2021-22 winter avocado campaign review

- Published on 9/05/2022 - Published by FRUITROP

- Free

A difficult season packed with lessons!

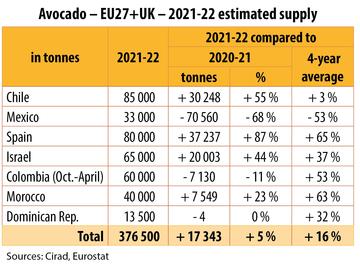

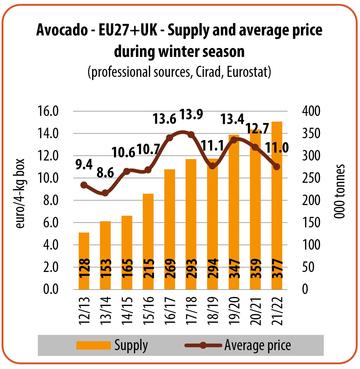

The customs figures as at February, supplemented by the professional data, enable us to draw up an initial provisional review of the 2021-22 winter season. The supply level, highly variable from month to month, made a modest overall rise over the period from October 2021 to April 2022 of just 5 %. Conversely, the campaign average price dropped to a distinctly greater degree (approximately -15 %), with our European barometer for the first time since 2015-16 dipping very slightly below the €11/box mark. Performance was unfortunately along the same lines as the 2021 summer campaign, which was also the worst season since 2014-15. So while volumes changed little overall, the division of the market between the origins underwent a major revision, for cyclical or structural reasons. The boom in Mediterranean volumes, which went from approximately 35-40 % of the overall supply to 50 %, is clearly an underlying shift. Israel nearly doubled its shipments, thanks to its cultivation area swelling by 5 000 ha in five years. There was a less explosive, yet still distinct, increase for Morocco, with the country’s 8 000 ha of young orchards not yet fully expressing their potential for climate reasons. The rise was more cyclical for Spain, though there is genuine surface area expansion, which will be expressed in the very near future (see “Spain producer country file” in this edition). The Latin American suppliers are of course on the reverse trajectory, meaning that they limited their shipments or sought to diversify them to avoid often difficult market conditions, in particular during their main market window from October to December. However, Chile regained its place as the number one supplier to Europe, although the diversification shift to Latin America took a big step up (more than 20 000 t, mainly to Argentina): it was also able to make a cyclical return to the US market (just under 8 000 t). Conversely, Mexico literally bolted away, particularly during the second part of the season, to get in on the red-hot US market (Michoacán), or to take advantage of less difficult conditions in Japan and Canada, in the case of Jalisco. Colombia too saw a considerable drop.

While it was difficult, this campaign did also provide many lessons, which deserve in-depth analysis. In particular, we can point to the increasingly acute fragility of the November-December period, which brings constantly growing volumes (a rise of more than 50 % in the supply in the space of 4 years). We should also mention the change in the Mediterranean trading calendar, which is tending to downscale to avoid this difficult end-of-year period. Yet above all, a major paradox is emerging, illustrated by an average price differential of 50 % this campaign between Europe and the USA: thanks to being fully open, the EC market is the most exposed to the big growth trajectory in worldwide production, already in place and set to increase, but its promotion practices are far from the best. This issue needs to be dealt with urgently, by boosting the budget of the World Avocado Organization, in the interests of all the industry operators.