FruitTrop Magazine n°236

- Publication date : 6/11/2015

- Price : EUR 50,00

- Detailled summary

- Articles from this magazine

One of the great mysteries of the world tropical fruit market has just been unveiled. The fresh pineapple sector has in recent months passed from the domain of the infinite to the finite. Analysts had long predicted the end of the golden age, or at the very least the end of the near-exponential growth in volumes available on the international market. Yet the gloomiest predictions had always been foiled, mocking the expertise of us supposedly well-informed observers. Doubtless by dint of sheer repetition, the prophecy is coming true this year.

While world pineapple production is fairly well distributed worldwide, the international market is extremely simple in terms of sources. The processed pineapple industry is nearly entirely based in Asia (Thailand, Philippines, Indonesia, Vietnam, Malaysia, etc.), and exports canned pineapple (from slices to all sorts of pieces) to the rest of the world. For the fresh export pineapple sector, we are not talking about a continent, region or sub-region, it all boils down to just one country: Costa Rica. Though a giant in the banana sector, within less than two decades it has hauled itself up to the same level for the pineapple: two million tonnes of exports in late 2014, for a customs value of 865 million USD, level pegging with the banana (2 171 000 t in 2014 for an export value of 904 million USD).

The auxiliary sources do not really have a say in the matter. Jealously observing the Costa Rican success which has verged on the miraculous (increasing volumes, with a satisfactory producer return), they have tried to embark on their own “road to Damascus”. Yet this road has proven long and strewn with pitfalls, explored by many but with practically none seeing it through to the end. Ecuador, Panama, Guatemala, Mexico, etc., have all had to kneel in frustration and uproot their stock en masse.

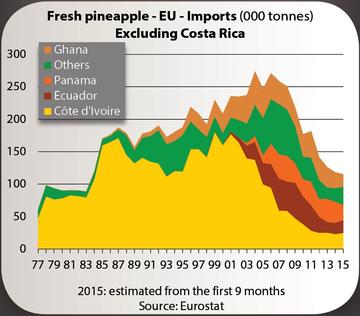

Africa has a different role in this contemporary history. A trailblazer on this market, especially the hegemonic Côte d’Ivoire, it deserted the sector in the early 2000s under the double blow of rapidly declining quality and the surge of the Costa Rican steamroller. Côte d’Ivoire and Ghana retained some surface areas for sea-freight exports, while Cameroon and Benin are holding up on air-freight niches, or in specific varieties such as Sugarloaf and Smooth Cayenne. And there is no turnaround on the horizon, with the prevailing trend being disinvestment, or at best no change. Traditional importers of African pineapples are still just as drawn to the bright lights of Central America.

We cannot finish this historical recap without mentioning the decisive role played by the introduction of a new pineapple variety, MD-2, into a world dominated until the 2000s by the Smooth Cayenne variety. World food had finally found its champion - a productive pineapple, though no more disease- and pest-sensitive than its competitors, and boasting a sweet taste (actually less acidic); a sort of hamburger-pineapple. To top it all, a powerful organisation in both logistical and commercial terms was required. And it was Del Monte which acted as the trailblazer, pulling off the coup of the century: becoming the pineapple king in both production and the main import markets, within the space of just a few years. The logistical and commercial compatibility between the pineapple and banana did the rest.

Yet everything in this old world is fleeting, and since there are more copiers than creators, this success story aroused greed. While the external competition rapidly ran out of steam (Côte d’Ivoire and many Latin American sources), internal competition soared. Del Monte’s threat to sue the crown thieves, i.e. those removing plant stock for replanting, did nothing to stop this. At most, it delayed the inevitable. The MD-2 wave broke over Costa Rica, with its planted area reaching nearly 40 000 hectares.

On the import side, the world according to MD-2 is also relatively simple. The United States imported 1 million tonnes, with 85-90 % from Costa Rica. The EU imported approximately 900 000 tonnes, with 86 % from Costa Rica, unsurprisingly.

This long historical recap is important, both to show the progress made in record time, less than two decades, and the turnaround we are seeing, which is a real break in the trend. Barring a sudden, serious climate vagary or a major world economic crisis, it has always been easy to predict the future for the pineapple, at least in terms of the main macroeconomic data. For fifteen years, Costa Rica’s annual exports from year to year could be plotted in a straight line, with a confidence level of 98 %. Then all of a sudden in the last few months, this fine statistical mechanism broke down. The combined total over a twelve-month period has now been falling for the past nine months! From a high point reached in November 2014 of 2 085 000 t, Costa Rican exports dropped back below 2 million t, waning to 1 923 000 t. This visibly struggling trend has pushed growth into negative figures, of - 8 %.

A similar type of misfortune came just before the financial crisis of 2008, when the price of agricultural inputs and energy exploded, dealing a heavy blow to the accounts of the operators (both producers and traders). This adverse effect on costs then combined with a distinct slowdown in demand, or even in certain cases a fall in consumption in the major importer countries, due to the major economic crisis. To demonstrate this, the growth rate of consumption in the United States was just 2 % in 2008 and 1 % in 2009, whereas it was 8 % on average the following five years. For the EU, the year 2009 actually closed with a 5 % drop in consumption.

But, to return to the crisis, or rather incipient crisis, in which we now find ourselves, there are three ways of analysing the causes. The first relates to production costs. Are we in a phase of increasing production factor costs, as during the subprimes crisis of 2008? We cannot be sure of anything without an analysis of a sufficiently wide range of accounts. Yet we can still observe that, all other things being equal, the prices of agricultural inputs and especially energy are at a historic low, and have been since June 2014.

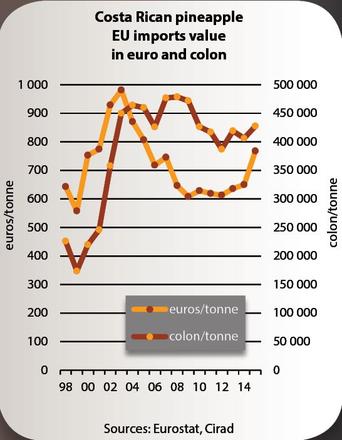

So if the field-edge cost or outgoing FOB have not increased, let’s look from the demand side. Here we have at least part of the explanation. Prices in 2014 once again hit a low point; a very low one indeed! The annual average import price of MD-2 on the German market dropped below 7 euros/box, to 6.6 euros exactly. Worse still, volatility in 2014 was extremely low, falling to 0.55 euro/box, i.e. 3 times less than in 2011. So it was low and in addition, unexpected.

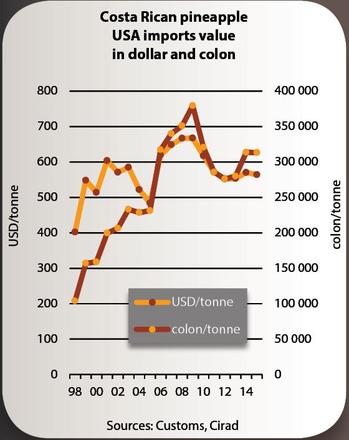

Finally, let’s look at the third and last cause of this crisis: the exchange rate. In 2014, the euro began to fall against the US dollar, but also against the Costa Rican colon. On 11 May 2014, 1 euro was worth 754 colons. Less than a year later, on 19 April 2015, it was worth just 555! The twin blow of the euro falling against local currency, plus the falling price of the pineapple in euros, drove the accounts of producers selling in the eurozone into the red. True, since approximately half of production is shipped to the United States, the improvement in the colon/US dollar exchange rate partially offset the euro effect; but only partially, since import prices maintained desperately low levels, as on the other markets.

If we add to this particularly gloomy economic picture the hardly ideal climate conditions of 2014, we can realise why some producers opted to quit the sector, or rather were forced to. According to Canapep, the Costa Rican producers/exporters association, quoted by Reefer Trends, the surface area in production slumped from 45 000 to 38 000 hectares due to lack of competitiveness, climate vagaries and export price stability. The small planters were the ones who paid the heaviest price, leading to a concentration trend. Farms of more than 100 hectares now account for more than 91 % of total surface areas.

Did the reduction in Costa Rican exports have a positive effect on the valuation of the export pineapple? This problem too can be studied from two perspectives. Firstly by gambling that fundamentally the reduction in the Costa Rican supply is helping weed out lower quality produce. This rather abrupt explanation would above all lead to the conclusion that the small producers, those currently disappearing, are the ones responsible for a large part of the substandard quality supply (in all senses of the word). The other perspective is to believe that quite simply, economic theory applies and that you can only push things so far. By selling reckless volumes, the market absorption capacities have been exceeded; that is the price most closely and directly resulting from this excess!

That was the theory, now for the practice, to keep the traditional economists happy. 2014, a high point in terms of volume and a low point in terms of price, gave way to 2015 — a low point for the past several years in terms of volume and a high point for the past several years in terms of price. Over the first nine months of the year, the average import price (taking Germany as the benchmark) was 8.4 euros/box, i.e. over 2 euros more than in 2014 for the same period, taking us back to levels never even approached since 2006. On a weekly basis, the price reached 11 euros per box in February and March! Import volumes are following an opposite trend: import price is inversely proportional to volumes on the market. As proof, when in January and February 2015 volumes fell by 20 %, import prices climbed by 16 % and 60 % respectively.

While it seems impossible to establish a rule, we cannot help but observe that over the first seven months of 2015, 6 times out of 7 when the volumes waned, prices climbed in greater proportions than the fall in imports. Finally, if we take turnover, things appear much clearer. Over the first seven months of the year, the turnover of the import industry into the EU amounted to approximately 4.3 billion euros in 2015, as opposed to 3.6 to 3.8 in 2012, 2013 or even 2014. Over the same period (seven months), import volumes fell by 11 % in 2015 from 2014. Of course, we must refrain from making a rule from a phenomenon detected in one particular year. Nonetheless, the reduction in the supply seems to be one of the leading explanations for the price behaviour on the European fresh pineapple market.

This year our refrain will switch to fruit quality, at times barely presentable on European supermarket shelves, and to the need to restore some added value by segmentation. The powerful tool of scaling down volumes on the market has played its part. Too bad that this has been at the price of many producers being wiped out, along with their workers. If we were concerned about it, we would need to seize this moment of grace to lay the foundations for long-term controlled development of the market. Yet we are caught in a frenzy of theory, which unfortunately for the weakest producers will not bear fruit, since as elsewhere, the market is focused on what is essential from its own viewpoint. So the urgent business has been taken care of; miracles will need to wait a little longer

Click "Continue" to continue shopping or "See your basket" to complete the order.