FruitTrop Magazine n°211

- Publication date : 30/05/2013

- Price : Free

- Articles from this magazine

South Africa, Réunion and Mauritius are still complementary sources, shaded by the giant, Madagascar, during the main season for litchi on the European market from November to February. Although the volumes exported from these minor sources are much smaller, they are important in terms of market segmentation. They thus use outlets that are parallel to supply from Madagascar thanks to a varying degree of competiveness and specific features of the fruits (fresh produce, size grading, etc.). A competitive advantage is also observed especially during the first part of the season when shipment is by air only.

The South African season was a little later than the others, starting with small air shipments in Week 46. Volumes did not increase until the following week. South African exports peaked in Week 49 but without equalling the volumes shipped at the same time in 2011. Competition from the other sources doubtless limited South African exports even though the produce was not aimed at the same clientele.

After fetching higher prices in the first weeks of the season, the prices of South African litchis shifted to approach those of the competition. As in previous years, these better graded fruits with good organoleptic qualities sold well, mainly on wholesale markets. Sales continued after the arrival of the first shipments by sea to meet specific traditional trade demand. A few batches shipped by air arrived in January. These were treated and untreated 'Mauritius' fruits, thus diversifying supply from South Africa. Although litchis from this source have a good image, quality was fragile this season with frequent fungal attacks that reduced the selling price of certain batches.

The sea transport season started later than planned. Initially set for the last week in December, the first containers did not arrive in Europe until the second week of January, thus increasing a dip in supply that benefited fruits from Madagascar that had arrived in the second conventional ship. South African deliveries were fairly irregular, making customer fidelity difficult. The litchis shipped in containers also displayed quality problems that sometimes obliged operators to make price concessions or discard the worst batches. However, good quality fruits sold well at distinctly higher prices than those of the preceding season. The crop in South Africa was somewhat later, depending on the production region, and the season continued after the end of sales of fruits from Madagascar. In February, South Africa was the only supplier of litchi to the European market and so prices were firm and stable. Demand for South African produce also increased again in the first half of February with the Chinese New Year celebrations. The export season finished in the second half of February with a few batches of Red McLean sold at EUR 3.00 to 3.25 per kg.

In spite of irregular deliveries, the volume exported from South Africa totalled around 3 600 tonnes, a substantial increase on the total of some 2 000 tonnes in the previous season. South Africa is thus still the second largest exporter after Madagascar. It contributes a significant complement by the segmentation of the range with strict selection of fruits and fruit size.

After the record volumes (more than 400 tonnes) shipped during the 2010-11 season, Réunion reduced its exports considerably in the 2011-12 season as a result of the small crop caused by poor weather. Quantities were large again in 2012-13 at 420 tonnes, beating the record set in 2010-11. Like most of the sources in the Indian Ocean, Réunion benefits from good natural conditions resulting in an early harvest and large production. Although this is a positive factor, it applied to the whole of the Indian Ocean and, resulting in particularly fierce competition.

The first litchis from Réunion appeared on the French market at the beginning of November. The symbolic quantities concerned fetched very untypical prices (EUR 13.00-14.00 per kg). Prices decreased considerably in the second week of sales first because of the massive increase in the total quantities available and secondly because of the poor receptiveness of the market. At the beginning of the season, consumers were little inclined to purchase fruits of a festive nature at particularly high retail prices. The decrease in prices was confirmed in Week 47 and became more marked. They decreased daily, and in the end lost 50% (EUR 5.50 to 7.00 per kg). Prices then differed according to the presentation of the fruits. Destemmed litchis were at the bottom of the ranges observed and bunches at the top. Fruits on the branch fetched intermediate prices. This trend continued throughout the season, with an increase in the difference between minimum and maximum prices.

The market was over-supplied in the second half of November and reached its lowest level, resulting in the accumulation of stocks that affected fresh fruits most because of their perishability. The trend reversed at the beginning of December as a result of the strong decrease in deliveries from Madagascar and Mauritius and also because of an increase in demand at the approach to the Christmas period. The arrival in Week 50 of the first litchis shipped by sea changed the profile of the market again. This produce was little sold on wholesale markets, leaving more scope for untreated fruits that were more at home there. Prices recovered markedly in the two weeks before Christmas while the volumes received increased. However, the price difference between destemmed fruits and bunches became lastingly marked: the former fetched EUR 5.00 per kg while the latter were sold at EUR 7.00 to 10.00 per kg. The volumes shipped from Réunion fell by half after Christmas, allowing prices to hold and even increase.

The Réunion season started earlier and ended more rapidly than in other years. It continued until the third week of January but with only marginal volumes. Prices continued to increase, nearly reaching the levels observed at the beginning of the season. At the end of January, the last shipments were disturbed by cyclone Dumile. However, it seems that this did not directly affect the litchi production zones.

Réunion anchored its position once again in a particularly competitive context in which supply from most Indian Ocean sources converged on Europe simultaneously. It is true that the fact that only fresh fruits are exported from Réunion is a definite advantage as exports are focused on the traditional quality market. However, the market is no proof against competing produce whose omnipresence weighs on selling prices. The early start of the season well before the Christmas period complicated the sale of produce whose retail price is high. Litchi from Réunion seems to find its place on the market just before the holiday period in a fairly narrow distribution channel. The difference in selling prices according to presentation (destemmed, on the branch, bunches) is a clear illustration of customer segmentation. This feature is probably more marked during the current period of economic stagnation.

Litchi exports from Mauritius during the 2012-13 season totalled some 270 tonnes, a record for a source that generally ships 120 to 150 tonnes. The record is particularly important as it came after the serious shortfall in 2011-12, when the total for the season was hardly 110 tonnes. Mauritius has a difficult position every year. It has the capacity to kick off the Indian Ocean season with early fruits but is exposed to frontal competition from neighbouring sources with greater production potential. This season again, Mauritius suffered from sales conditions on the European market. The 'early fruit' aspect was wiped out by the earliness of the harvest in the main supply sources. Indeed, the first batches from Mauritius reached Europe at the same time as the larger volumes from Madagascar.

The usual week or two weeks with no real competition allowing the sale of the limited quantities available at high prices were not there this season. However, Mauritius has the advantage of being able to adapt supply by adjusting shipments of fresh and treated litchis in the light of sales conditions. This facility was also well supported by excellent air freight rates—half the figure applied to competing sources. The limiting of approach costs made up for the higher cost of labour in Mauritius than in Madagascar for example.

Nevertheless, the price of litchis on the branch from Mauritius fell during the first week of sales under pressure from the cumulated tonnage reaching the European markets. Offered at EUR 13.00 per kg at the beginning of Week 45, they changed hands at EUR 10.50 to 12.00 per kg at the end of the week. The price fell from EUR 10.00 to 7.00 per kg during the following week and the trend continued until Week 49 when the level stabilised at between EUR 4.00 and 5.00 per kg. The reduction of the tonnages shipped from both Mauritius and Madagascar favoured a firming of prices. This was confirmed just before the holidays (EUR 5.00 to 6.50 per kg) as demand was brisker. In the last week of the year, which marked the end of the season for Mauritius, prices increased to EUR 7.00 to 7.50 per kg for very limited quantities.

Exports of treated fruits were more concentrated in time. Operations started in Week 46 and finished in Week 49 just before the arrival of the first ship from Madagascar. The price movement displayed a fall from EUR 6.00 to EUR 4.00 to 5.00 per kg, much the same as the price of competing produce. The prices of treated and fresh fruits matched in Weeks 48 and 49, a feature rarely observed. The fall in the price of fresh fruits was probably speeded up by their greater fragility and shorter shelf life in a context of massive supply causing the accumulation of stocks.

The loss of the early fruit position at the beginning of the season as a result of the earliness of all the Indian Ocean harvest considerably hindered the sale of litchis from Mauritius. The substantial supply from the various sources aggravated the worsening of market conditions in a context that was little favourable for the sale of fruits at high prices. The twin position of Maurice with treated and fresh fruits possibly prevented disappointing sales. The competitiveness of Mauritian fruits is a strong point for a source whose production is still smaller and more fragile than that of the other sources in the region. It made it possible to maintain market presence during the peak air freight supply period.

After a longer 2011 season with large volumes shipped (620 tonnes), Israel seems to have refocused on the summer litchi market. The some 470 tonnes exported in 2012 is the same as the figure for 2009, which marked the decline of a country that shipped 600 to 800 tonnes at the beginning of the 2000s. The 2011 season held a glimpse of a renewal of the interest in this fruit. The last season seems to indicate the opposite, unless the reasons were conjunctural. It is true that the litchi market is far from dynamic in the summer. However, supply at other times of the year maintain a current of business and satisfy a small number of customers, an important feature for anchoring an exotic fruit in European markets.

The 2012 Israeli season is hinged mainly on the 'Mauritius' variety, with the first batches arriving in Europe at the beginning of July, as in most previous seasons. With an asking price of around EUR 5.00 per kg, the first shipments were shifted without great enthusiasm as cheaper seasonal fruits were available. Prices then fell as supply increased, peaking in the second half of July. Prices were down to EUR 1.00 per kg at the beginning of August. They stabilised at this level until the end of the season in the last week of August, with the volumes released decreasing strongly.

The maintaining of comparatively stable prices during the season appears to show that the volumes shipped roughly match natural market demand, strengthening the trade position for the produce. The larger volumes shipped during the previous season had sent prices down more markedly, with selling prices of EUR 3.00 to 3.50 per kg. Shipments were recentred on a shorter period making sales stronger and avoiding the low prices of poorer fruits at the end of the season. However, this source has certainly lost some of its originality by seemingly abandoning its varietal diversification with 'No Mai Chi' (seedless) and 'Yellow Red', that had extended Israeli exports until practically mid-October in 2011.

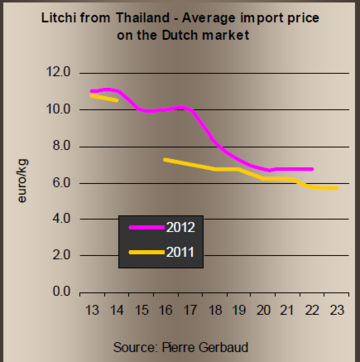

Thai litchi exports to the European market were estimated at 500 to 600 tonnes in 2011. The 2012 season seems to have been about the same, with slightly more than 600 tonnes. The Thai season is a short one, running from April to June and generally stopping when the first Israeli litchis arrive. This confirms the difficulty of selling produce whose peak consumption is at the end of the year at lower prices. The meteorological problems that affected the country at the end of 2011 may also have reduced production. Export of litchis is just one market segment from this source, where a substantial processing industry is developing, producing canned litchis in particular. The decrease in its supply in recent years is keeping Thailand in the trade segment of exotics shipped by air and sold at high prices

Click "Continue" to continue shopping or "See your basket" to complete the order.