2014-2015 sea-freight pineapple campaign

- Published on 6/11/2015 - Published by PAQUI T.

- Free

Sweet in need of periodicity

The pineapple campaign (December 2014 to September 2015) was exceptional in more than one sense. First of all, prices scaled heights long forgotten, and secondly the Latin American supply to the European market was fairly scarce at times. These two factors began the year on a high by virtue of the near-parity of the dollar and euro, enabling sales at average rates of more than 10 euros per box over a relatively long period. Despite these good results, operators remain sceptical since they do not have any control over these factors. Is there no happy medium to be found between an excessive Latin American supply and the market absorption capacities? With the one-million tonnes mark about to be breached for pineapple imports into Europe, can the market not be revitalised by restoring a degree of seasonality or periodicity to the pineapple supply?

Summary

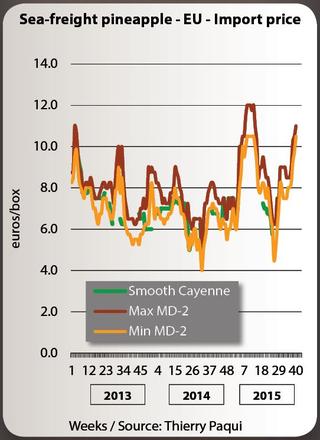

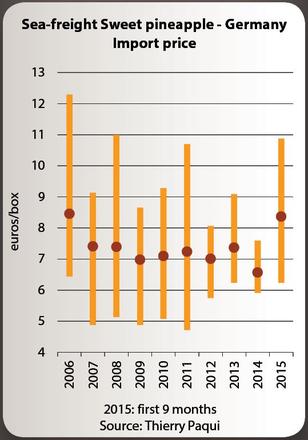

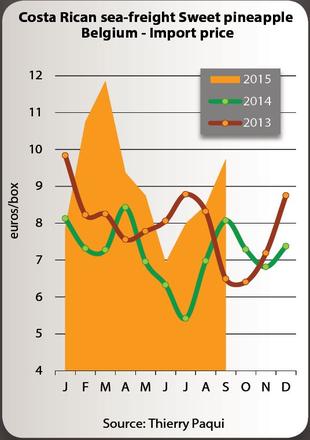

With the exception of the previous campaign (October 2013 to November 2014), when average prices fluctuated between 5.50 and 7.50 euros/box, Sweet rates have been in relatively stable in recent years, at between 6.00 and 8.00 euros/box depending on the size. Each campaign has seen more or less dynamic periods of activity, which have enabled operators to charge prices above or below these averages. The last campaign (week 49 2014 to week 40 2015) saw a fine rise in rates, to between 7.00 and 9.50 euros/box. During periods of strong demand, rates reached and even exceeded the 11 euros/box mark! It had been a long time since the small brands had so much to celebrate.

Costa Rica less flamboyant

Once again, pineapple sales in Europe followed the Latin America tempo, and more particularly the Costa Rican tempo. On a European market which imported 934 593 t of pineapples in 2014, Costa Rica accounted for more than 87 %, with 817 317 t.

Several times over the last ten months, the Costa Rican Sweet supply to the European market has dipped. The flooding which hit the country on several occasions impeded or delayed exports, and also affected production by preventing producers from planting or quite simply by destroying some of the plants. In addition, the appeal of the North American market, especially at the beginning of the year, was high, not only by virtue of good demand but also the dollar rate which, at least in March and April, was roughly equal to the euro rate. With an equivalent price per box on both markets, the lower delivery costs for the United States contributed to reducing volumes shipped to the European markets.

Prices soaring as volumes dwindle

During the previous campaign, in view of their losses several importers questioned their way of working with their Costa Rican suppliers. They contemplated reducing their imports to bring them a little more into line with market expectations, in the hope of price rises. This option of scaling down in order to stabilise and raise their rates, when based on a quality supply, has already proven effective, especially for Compagnie Fruitière, the leading exporter of Sweet from Africa, which has refocused its production on two countries, Côte d’Ivoire and Ghana. Similarly, since late 2014, Del Monte has opted to reduce its exports to Europe with a view to stabilising and raising its prices.

The relatively high average prices of Sweet charged over the past ten months seem to indicate that the avenue is worthy of exploration. While all operators agree that the market had often lacked fruit over the period, they also recognise that demand has very rarely materialised. Many actually believe that rates would definitely have collapsed if the supply had been a bit larger. In other words the weak demand would have struggled to absorb more substantial volumes. So it is more the scarcity of the supply which has enabled prices to increase. Meanwhile, the volumes absorbed by the European market are continuing to rise.

Despite the relatively high level of rates, operators kept sounding the alarm, since demand was not forthcoming. Despite a sometimes limited supply, demand was often lukewarm, without any genuine period of congestion, quite the opposite. Of most concern to operators were the weakness of demand and the fact that it is only picking up increasingly late at key moments of the campaign, such as Easter and the end of the year.

Promotions cancelled

The pineapple, an exotic fruit turned mass consumption product, is forever tied to the supermarket circuits, outside of which it is difficult, if not practically impossible, to sell import volumes in Europe. This fruit has become an essential loss leader for these chains, and so better organisation of procurement is required.

During the past campaign, several operators committed to pre-planned promotions had difficulty in meeting their commitments, so lean was the supply. Thus pineapples were sometimes sold speculatively at high prices. At certain points in the campaign, the supply was so scarce that some, with varying degrees of success, tried to renegotiate the agreements.

There were two consequences resulting from this increase in rates. The German discount stores (especially Aldi) purely and simply cancelled the promotions planned on the grounds that they feared being unable to procure the necessary volumes. Whether or not that is true, this explanation provides food for thought on the price that these essential operators are prepared to pay under these conditions. In other cases, although this price increase was accepted by the supermarkets and hypermarkets, it gave rise to a slowdown in store sales, with retail fruits becoming too expensive. This slowdown also had repercussions on the fluidity of import volumes.

Scaling down to boost value?

The reduced Sweet supply over the past few months was a cyclical phenomenon. Should more structural changes be considered, to govern the supply to the European market? What solution could be proposed to absorb the notorious natural-flowering fruits, which invade the markets in substantial volumes every year, causing catastrophic price drops?

Both Costa Rican operators and importers lose money when the market is over-supplied. Some believe that reducing the supply by 25 to 30 % (which roughly equates to the current market situation) should contribute to improving pineapple sales. Yet no-one really wants to take the first step or risk losing suppliers by scaling down their imports. While Latin American producers are seeking better value from their pineapples, they must play by the rules and refrain from overloading the market when it is saturated.

It is difficult to talk about seasonality for a fruit available year-round. However, an option for consideration could be stepping up the supply at certain times of year, as used to be the case: from November to December and from March to June. This solution would of course apply to the planned fruits rather than natural-flowering fruits, which due to their abundance and erratic nature should be considered as a potential reserve for importers, such is their disruption to the market organisation. Importers could then use them depending on demand on the European market. Yet this is of course a vain wish which has little chance of being fulfilled.

Key moments of the 2014-15 campaign

Week 49 2014 to week 2 2015

The end-of-year festivities, usually a favourable period for the pineapple market, were complicated in more than one sense. Operators were expecting to be under siege for the first three weeks of December, given the planned promotions. Yet this did not prove to be the case, quite the opposite. Despite a rather limited supply, in-store sales did not materialise, with the pineapple generating very little interest. Demand remained flat throughout the month. Stocks gradually formed, and stored batches made selling the incoming batches slightly more complicated with every passing week. Exports to the East European markets (especially Russia) were at a standstill. The devaluation of the rouble at the end of the year made any exports to this market unprofitable and fraught. Nor did the general strike in Belgium (which started on 15 December) facilitate pineapple sales in late 2014. The market very rapidly became congested. To avoid being left with stocks at the beginning of the year, when demand is generally very weak, the operators resorted to clearance sales.

The average rate outside of these sales was between 6.00 and 7.50 euros/box, leaving operators with little confidence in the future. Furthermore, at the end of this period, reports that the Costa Rica would provide a small Sweet supply began to circulate.

Weeks 3 to 22, 2015

The Costa Rican Sweet supply gradually decreased to reach under-supply levels. There were several reasons for this: first of all, a freight allocation problem, as Costa Rican melon exports supplanted pineapple exports. Secondly, the heavy rains in Costa Rica considerably limited availability. This shortfall caused a price increase, most particularly for the less abundant large sizes. This increase began in February, generally a quiet month in terms of demand, and continued until late March, just before Easter.

Furthermore, the North American market was dynamic whereas the European market, with its higher delivery costs, was less appealing due to the euro-dollar near-parity. Just after Easter, the arrival of slightly more substantial volumes of Sweet raised fears of a rapid drop in prices, especially since the period coincided with the start of the school holidays. However, the supply was still small enough to help stabilise the fall in rates, while maintaining a relatively high price level. In late May, the first summer fruits, despite their high price, led to a reduction in pineapple demand, forcing operators to gradually adjust their prices. During week 21, Aldi cancelled a series of pineapple promotions.

Average Sweet rates varied between 7.00 and 12.00 euros/box, and were at their highest during weeks 8 to 13, at between 10 and 12 euros/box.

Weeks 23 to 29, 2015

The seasonal fruits supply captured the bulk of demand, while maintaining high prices. Increasingly struggling to sell off their batches, the operators reacted by lowering their prices in the hope of getting sales moving. The lack of interest in the fruit arose when natural-flowering pineapples arrived; fortunately the flowering proved shorter than predicted. These unplanned volumes caused a drop in rates, which affected all the operators, even for established brands such as Del Monte and Dole, which ended up with too much fruit to put on the market. With sales remaining at a standstill, several batches were offered at post-sale prices.

Although the average rates were between 4.5 and 7.00 euros/box, several clearance sales were made at much lower prices. Despite the heavy rains which at one time led to the closure of the port of Limon in Costa Rica, the situation remained critical.

Weeks 30 to 40, 2015

The Sweet supply from Costa Rica gradually waned, contributing to stabilising the market and putting it back an upward trajectory. Unfortunately, as over the previous months, the reduced supply could not be sustained by demand which in summer is primarily captured by the abundance of seasonal fruits. In addition, the absence of some of the operators on leave made an impact on sales.

While the end of the school holidays resulted in a slight improvement in sales, demand never completely switched back to the pineapple, due to residual batches of seasonal fruits. The Sweet supply also comprised mainly small fruits, which were more in competition with summer fruits. Hence the large sizes were better valued, though demand remained lukewarm