FruitTrop Magazine n°215

- Publication date : 29/10/2013

- Price : Free

- Articles from this magazine

Let’s not put a damper on our moment of pleasure. The pineapple market, particularly in Europe, is going better… slightly. Import prices have stopped falling, and the extreme volatility and nervousness of the markets have eased. Yet our satisfaction should be restrained, since this highly fragile and fortunate lull on the European pineapple market seems to be merely the result of a short-term fall in volumes on the market.

no doubt that the pineapple market is still at the gates of hell, again. The original sin is unfortunately always the same: a structurally excessive worldwide supply. The equation is simple to resolve, yet it seems that only the vagaries of the weather or agronomic problems have the key to doing so. The strict parallel with the banana is also a useful one to draw, with the same causes always producing the same effects. More generally, both these products pose the problem of managing agricultural markets. The absence of market coordination or regulation is, for agricultural products, a major handicap to the smooth development of a market and to accurate and fair valuation of a product: a heretical thought in a world where deregulation, as the source of all progress, is a religion.

What do the world statistics tell us? Unfortunately, for the moment we need to make do with the 2011 data. They show a steep increase in world production: + 8 % from 2010 and + 11 % on the 2009-10-11 three-year average. Production is approaching 22 million tonnes, twice the figure in 1987. World fresh pineapple imports are precisely following the upward trend observed in production. The 3-million tonne mark was touched in 2011, the figure doubling in just eight years! The world processed pineapple trade (juice and tinned) is also contributing to the globalisation of this fruit. Four out of every ten pineapples produced find their way onto the world market, of which 68 % in the fresh sector (see inset). However, the reference to 2011 is not the best in our current market context. Indeed, it was another year of import growth. Yet this is no longer the case in Europe, unlike in the United States (see inset), a bottomless pit for the pineapple. So we should see the appearance in the FAO’s forthcoming figures of a break in the trend, both for world production and for exports.

True, the 2011 figures should be put in perspective, but we can only rejoice that a product has had such success, and in record time. The flip side of the coin is that as it has spread, this fruit has gone from the status of exotic fruit, with highly festive associations, to a commodity that forms a basic part of the shelves of many European supermarkets. Yet how could we imagine another outcome when the pineapple market already, for Europe alone, represents one fifth of the banana market, the undisputed number one import! The niche market has long since become a mass market, with all the attributes: low and highly fluctuating prices, a very wide (or excessively wide) quality range, highly disruptive spot supplies, deseasonalisation (excessive year-round presence), etc. This market langour is reinforced by what had originally got it going: the MD-2 variety. Del Monte’s flagship pineapple from the mid-90s, and for more than a decade, it now forms the core of the range, often not very good, often not very presentable and too often unappealing. The sad and textbook story of a successful segmentation, so successful that the outsider has killed off the champion, the historic smooth Cayenne, to become the sole reference on the market.

It was a perfect crime until the uncontrolled distribution of the variety. Rather than distribution, we could talk about proliferation, or even swarming. As imitation is far more commonplace in the world than innovation, producers of all sorts (both very big and very small) hurled themselves onto the goose with the golden eggs. Except that, although MD-2 is not very complex to produce, Del Monte had long years of agronomic experience, and above all a packing, transport and distribution chain that left nothing to chance. Without even minimal technical control, the variety has slumped in terms of quality. The inflation of volumes mentioned above has of course accelerated this suicidal drift.

This explosion led to market volumes doubling in less than a decade in Europe, and in seven years for the United States. What was gained in terms of diversity of commercial players over this period was lost in terms of diversity of sources. The Costa Rican giant completely annihilated the competition. In 2012, it represented 85 % of the supply, on both the EU-27 market and the US market; making for complete hegemony from a source which, as we remarked, conceals an extremely heterogeneous set of situations within Costa Rica itself (see inset). The sector is highly varied. The national professional organisation, Canapep, comprises more than 1 300 producers, of which just 10 % are large to medium-sized. The majority of the planted surface area (65 %) is in the hands of independent producers who do not manage the export activity themselves.

Other sources have attempted to gain a foothold on the world market. We have lost count of the development plans, the big national schemes, and the ambitious projects. The end result: veni, vidi but not vici. Ecuador, which had very big ambitions, announced in March 2013 that the surface area dedicated to the pineapple had fallen by three quarters (source: Reefer Trends). There apparently remains just 1 500 ha of the 5 500 that Ecuador had at its disposal in 2003. Without exception, all the sources that used to supplement the Costa Rican supply have cut back their volumes to the EU. The situation is slightly different in the United States. Mexico, the number two supplier with just a 6 % market share in 2012, has achieved its best year: as has Honduras (market share 4 %), continuing its slow progress. Ecuador is collapsing in the United States as it is in the EU. Panama, Guatemala and all the others have at best maintained their exports. As regards African sources to the European market, the situation is no better. As expected, Cameroon (no. 6 supplier) plummeted in 2012 and the trend was confirmed in the 1st half of 2013. Côte d’Ivoire seems to have halted its freefall. It maintained its place as the number 4 supplier, and made an upward leap in the 1st half of 2013. Ghana, the number two supplier ahead of Panama, found the path to growth again in the 1st half of 2013, after a lacklustre 2012. Among the more restricted sources, Benin (under 2 500 tonnes/year) is in the process of winning over the air-freight Sugarloaf pineapple market. At the bottom of the ranking is Togo, which on average is maintaining an export performance of 1 000 tonnes to the EU per year.

In more general terms, 2012 provided proof that what goes up must come down… except perhaps in the United States. Indeed, whereas the EU market shrank in 2012 by 55 000 tonnes (- 6 % on 2011), the US market continued to expand and not in a small way: it gained a staggering 13 % in volume! At the current rate of consumption, of around 925 000 tonnes, the million-tonne mark will be reached well before the end of 2013. Given the supply structure, it is Costa Rica which sets the tone. The supply went up by more than 16 % between 2011 and 2012. So as regards the EU, the situation is completely different. After reaching 919 000 tonnes in 2011 in a deteriorated market situation, we seem to be coming to our senses, back to a supply level of 850 000 tonnes, which seems better suited to the market absorption potential. Since 2008 the 900 000-tonne mark has been crossed three times; three times too many for the profitability of this industry.

The European consumption level is 1.7 kg per capita per year, down 100 g between 2011 and 2012. We should remember that it tripled in fewer than fifteen years, but the trend since 2008 has been for stabilisation. This average conceals a very great diversity between the Member States. In the previous pineapple report in FruiTrop (no.204, October 2012, page 41), we showed that we could not expect miracles from the new East European Member States. True, their consumption is growing, but they are starting from a long way down and their progress is very slow. Most of these countries consume just 300 to 400 g per year (at best), barely one third of a pineapple per capita per year.

Further on in the report, Thierry Paqui reviews how the season has gone, and shows how the fall in the supply affected pineapple valuation in Europe. Overall, in terms of annual average, there is an apparent murmur at the import stage. The average price per box held up at 7 euros in 2012, and even gained 0.50 euro over the first nine months of 2013. Yet the novelty lies in the narrowing of the price range. The only price movements since 2012 have been within a band of 6 to 8 euros/box. As the German price movements graph shows, we are a long way from the range of 5 to nearly 11 euros/box of the annus horribilis 2011. The market volatility seems to be taking something of an upturn in 2013, though starting from a high average price (7.5 euros/box).

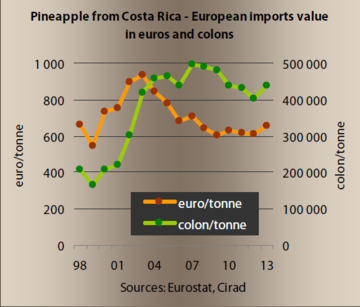

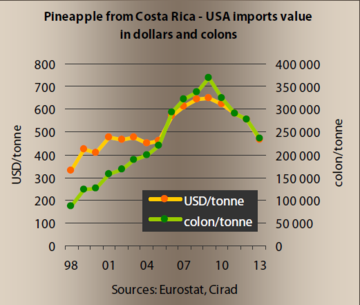

Nonetheless we cannot start celebrating: the scar has not yet healed. We can clearly see that the situation is fragile and is due to a welcome yet unplanned decrease in the supply, especially from Costa Rica, and to a US market which is driving or even carrying the global trend. We might also wonder whether things have gone too far there as well. The customs value in the United States dipped for the third consecutive year, while it stabilised in Europe. Since 2009, pineapples arriving at the US border have lost more than 100 USD/tonne in value, i.e. a fall of 16 %! And the exchange rate effect has not given exporters a breather, because since 2009, in local currency, the revenue of the operators has fallen by one quarter. Yet the price of the production factors has not fallen; quite the opposite! For example, fertilisers went up from an index of 204 in 2009 (index 100 in 2005) to 259 in 2012, i.e. inflation of 26 %, equivalent to the deflation on pineapple import prices into the United States. The scissors effect between cost and sale price is worrying. The same goes for energy, which over that period went from an index of 114 to 187 (source: World Bank). The spiralling production costs in Panama perfectly illustrate the pressure on the margins. Between 2011 and 2012, the production cost per hectare of pineapple increased by nearly 30 %, from 22 000 to 28 000 USD/hectare (source: La Prensa). It is virtually only the Dominican Republic that is still providing grounds for optimism. It has just announced development plans and planted millions of plants, more exactly 10 million, which equates to between 200 and 250 hectares (source: Reefer Trends).

And the Costa Rican producers will not find their redemption from Europe. True, prices in the national currency (colon) have stopped falling, even taking a slight upturn in 2013, but the situation remains highly precarious. In a memorandum released in 2012, analysts of the Costa Rican bank BCR drew a parallel between the appreciation of the colon against the dollar and the loss of profitability and competitiveness of the pineapple sector. The study even mentioned a probable relationship between the big fall in the number of exporters and this appreciation of the colon. Indeed, their number went from 144 in 2007 to 116 in 2011. In June 2013, a report by the Ministry of Agriculture drove home the point. According to the site Reefer Trends, of the 350 companies inspected by the authorities, 150 are in big difficulties paying their debts.

The situation of Ghana is also a good example of the influence of the exchange rate on the valuation of export products; in this scenario we can note the beneficial effect of depreciation of the national currency against the euro. Since the early 2000s, the New Ghanaian Cedi has consistently lost ground against the euro. Between 2010 and 2013, it lost 28 % of its value. In turn, the Cedi equivalents of the EU import prices denominated in euro have soared by 46 %. This is clearly one of the reasons keeping this source in second position in Europe.

Furthermore, we cannot talk about pineapples without mentioning the problem of its environmental impacts, particularly those relating to the use of pesticides. We can mention for example the decision of two municipalities on the Caribbean coast (May 2012) to prohibit extension of pineapple surface areas on their territory, or also the accusations raised by residents around the plantations (near Limon) about water pollution and the increase in fish mortality (July 2013). The poor working conditions of the labourers are also regularly pointed out by the NGOs, e.g. in 2010 by Consumers International. The sector is under close scrutiny, and must give its customers, whether distributors or consumers, guarantees of the high social and environmental quality of export products. This is an obvious point in terms of the consumption markets, but it is far from shared by all the production zones. So we should watch out for the devastating effects of some unenlightened individuals who are gravely endangering a sector driving economic and social development.

Overall, the outlook is rather gloomy. The market has lost its rudder, and is moving in response to the supply pressure, i.e. the climate and agronomic vagaries, and to the comparative profitability of the operators, in which the exchange rate plays a considerable role. It seems that the European market is set up to absorb 800 000 to 850 000 tonnes per year. The US market seems to have also reached a limit of around 900 000 tonnes. At least in theory. In practice, there is nobody keeping count, and above all to close off the valves in case of flood. They can only resign themselves, and ride out the storm for the long haul, or at least until the weakest have been commercially sunk!

Click "Continue" to continue shopping or "See your basket" to complete the order.