FruitTrop Magazine n°244

- Publication date : 3/11/2016

- Price : Free

- Detailled summary

- Articles from this magazine

The fruit and vegetables trade has been facing great instability in recent times. This is down to increasingly capricious weather, against a backdrop of global warming, but above all to a highly unstable period of European politics: Russian embargos, Brexit, EU-Morocco relations, etc.). Meanwhile, we are seeing demand switch toward local production, which is hitting imported produce increasingly hard.

The Mediterranean campaign began last year under particular circumstances, after the summer heat curtailed the Spanish potential (very big shortfall in the Murcia zone, and delayed planting in Almeria) and brought forward the end of the European season. So the winter campaign started with high prices, around 1 euro/kg into Europe for round tomatoes. The market swelled abruptly after mid-October, as the Moroccan supply progressed, with its shipments climbing from 5 000 t to 8 000 t per week into Perpignan, saturating the European market until early November. Local demand and the first shipments to Russia were insufficient to ease shipments bound for Europe. The price for Moroccan round tomatoes dropped to 0.49 euro/kg in week 45.

Business was then in a terrible state in France, as a result of the Paris attacks. Nonetheless the situation improved at the end of the year for the round tomato, with strong Russian demand following the implementation of the Turkish boycott. Trade also picked up in the small segment in the run-up to the end-of-year festivities. Rates were able to be revised upward. However, sales were mixed for the holidays, with demand switching more significantly to the vine tomato and local tomatoes produced with artificial light.

Business struggled to pick up again afterwards, with difficulties selling off the stocks formed at the end of the year. Shipments to Russia slowed down (with the let-up by confectioners), while the heat was boosting the Mediterranean production. So rates again neared 0.48-0.50 euro/kg at the import stage for Moroccan round tomatoes. Thereafter, the market settled a little, though retaining some pressure due to the now early start to the European campaigns (mid-February), with good volumes from the beginning of the season given the mild winter. So prices fluctuated between 0.60 and 0.75 euro/kg until mid-March.

The Easter holidays enabled prices to strengthen slightly, though the market remained highly uncertain until mid-April. The paucity of the small segment Spanish supply fortunately helped keep rates high at the end of the season. Volumes were also lighter in Morocco, including for the round tomato. In late April, only the operators involved in programmes remained. However, rates were ebbing constantly, given the very poor spring weather, which greatly reduced demand.

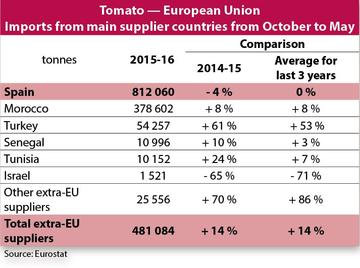

Hence Spanish tomato exports to the EU-28 were a bit smaller than the previous year (812 000 t, i.e. - 4 % on 2014-15). Nonetheless, they remain overall around average for the past three years, according to the figures from the European Customs from between October and May, while most of the extra-European suppliers registered a rise after a lukewarm 2014-15. There was a marked increase for Turkey to Europe (+ 53 % on the 3-year average) due to the Russian embargo, and to a lesser degree for Senegal (+ 3 %) and Tunisia (+ 7 %). Imports from Morocco, the main supplier to the European winter market, were up again (+ 8 %), while Israel continued its downturn (- 71 %).

Notwithstanding the increasingly disturbed weather, against the backdrop of global warming, the 2016-17 campaign has already been marked by uncertainties given the political tensions destabilising the economic sphere in recent years. Nonetheless, it began with some rather positive signals, especially the reopening of the Russian market to Turkish fruit and vegetables. This reopening resulted in tomato orders from September, and should indirectly ease the European market, which had been under greater strain since early 2016 due to the embargo.

Conversely, we are not expecting any real softening in relations between the EU and Russia which would enable exports to resume to this destination, especially from Spain. Indeed, the forthcoming negotiations between the two big blocks are not planned before early 2017. Europe is due to rule in January on whether to retain its sanctions, which were implemented following the conflict in Ukraine, but there is little chance of it being lifted before late 2017, according to European Union experts. For their part, the Russian authorities are asserting that the country could maintain the boycott for several years, thanks to subsidies granted to Russian growers.

However, the big disturbances could come from Brexit, which will also entail adjustments over the coming years. The talks with the European Union for the UK’s withdrawal are not due to start until late March 2017, and not conclude until summer 2019. However, this Sword of Damocles could change the hand, hitting Spanish exports hard; especially from the Canaries, for which the UK is the main tomato destination. The UK imports 220 000 t of tomatoes between October and May, 124 000 t of which from Spain and 39 000 t from Morocco. Yet even before the negotiations, experts fear the UK could hit a phase of economic and political turbulence, with the ongoing fall in the pound, which could lead to payment conditions becoming harder. If the fall in shipments to the UK is confirmed, exporters will need to find alternative markets, with the risks inherent to these new headings.

Furthermore, relations have become strained between the European Union and Morocco after the decision by the European Court of Justice on 10 December to rule in favour of the separatist Polisario Front. Thus it voided the trade agreement relating to agricultural products, signed in 2012 between Morocco and the European Community, on the grounds that Western Sahara is deemed a “non-autonomous territory” by the UN. It is actually a former Spanish colony annexed by Morocco in 1975, but whose independence is claimed by the Polisario Front, and supported by Algeria. This decision angered the King of Morocco, who decided that “all contact with the European institutions would be suspended” from 25 February. However, the Advocate General of the European Court of Justice ruled, on 13 September, that the annulment of the agreement was unjustified, since the opinion was based on the principle that the 2012 agreement “did not apply to Western Sahara”. The Court judges however need to deliberate further, and the verdict will not be returned until a later date.

The 2016-17 campaign has got off to a good start, since while volumes returned to a near-normal level in late summer in Murcia, compared to the lean 2015-16 season, availability was set to be light at the beginning of the season. Indeed, the start of the Almeria zone is still highly progressive this year, and the Moroccan potential is fairly low. Although planting has not been delayed, as in 2015, by Ramadan which moved to the early summer, Moroccan volumes have been much smaller in the early autumn due to the summer heatwaves (Chergui), which led to flower droppage on the first trusses. Temperatures were even in excess of 30°C in early October. Surface areas are apparently stable overall on a nationwide scale, or even down slightly, with several producers now switching to other crops such as red berries, which are booming. The conversion apparently mainly affects round tomatoes, but maybe also certain small segment varieties.

In addition, after steadily increasing since the 2012-13 campaign, as the Association Agreement between Morocco and the European Union developed, the duty-free quota has now been set for Moroccan tomatoes: 257 000 t + an additional 28 000 t, as opposed to 185 000 t + an additional 28 000 t in 2012-13. We are also expecting a slight fall in surface areas in Spain, especially Almeria (10 700 ha, i.e. - 2.1 % on 2015), mainly for the elongated tomato, in favour of the pepper. However the operators are worried at the development of hydroponic winter tomato production with artificial light in Benelux and France, which now extends until January, and which although expensive, enjoys the status of local produce, a highly prized criterion these days.

Click "Continue" to continue shopping or "See your basket" to complete the order.