FruitTrop Magazine n°245

- Publication date : 9/12/2016

- Price : Free

- Detailled summary

- Articles from this magazine

It is quite a rare occurrence. The emergence of a new product always attracts special attention, especially in the fruits and vegetables industry, which is more characterised by stagnating or even decreasing consumption. Novelty often springs up where it was not expected. Indeed, what could be more common and insignificant than the potato, a product with apparently little crowd-pulling potential. Yet it is this tuber, in its sweet version, hitherto with no impact on the markets, that is generating some excitement. True, the expansion trend goes back to the mid-2000s rather than yesterday. However, it has picked up noticeably in recent years, accompanied by modifications in terms of supply. This will be especially clear when the forthcoming Medfel in April 2017 puts the potato and sweet potato in the limelight.

World sweet potato production is estimated at nearly 104 million tonnes per year (FAO, 2013), making it one of the most cultivated tubers. It is in third position behind the potato (385 million tonnes) and cassava (270 million tonnes), but ahead of the yam (68 million tonnes) and taro (10 million tonnes). World production has been stable since the mid-2000s, after going through a big downturn in the early 2000s due to the collapse of Chinese production, which went from 140 million tonnes in 2000 to nearly 71 million tonnes in 2014. China, although on the slide, remains by far the world number one sweet potato producer. The top ten producer countries produce nearly 88 % of the world total.

Sweet potatoes are primarily produced in Asia (75 %), due to China’s massive production. Africa follows far behind with 20 % of world production. The Americas contribute just around 4 % and Oceania 0.8 %. Europe provides only an anecdotal proportion of world production, with just 0.05 %. The predominant cultivation of the potato, the resulting dietary habits and the less favourable weather conditions doubtless explain this lower interest in sweet potatoes. Production has shown fairly high stability in its development over the past decade. It is rising, though slowly, in Asia, the Americas, Oceania and Europe. Only Africa seems to be seeing a slightly more marked rise.

In Portugal, the main sweet potato production region is Alentejo, south-east of Lisbon. According to the cross-referencing carried out based on European statistics, Portugal’s exportable production is around 1 300 tonnes. The varieties most frequently encountered from Portugal are Beauregard (orange-fleshed) and Rubina.

Spain had a total cultivation area of around a thousand hectares, for an estimated production of 10 000 tonnes, in the early 2000s. This has apparently doubled since then. Sweet potato production is concentrated in Andalusia, in the Cadiz region, with approximately 60 % of Spanish surface areas dedicated to this crop. The second production region is Valencia, with nearly 20 % of surface areas. The remainder is divided between the other regions, including the Canaries. The Valencia region primarily cultivates the California variety (orange-fleshed). In Andalusia, certain particular varieties have developed: Amarilla from Malaga (white-fleshed and skinned), Rosa de Malaga (white-fleshed), Violeta Roja (white-fleshed), Lisa de Tucuman and Georgia Jet (orange-fleshed). Production extends from September to April. The most common export variety is Beauregard.

Italian sweet potato production occupies approximately 250 hectares for a harvest varying, depending on the year, between 5 000 and 10 000 tonnes. The bulk of production is located in Veneto (60 %) and Puglia (22 %). Additional production is based in Tuscany, Marche and Sicily. The Beauregard variety, but also white-skinned and fleshed, and violet-skinned and fleshed varieties, seem to dominate Italian production. The harvest is carried out mainly between August and October.

Sweet potato production in Metropolitan France remains marginal, with planted surface areas still modest though rising. They are situated mainly in the south of the country, though also in the Western regions and as far north as Normandy. Production is estimated at around one thousand tonnes. Previously absent from the traditional trade circuits, it emerged in 2014 and 2015.

There are some indications to be found in national agricultural statistics under the section “Other tropical tubers” (excluding the potato, yam and cassava). We can assume that this section corresponds to the sweet potato, though it may also relate to other products (dasheen, taro, etc.). According to these documents, the planted surface areas were 1 314 ha in 2013, down to 1 134 ha in 2014; while the harvest was 8 794 t in 2013 and 6 134 t in 2014. This production is primarily located in the Overseas Departments, more particularly Reunion, Martinique and Guadeloupe, and mainly consumed locally.

According to the literature, there are approximately 500 varieties of sweet potato, divided by skin and flesh colorations (o = orange-fleshed; w = white-fleshed; ww = white-skinned and fleshed; v = violet-fleshed). We can mention the following varieties:

For Africa (Benin, Senegal): Ndargu, Fanaye, Ciam, Clone 2, Clone 29, 2532 Tis, 2544, 83-176 Tis, Walo.

Unspecified source: Evageline (o), Cavington (o), Beauregard (o), Hernandez (o), 573 (o), Puerte Rican (o), 4 Rubina (o), Orleans (w), Japanese (w), Murasaki (w), 14 Purple (v), Bonita, O’Henry (ww).

In the United States, the variety which is apparently the most cultivated, especially in Florida, is Beauregard (o), but we can also find Covington (o), Hernandez (o), Carolina Ruby (o), Japanese (w) and O’Henry (ww), especially in Carolina.

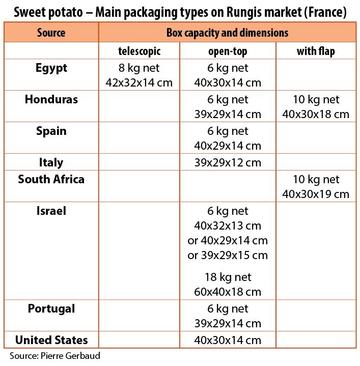

The packaging is described for each source, and the dimensions are given as a guide, since they can vary to within a centimetre after assembly and use depending on the moisture absorbed and pressures applied. The 40x30 cm open-top box seems to be the most often used by the majority of sources. All the boxes observed possess locking tabs, enabling them to stacked on the pallets.

While the marking on the packaging includes the source and nature of the product as a matter of course, the other usual information is less regular. The variety is rarely mentioned. It can be found on Portuguese and Spanish produce (Beauregard, Rubina), incidentally for Honduran produce (Beauregard, Blesbok, Bosbok), sometimes for South African produce (Bushbuk) and never for the other sources. Some sources, such as Israel, the United States and South Africa, state the storage temperature of 14°C. The size scales remain irregular depending on the sources and commercial brands. The size scale is often printed on the packaging, but not specified.

Of the 104 million tonnes produced worldwide, the world trade involves only 240 000 tonnes. The disproportion between production and trade illustrates the predominance of self-consumption of this product in the producer countries, where it is a staple.

China and Indonesia are among the top ten producer countries and have little involvement in international trade. More astonishing is the position of the American countries, and more particularly the United States, in the production/export ratio: though small producers at a world level, they play a major role in the field of exports. More astonishing still is the position of certain European countries, all situated in the Mediterranean zone. While Italy and Spain have indeed seen increasing production for some years, French production remains very limited and is above all based in the Overseas Departments. The main importer countries are, in some cases, also exporters, but there is minimal correspondence.

European Union imports increased more than 4-fold between 2005 and 2015. The main supplier countries are not among the biggest producer countries, except for China which seems to be merely a top-up source as far as Europe is concerned.

The United Kingdom and the Netherlands are the biggest importers in the European Union, supplied by third countries. While forwarding from the United Kingdom to other EU Member States is fairly low, forwarding from the Netherlands is high (50 %). The French supply comprises one-third volumes from third countries, and two-thirds intra-Community volumes. The last column of the table below sets out the imports of the main Member States minus their exports. Hence the negative results from Spain and Portugal give a rough idea of their own productions.

The concentration of the intra and extra-Community supply from September to December corresponds to peak European production periods (Spain, Italy and Portugal), but also peaks from other Northern Hemisphere suppliers such as the United States or, closer to home, Egypt and Israel.

Click "Continue" to continue shopping or "See your basket" to complete the order.