / Thématique : Review and Forecasts

- Country : South africa , Brazil , China , Costa rica , Egypt , Spain , United States , Ghana , Guatemala , Honduras

- Keywords : Export , Import , Price , Production

Sweet potato

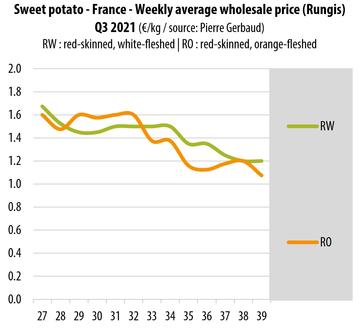

The sweet potato market swelled in Q3 2021 from the previous period. It was primarily Brazil and Honduras which supplied white-fleshed sweet potatoes. The South African campaign progressed rapidly in July, with rates falling. The Brazilian supply, steadier throughout the quarter, was valued at around €1.50/kg in July and August. Rates dipped in September to €1.20/kg. Honduras, mainly known for its orange-fleshed sweet potato exports, shipped white-fleshed tubers in July and August. After fairly low levels in July, prices increased in August to match those of Brazilian produce, and fell in early September before the available supply disappeared. Egypt, generally in place at this time of year, seems to have favoured orange-fleshed sweet potatoes to kick off its export campaign.

Orange-fleshed sweet potato demand, generally livelier than for the white-fleshed varieties, slowed down during the summer. From €1.50/kg to more than €2.00/kg in Q2, rates for Honduran produce held up at €1.60/kg in July and August, before a steep downturn in September (€1.20-€1.30/kg). This rapid fall was doubtless due to the increase in availability, especially with Egyptian shipments progressing. The cost price of Egyptian merchandise, lower than its Honduran counterpart, also contributed to this downward trend. The supply was topped up by Guatemalan shipments at the start and end of the period. They sold on the same price footing as Honduran produce. Meanwhile, the market received produce from Spain and the USA, which sold on the same price footing.

Yam

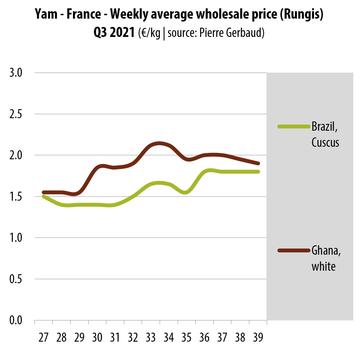

The market was supplied mainly by Ghana for white yams, and by Brazil for Cuscus. There was a gradual transition from the old to the new harvest for Ghanaian produce in July. The last stored yam batches sold on a downward footing, given the arrival of the new harvest. So the average price in July was reduced by the residual batches from the old campaign. In August and September, only the produce from the new harvest was available, causing a significant price increase, of more than €2.00/kg. Rates stabilised in September at below €2.00/kg. The increase in prices registered was in no way attributable to regained demand, but to compression of the supply. We can also note the uneven quality of the tubers shipped by Ghana, occasionally causing sales at lower prices. Brazil provided a steady supply of Cuscus yams throughout the period, which followed the same price trajectory as the competing products, but at a lower level.

Eddoe

Costa Rica remained the main market supplier, with fairly limited quantities against what was also a modest demand. Sale prices remained fairly stables, with small variations according to incoming shipments and sizing.

Cassava

There was a big increase in Costa Rican cassava prices in late July, going from an average of €1.20/kg to €1.60/kg, and then €1.90/kg, a level rarely reached for this product. Rates dropped slightly in September, while maintaining a high level. This price increase is attributable to a big fall in the supply, caused by stricter application of the regulations on coating products used for certain tubers. Cassava tubers are coated with paraffin to extend their keeping time. Products of mineral origin have been prohibited on imports into the European Union for the past several years. As inspections have revealed use of these banned products, the flow of merchandise has greatly dwindled, explaining the dwindling cassava supply to the market, and consequently, the increasing sale prices.

Ginger

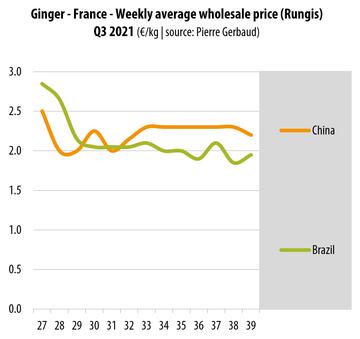

Brazil, and to a more modest extent China, provided the market supply during Q3 2021. In July, sale prices carried on from the end of Q2 (€2.50-€3.00/kg). They dropped again in August (€2.00-€2.50/kg), according to the packaging provided and product quality. The slump in prices came not from an increase in the supply, but rather a contraction of demand. The reduction in Brazilian shipments was offset by rising shipments from China.