Mango monthly review: November 2022

- Published on 7/12/2022 - Published by GERBAUD Pierre

- Free

The under-supply continued

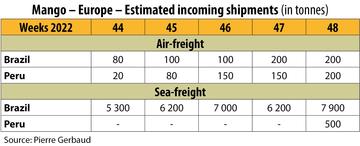

The under-supply observed in the second half of October continued in November, which helped keep prices high. Brazil was the main mango supplier after Spain’s gradual disappearance in the middle of the month, having provided primarily Keitt variety mangos after the end of its Osteen campaign at the beginning of the period. Spanish fruit took advantage of the good market conditions, to sell at similar prices to fruit from the competing origins. Yet the Keitt campaign proved short-lived, and characterised by moderate quantities. The weather conditions during the fruit growth phase accelerated the mango maturation process. This led to increased fruit fragility, often requiring rapid placement. Brazilian shipments were slower than in previous years, widening the fruit shortfall on the European markets. Hence rates maintained high levels across all varieties during the first half of November. In the second part of the month, the supply became denser due to the accumulation of increasing shipments, leading to a dip in prices.

The air-freight mango market proved distinctly more complicated. The combined shipments from Brazil and the start of the Peruvian campaign quickly saturated the markets, particularly in the second half of the month. The predominance of large sizes for Brazil and small sizes for Peru disrupted sales. The batches of advanced maturity, and large shipments received, created a supply/demand imbalance. The situation was aggravated by hesitant consumption because of the high retail prices, reflecting the product’s cost price. In the second half of the month, numerous batches were placed "on commission" on the wholesale markets and/or sold at low prices (from €3.00/kg).