Mango monthly review: July 2022

- Published on 17/08/2022 - Published by GERBAUD Pierre

- Free

Market strengthened constantly throughout July

Informations

- Product(s) : Mango

- Rubrique / Thématique : Review and Forecasts

- Country : Brazil , Israel , Mexico , Puerto Rico , Dominican republic , Senegal

- Keywords : Export , Import , Price , Production

Carrying on from June, the mango market strengthened constantly throughout July. The ongoing delay to the start of the Senegalese campaign was probably one of the main reasons for this unusual trajectory for this time of year, when we generally see demand wane in the face of a substantial supply. The absence of Senegal, the only origin to offer Kent variety mangos, caused a steep price increase in fruit from this source to levels rarely reached (€8.00-€9.00/box). The overall shortfall extended to all mangos from origins active on the market: Brazil, the Dominican Republic and Puerto Rico. However, the wide quality divergence of the mangos on the market entailed systematic sorting of the fruit (fungal attacks), and consequently weighed down on the economic results of the transactions. The market tightened up more at the end of the month, with the appearance of the first batches from Israel.

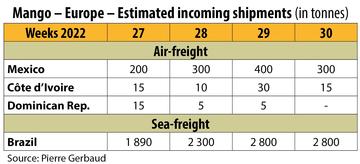

The air-freight mango market was more mixed from mid-July, with the Mexican supply on a steep rise as demand was dwindling. In addition, the variable quality of the incoming batches forced the recipients to apply sometimes substantial sorting. Hence many batches were placed “on commission” on the wholesale markets, and often sold at low prices (€3.00/kg). The small tonnages from Senegal sold more steadily, at between €4.50 and €5.00/kg. In the middle of the month, the Israeli campaign started with Aya variety fruits, and quickly continued with a wider varietal range: Omer/Kasturi and Shelly. Israeli produce of satisfactory quality made up for the haphazard quality of the Mexican fruit. Its prices remained stable until the end of the period.