FruitTrop Magazine n°216

- Publication date : 29/11/2013

- Price : Free

- Articles from this magazine

The 2013-14 season should produce a better vintage than last year for Brazilian and Floridian orange producers, which between them control more than 80 % of world orange juice trade. With the Brazilian harvest set to fall steeply, there is renewed hope of seeing the main concentrated juice market indicators emerge from the red zone. The last two high-production seasons 2011-12 and 2012-13, in a context of structural decline in demand, had driven down rates on the physical market by more than 20 %, plunging the vast majority of Brazilian orange producers into crisis. Faced with juice stocks building up to reach a historic level, raw material purchases by the handful of big manufacturers in the sector had dried up, to the point of pushing the price per field crate of oranges below the production cost.

With 421 million field crates, the combined 2013-14 harvests for Florida and Sao Paulo state are at their lowest level for the past ten years. The fall from last season is 20 %, and nearly 30 % from 2011-12. The Floridian season seems to be practically stable in relation to last year, if we believe the estimates of the main consultants from the sector (no official forecast from the USDA at the time of going to press, due to the shutdown in October). However, with 130 to 132 million boxes, it would seem to be among the lowest ever recorded, nearly equalling the historic low point of 129 million boxes of 2006-07, when devastating hurricanes had caused extensive direct losses. Yet should this level not itself be considered too high?

This is clearly the case if fruit dropping is as great as in 2012-13, when it led the USDA to slash by more than 20 million boxes the initial October forecast, as the season progressed. At present, Brazil has the most marked production fall: the Sao Paulo region, the country’s citrus growing heartland, is reportedly 100 million field crates down on the last two seasons. As in Florida, the harvest, estimated at 290 million field crates, is reportedly verging on the lowest levels ever recorded since the early 2000s. In addition, the juice yield also seems to be among the lowest, for lack of sufficient rainfall during the last cropping cycle. In early October, it took 270 field crates of 40.8 kg to produce one tonne of concentrated juice, as opposed to 240 in a satisfactory year.

The market has reacted positively to this projection. The spot price per field crate of oranges was at 7.80 BRL in mid-October, up by nearly 2 BRL from early 2013 according to CEPEA. The concentrated juice physical market has also bounced back. After dropping 600 USD per tonne in a year, since the announcement in spring 2012 of another heavy season in Brazil, rates have started to bounce back. They were at 2 375 USD/t FOB Rotterdam, according to Foodnews in late July, after strengthening by 200 USD since spring. Why did the upturn not continue from there, and why has it not been as marked as at the opening of the 2010-11 season, when such a low combined production had been announced? The answer lies of course in the Brazilian stocks, which have never been as large.

The fall in Brazilian production which should be seen in 2013-14 is not only due to the lack of rain and to the inevitable stress on the orchards after two high-production years. It also reveals the structural problems from which the Brazilian industry is continuing to suffer, with an intensity seemingly never to have been as great. On the one hand, the sanitary situation of the cultivation stock remains very bad. The toll taken by the most emblematic of the many pathologies affecting Brazilian citrus growing, namely greening, is heavier every year. According to CDA, this incurable and lethal bacteriosis has cost the Brazilian cultivation stock 30 million trees since its appearance in 2004, 7.5 million of which in 2012 alone, i.e. approximately 3 %. And the bill is set to be even greater in 2013, since 3.7 million orange trees were already pulled up in the first half-year alone.

The economic situation of small and medium producers, on which a large proportion of the supply chain continues to rely, is also increasingly worrying. The price per field crate of oranges paid by the industry on a non-contract basis fluctuated between 2.80 and 3.20 USD throughout the 2012-13 season, while the production cost is estimated at between 3.70 and 5.50 USD (4.40 USD according to Consecitrus, the industry’s representative body). Meanwhile, the production costs keep swelling. The steep rise in labour costs in the country, in the midst of an economic boom, comes on top of the worldwide price increases in energy and agricultural inputs. Hence the number of producers abandoning the orange in favour of more lucrative crops such as soy or sugar cane has taken on proportions never seen last season. According to IBGE, the Brazilian orange cultivation area lost 60 000 ha between 2011-12 and 2012-13, i.e. 7.5 % of its total extension. This massive wave of uprooting came when the Brazilian State decided to support the sector by releasing a package of 65 million USD. Manufacturers paying between 11 and 12 BRL per field crate of oranges were entitled to a storage subsidy, helping them protect themselves against the market falls.

Yet faced with rising production costs and sanitary problems, many producers have lost the will to go on, especially since the processing sector is increasingly powerful thanks to the concentration and vertical integration operations performed in recent years. Since 2010 and the merger of Citrosuco/Citrovita, the Brazilian industry no longer has four heavyweights, but three giants who incorporate a growing share of their own production. According to the Chairman of CitrusBR, 40 % of the supply of these groups comprises their own production, as opposed to around ten percent thirty years ago. The producers’ associations lament the increasingly imbalanced relationships of power, and the increasingly unequal distribution of added value. The main association, Associtrus, has even taken the matter before the Federal authorities to obtain a re-balance from the State, pointing out that the 180 % increase in concentrated juice rates over the past eight to ten years had coincided with a fall in the purchase price of raw material.

In this context it is hard to imagine seeing the surface areas bounce back, especially in the Sao Paulo region. However, the cultivation area is tending to grow on the other side of the State borders, in the “Triangulo Mineiro” in the western tip of the neighbouring department of Minas Gerais. The sanitary pressure is lower there, and land prices much less high. Surface areas there rose by 7 % in 2012 and by nearly 30 % since 2008. However, these surface areas seem well short of compensating for the decline of the Sao Paulo region.

There will be no rising volumes of oranges for processing to be found in Florida either in the coming years. True, the economic results have been convincing in recent seasons, thanks to a positioning on an NFC market more lively and more lucrative than the concentrated market. Since 2006-07, the price per field crate from the orchard has risen to a lucrative level of between 6 and 10 USD (approximately 8 USD in recent seasons). However, most investors are still reticent, given the difficulties facing the industry, and which are also tending to proliferate. In 2010 black spot was added to the list of sanitary problems, which had long since included citrus canker and tristeza, and since 2005 very severe greening. Managing the latter disease and the explosion in energy prices have driven production costs up steeply, not to mention the urban development in this prized region and the shortage of agricultural labour.

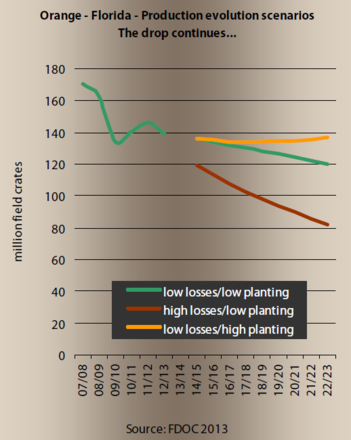

With so many uncertainties over the long term, the continuing downward trend of the cultivation area is no surprise. True, the tree mortality rate remains stable and rather low, at least for the moment. Nonetheless, it remains twice the renewal rate of the cultivation stock. Assuming this trend is extended over the coming years, FDOC predicts a continued downward trend of production, and a harvest of barely more than 120 million field crates by 2020, i.e. approximately 10 million boxes fewer than at present. Yet other problems are coming on top of the reduction in the number of productive trees. Due to lack of renewal, the cultivation stock is ageing and yields are declining: they have gone from 350 field crates per acre before the hurricanes in the mid-2000s to 260-290 field crates per acre in recent seasons. Finally, should we see a one-off and short-term problem in the abnormally abundant fruit dropping that occurred in 2012-13 or, conversely, the sign of very high stress on the trees because of sanitary problems, and in particular greening? Next season will surely provide some answers.

While Florida and Brazil are on a rather downward trend, China is making big steps forward. Could the boom in its citrus production, from under 12 million tonnes to more than 26.5 million tonnes between 2000 and 2010, upset the balances on the world concentrated juice market? A study recently published by the University of Florida makes some interesting points to think about, looking into whether the Middle Kingdom should be seen more as a potential market or as a medium-term competitor. The harvest levels expected in the coming years are somewhat concerning, if we can believe the projections: the production boom does not seem to be close to stopping, since in view of the planted surface areas, China could be capable of producing more than 40 million tonnes of citruses by 2015, with more than 10 million tonnes of oranges (as opposed to fewer than 7 million today). Juice orange production, growth of which is among the main expectations of the 2nd strategic citrus plan launched in 2008, should also take off and rise from its current level of 2 million tonnes to 4 million in 2015 and 7 million in 2020. Under this programme, a “juice orange citrus belt” has been set up and is continuing to be developed in the upper and middle valleys of the Yangtze, especially in Shaanxi, Sichuan and Gansu provinces. Another reason for concern is that the processing capacity should also increase steeply, going from 1.2 million tonnes in 2010 to 1.5 million tonnes in 2015. While the growth in Chinese orange juice production is not in doubt, will this source be able to compete with, or even as has been seen in other sectors crush, the industries of other producer countries?

For the authors of the study published by the University of Florida, the answer is no, at least in the medium term. Although orange juice remains primarily an ingredient in the composition of low-juice drinks, the annual growth of volumes sold locally has been more than 20 % in the past 10 years. The margin for growth is extremely wide given the present consumption of around one third of a litre per capita. Hence the Chinese market should absorb most of this additional production, with the consumption projections counting on a level of approximately one litre per capita by 2015. The lack of competitiveness of Chinese concentrated juice is another factor reinforcing the hypothesis of a small presence from this source on the international market in the medium term. A processing period shortened to four months because of the tightness of the production window, the high energy price and the lack of organisation of the sector mean that the cost of production is now high, and approximately 10 % above those applicable on the international market. As proof of this, Chinese factories are not operating at full capacity, and 75% of consumption is catered for by imports.

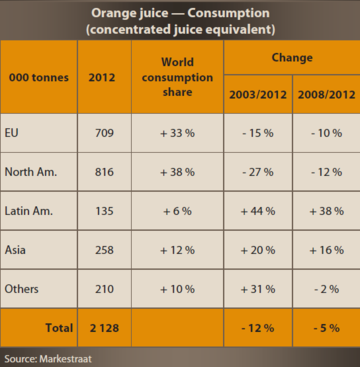

The downward trend in volumes available on the international market seems rather clear. Unfortunately, it seems just as clearly that demand is going the same way. If we believe the statistics in Markestraat, the combined consumption of the world’s 40 biggest markets (expressed in concentrated juice equivalent) went down from 2.4 to 2.1 million tonnes between 2003 and 2012, i.e. a fall of just over 12 %. Is this trend, to be attributed to the drop in volumes absorbed by the EU-27 and above all to the clear fall in sales in the United States (down by nearly 27 % over the same period!), about to ease off? That is what the period 2008-2011 could lead us to think, when the extent of the fall seemed less pronounced, before the “Carbendazim crisis”, the fungicide discovered in Brazilian juice at doses with no effect on health, arose to sow unease among consumers in 2012. The 2013 figures will help see things more clearly. The acceleration of growth on the emerging markets (particularly South America) seems to be another positive indicator.

The comparison of the worldwide consumption curve and the highly irregular curve of concentrated juice production from the two main players shows that the two phenomena appear fairly parallel. What can we conclude in terms of prices in this context? Perhaps Coca Cola can answer this tricky question. To secure the supply of its brands Minute Maid and Simply, the multinational, the world leader in juice sales, announced the signature of a supply programme for the next 20 years with Cutrale and Peace River Citrus, which should lead to 10 000 ha of orange orchards being planted in Florida. This 2 million USD strategic sourcing makes a much better case than all the statistics on Earth for some pull on the international market in the coming years.

Click "Continue" to continue shopping or "See your basket" to complete the order.