FruitTrop Magazine n°239

- Publication date : 5/04/2016

- Price : Free

- Detailled summary

- Articles from this magazine

How is the mango market going? Quite nicely, thank you. Good news is rare enough in the sluggish current economic context that it is worthy of special emphasis. The continual rise in volumes sold in Europe and North America, and the price levels obtained throughout the year, seem to confirm this. Europe is importing ever more mangoes, with a total for 2015, if we add Spain to the extra-Community sources, of more than 290 000 tonnes. The 300 000-t threshold is within reach. North America is still on the rise with 460 000 t of imports, for a smaller population. So is the European market still attractive for this product, with further growth opportunities?

While certain rumours had it that Brazilian production, and consequently its exports to Europe, were on the wane, we cannot help but observe that this is not the case. Quite the contrary, the source is making a big contribution to the general growth in volumes to the European markets. After fluctuating between 85 000 and 95 000 t of exports over recent years, Brazil seems to have shifted up a gear. In 2014, it touched on 100 000 t of exports to the European Union. In 2015, it smashed its record once again, reaching 111 500 t, i.e. more than one third of mangoes sold in Europe. This is a noteworthy record since in parallel it supplied the North American markets with 10 000 t more than the previous years. If we add to this the dynamism of its internal market, which absorbs not only local varieties but also more and more export varieties, we can only assume that the Brazilian sector is in good health.

In 2015, Tommy Atkins remained the most common Brazilian export variety. Cultivation methods, productivity, suitability for the pedoclimatic conditions of the country, its good coloration and its good transportability all work in favour of it being exported year-round. Yet its lack of flavour and its somewhat fibrous flesh mean that other varieties are preferred. Hence for the past few years, we have observed a conversion of the Brazilian cultivation stock toward fibreless varieties, which has proceeded rapidly if we look at the past six campaigns. Tommy Atkins, which still represented nearly 75 % of mangoes exported from Brazil to Europe in 2010, made up just 36 % of shipments in 2015. So Brazil’s flagship variety seems to have halved during this period.

Conversely, other so-called “fibreless” varieties, marginal in 2010 with a maximum of 10 % of exported volumes, have increased considerably. Kents went from 8.8 % in 2010 to 22.0 % in 2015, Keitts from 10.2 % to 21.2 % and Palmers from 5.6 % to 20.3 %. In other words, “fibreless” varieties now represent nearly two-thirds of Brazilian exports. This varietal conversion has been driven by demand from European purchasers. Shipments to the United States still for the vast majority comprise Tommy Atkins. The heat treatment required by the US sanitary authorities may not be unrelated to this, as the variety can definitely withstand this physiological shock better.

The time of year when exported varieties are at their most diverse corresponds to the biggest flows from September to December, when Tommy Atkins see their lowest level, and shipments of Palmer, Keitt and Kent progress. The latter variety is the most tightly concentrated, in a period between October and early January. The massive arrival of Kent volumes in October influences prices, which generally dip, dragging down those of the other two varieties, which depreciate just as rapidly, often to lower levels. Within a few years, Tommy Atkins has been reduced to the rank of a top-up variety. Nonetheless, it remains an important part of the Brazilian calendar in general, enabling it to maintain a year-round presence on European markets.

While Kent rates collapsed at the end of the year due to the large volumes shipped over a short period and to the early start of the Peruvian campaign, the Tommy Atkins rate was considerably more volatile. Three peaks above 6.00 euros/box punctuated the Brazilian campaign and revealed more or less extended supply interruptions to the European market. The first peak, definitely the most surprising given its improbability, extended from mid-January to mid-February, which was down to the late start by Peru in early 2015. Generally at this time of year, Tommy Atkins prices are at their lowest given the large quantities shipped by Peru. This was not the case in 2015 because of the delay to Peruvian production. The second peak came from mid-April to mid-May, always a tricky period between the end of the Peruvian campaign and the beginning of the West African campaign. The rapid withdrawal of Peru and the late start by Côte d’Ivoire opened up a market window for Brazil. Finally, the third peak from mid-July to mid-October is more difficult to explain, at least for the first half, insofar as shipments from Senegal, Israel and the Dominican Republic were bigger than in previous years until late August. Was consumption more dynamic in this summer period? In September and until mid-October, the European market was under-supplied because of the delay to Brazilian Kent production. The most difficult period for Brazilian mangoes was from late May to late June, when the cumulative incoming shipments, especially from Africa, choked up the European market. Brazilian Tommy Atkins found intense competition from Kent, available in abundance at low prices, whereupon their rates plunged to below 4.00 euros/box for several weeks.

In spite of difficulties in June and December, Brazil enjoyed a positive campaign overall, going by the sale prices obtained by most of the exports to Europe. The rise in tonnages in both Europe and North America consolidated Brazil’s lead in the field of the mango. The synergy provided by this country’s wide range of fruits and vegetable exports makes a big contribution to its position as an essential source for the European supply.

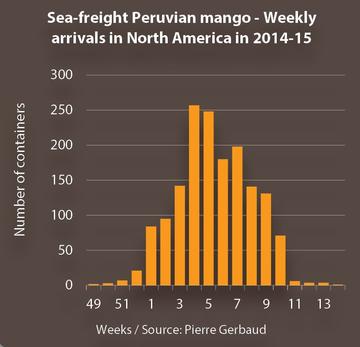

After a difficult 2013-14 campaign, when prices were particularly low during the first half of the season, a busy export period, the Peruvian 2014-15 campaign got off to a more auspicious start. Not that volumes were smaller - quite the contrary, since it exported its largest ever quantities to Europe, with 78 300 t as opposed to 72 000 t in 2014. The calendar and division of volumes aided this more fitting proceedings. The relative lateness of the campaign helped prevent the always disastrous clash with the end of the Brazilian season, as had been the case the previous year. The first incoming shipments in the second half of December 2014 were very moderate, and took over from the Brazilian supply as it came to the end of its period. So the handover between the two sources went smoothly, with Peru gradually compensating for the decrease in Brazilian shipments, before replacing them completely. In January-February 2015, Peruvian mango prices peaked, whereas at the same time the previous year they had been in the depths (3.00 euros/box, or even less). They stabilised at between 7.50 and 8.00 euros/box, a level rarely approached at this time of year, while volumes progressed gradually. In the second half of February and early March, the situation was tighter, with the Peruvian shipments peaking at a tempo of 200 to 250 containers per week. Rates dipped but remained satisfactory (between 5.50 and 6.00 euros/box). From the second week of March, the anticipation of a rapidly ending Peruvian campaign and a late start by West Africa caused rates to rally. True, Peruvian shipments decreased by around 150 containers per week, but the market remained decently supplied by Brazil, which made its return with quantities on the rise, especially comprising the less sought-after Tommy Atkins. Peruvian mango rates picked up to high levels of around 7.50 euros/box, until the Easter holidays. They dipped again thereafter until the end of the campaign, in early May, still at strong levels (6.50 euros/box) in spite of lower quality.

At the end of 2015, the new Peruvian export campaign began under less good conditions, repeating to a lesser degree the 2013-14 scenario. Shipments proved to be earlier and progressed rapidly from early December, while Brazilian shipments were still large. The combined volumes from both sources drove rates downward, going from 6.00 euros/box for the first arrivals to 4.50 euros/box from mid-December, a level which would hold up throughout January 2016.

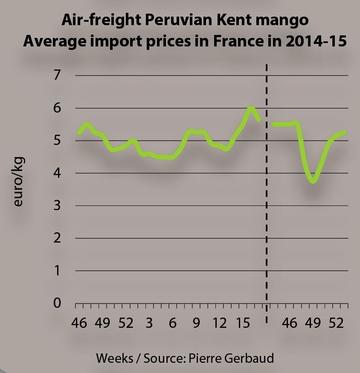

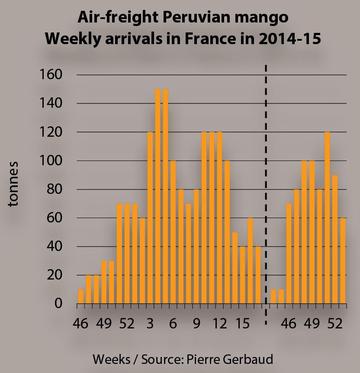

Like the sea-freight campaign, the first Peruvian air-freight mangoes went on the market early from mid-November 2014. Conversely, prices remained fairly high, at between 4.50 and 5.50 euros/kg, fluctuating in line with the volumes received. In December and January, they stabilised at around 4.50 euros/kg, given the overlap of the Peruvian and Brazilian campaigns which resulted in a supply surplus for the demand, which was moderate at this time. Rates strengthened from mid-February to early March, to in excess of 5.00 euros/kg. In March, volumes grew while demand remained stable, leading to fruit storage. The advancing maturity of the fruits required rapid sales, inevitably accompanied by pricing concessions. Just before the Easter holidays, prices picked up considerably due to a stronger demand, while volumes dwindled until the end of the campaign in the second half of April.

The 2015-16 campaign started early at the beginning of November, and rapidly came up against the abundant Brazilian shipments, causing rates of both sources to drop. Unlike sea-freight shipments, whose transport times mean a long inertia on price fluctuations, air-freight shipments are more rapidly adjustable. In mid-December, the drastic reduction in Brazilian shipments opened up the way to Peruvian produce, whose prices picked up in the run-up to the end-of-year holidays, a period generally enjoying more intense demand.

The opening part of the campaign seemingly remains the trickiest point for Peru, which is the number two mango supplier to the European Union. Early starts are particularly unfavourable for it, given the weight of its Brazilian rival during the transition between the two sources. Conversely, the end of the season seems easier, due to the fairly late start to the West African campaign for the past several years. Varietal diversification could perhaps compensate for the relative under-supply in April.

The big rise in West African volumes observed over the past few years continued in 2015. Driven by Côte d’Ivoire, the region’s main exporter source, Mali and Burkina Faso this year too hit new export heights. The combined total exports of these three sources amounted to nearly 33 000 t in 2015, after 24 200 t in 2013 and 27 400 t in 2014. True, Côte d’Ivoire remains the driving force for this rise with 23 000 t, but neighbouring countries have also contributed to this boom, with an increase of 1 000 t for Burkina Faso and 2 000 t for Mali. In spite of their landlocked location, these two countries consolidated their place as regular suppliers to the European market.

In autumn 2014, in the context of a steep increase in interceptions due to fruit fly damage, the phytosanitary services of the European Commission asked Côte d’Ivoire to set up an effective management programme as a matter of urgency. In spite of the slight delay before the start of the next campaign the Ivorian administration, as well as the industry operators, rallied to provide a solution. Given the gravity of the situation which could eventually have led to an embargo on the source, the Ivorian operators acted to propose and implement a management plan:

These measures were especially urgently required since at European level inspection methods were being stepped up, especially in the Netherlands and Belgium, where Community audits of the phytosanitary services had revealed glimpses of some failures.

This wake-up call has apparently been beneficial to the Ivorian industry, in view of the drastic reduction in the number of interceptions during the 2015 campaign. Only ten were recorded by the European Commission, as opposed to 64 in 2014. Although the number of interceptions was greater than that tolerated by the European Commission (5), this represents striking progress. This convincing result, as well as the ongoing intensification of fruit fly management, should forestall the risk of heavier sanctions against the biggest West African supplier to the EU.

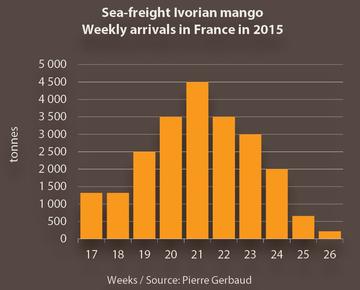

Unlike in previous years when exports began by agreement between professionals when the fruits were judged physiologically ripe, the Ivorian public authorities this year decided to announce a harvest start date in order to prevent shipments of immature fruits, and in so doing, tarnished the source’s image right from the beginning of the campaign. The date set was 20 March, an apparently arbitrary decision, insofar as the majority of the fruits had apparently not reached optimum harvesting point. This date was doubtless chosen to enable the export of Amélie mangoes, theoretically an earlier variety, when the European market would be relatively under-supplied due to the rapid decrease in Peruvian shipments at the end of that source’s season. In reality, the Amélie had not matured any further than the Kent. Hence apart from a few containers of Amélie of average quality received in April, the real start to the campaign came in the first ten days of April, resulting in a market launch at the end of the month. Taking advantage of a scarce market supply after the disappearance of Peruvian mangoes, the Ivorian fruit sold fluidly throughout May, at prices which were high but gradually waning, from 7.00 euros/box on average at the beginning of the period to 5.00 euros/box in late May. Due to this massive supply in a short space of time, the fruits received were stored for a relatively long time, resulting in qualitative deterioration. The concentration of the Ivorian campaign is nothing new. Hence 73 % of the total volumes were shipped during May alone in 2015. In spite of a fairly good split between the various European markets, Ivorian mangoes saw their rates dip in mid-June, before stabilising at around 3.00 euros/box. The final batches sold in the first half of July at lower prices. Apart from some Amélie shipments at the beginning of the campaign and Keitt shipments in June, Côte d’Ivoire exported only Kent.

Unlike the previous year, Ivorian fruits sold better in the first part of the campaign, and saw their prices deteriorate steeply in the second half. At that point, the market perhaps reached the limits of its absorption capacity, in the knowledge that tropical fruit consumption decreases at this time of year due to the massive presence of seasonal fruits, often less expensive and more familiar to the public. A concentration of supply and market fluidity are generally contradictory. Côte d’Ivoire always finds itself subject to fairly late starts, and real risks of qualitative deterioration of the fruits in June shipments. So this source remains caught between the physiological maturity of the fruits and the arrival of the rains in the second half of May, often synonymous with fungal development. If the industry has managed to curb the fruit fly infestation problem, which illustrates the importance attached to it, why can it not manage to improve the quality of end-of-campaign mangoes?

The air-freight export campaign followed roughly the same profile as the sea-freight campaign, but with a slight time difference. It extended from mid-April to mid-June, like the previous year. The first incoming shipments were received in week 16, after the Easter holidays. Given the difficult transition between Peru and West Africa, this produce was well valued for the first five weeks of the campaign, then rates dipped from 5.50 to 4.00 euros/kg in the second half of May. The second part of the campaign was characterised by falling prices, down to 2.50 euros/kg at the end of the campaign. As in previous years, Ivorian operators compensated for the late start to sea-freight shipments by large air-freight shipments. Volumes progressed very quickly, at first making up for the lack of fruits on the market, with high prices. The shipments maintained a high tempo, rapidly exceeding the absorption capacities of the market. The accumulation of volumes which were harder to sell, especially because of the arrival of seasonal fruits (early this year due to a mild winter), triggered the cycle of poor sales/storage/quality deterioration (high maturity)/falling rates. Competition from the other West African sources, which were shipping the same produce during the same period, only aggravated this cycle, which ended in clearance sales and disaffection with the source by customers, who switched their purchases to seasonal fruits or mangoes from other sources. We might consider that, out of a thousand or so tonnes shipped, one third sold at prices less than 4.00 euros/kg, a threshold below which economic results are affected.

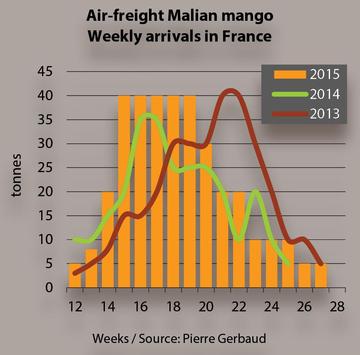

With nearly 6 000 t of exports in 2015, Mali achieved a new high score on the European market. Of this total, an estimated 800 t was air-freight fruit, with more than 5 000 t exported by sea-freight via Abidjan or Dakar.

The earlier Malian campaign began in the second half of March, though one week behind 2014. The first shipments comprised Amélie and Valencia. Since Peruvian volumes were moderate at this time of year, these mangoes sold at between 3.50 and 4.00 euros/kg in the run-up to the Easter holidays. Amélie, which supplied mainly ethnic distribution circuits, sold steadily at around 3.00 euros/kg until early June. Valencia traded at a high price at the beginning of the campaign (between 3.50 and 4.00 euros/kg), when the market was receiving small quantities of Kent. Thereafter, their rates dipped with the appearance of Kent, the strong presence of which in mid-May sent Valencia rates plunging below 3.00 euros/kg. The final batches shipped in late May found slightly stronger prices. The Malian Kent campaign started at the same time as the Ivorian campaign, in week 16. This variety rapidly made an impact on the European market. The first shipments sold at between 4.00 and 4.50 euros/kg, but these prices rapidly deteriorated under the effect of the massive presence of Ivorian fruits. They stabilised at between 3.00 and 3.50 euros/kg until the end of the campaign, in early July. The end of Ivorian shipments did not result in rates strengthening, as has sometimes been the case, because of the poorer fruit quality and the more intense and earlier competition from Senegal and Mexico.

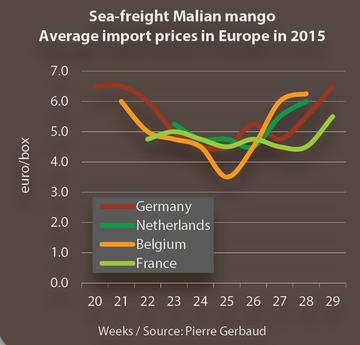

As already underlined above, Malian sea-freight volumes increased considerably this year, with approximately 2 000 t more than the previous year. The Malian campaign extended from the second week of May to mid-July, and saw rates following more or less the same pattern on the various European markets, with an even split. From around 6.00 euros/box for the first shipments, they rapidly dropped to 4.50-5.00 euros/box in late May and June, under the effect of the overall volumes from Mali, but also from Burkina Faso and above all Côte d’Ivoire. It was not until the first half of July that prices strengthened and nearly returned to their starting point, with the end of the Ivorian campaign and Senegalese shipments making little headway. The somewhat late start to Malian production helped provide a more favourable market window. Overall, the comparison of the price curves for 2014 and 2015 reveals slower rates year on year, probably due to the increase in volumes sold. Mali remains a top-up source for Côte d’Ivoire, because of its landlocked location which makes produce transport logistics more complex, and increases forwarding costs. Nonetheless, by working on the more or less early production time, and diversifying its recipient markets, Mali is finding market slots in which its produce is well valued.

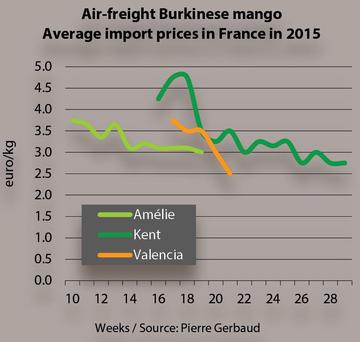

Burkina Faso expanded its presence on the European markets during the 2015 campaign, with more than 4 000 t shipped, as opposed to 3 000 t in 2014, but with a similar split: 22 % by air-freight and 78 % by sea-freight. Taking advantage of the good market conditions in Europe, Burkinese exporters took advantage of their slightly early harvest to ship their first volumes from week 10 (in early March), i.e. three weeks before Mali and six before Côte d’Ivoire. True, quantities were limited and primarily comprised Amélie. Yet with high market demand, they sold at more than 3.50 euros/kg for the first month of sale, thereafter falling to around 3.00 euros/kg due to the climbing West African supply and the competition of more sought-after varieties. In week 16 Kent came onto the market, with high prices in the second half of April before the massive influx of Ivorian fruits. From a level of 4.50 euros/kg, the price waned constantly until the end of the campaign, to around 3.00 euros/kg. The campaign was significantly extended until week 29 in 2015, whereas it traditionally finishes three weeks earlier. While certain companies were still shipping standard quality fruit, others managed to secure value for their produce by rigorous selection and a presentation in no way inferior to the more renowned brands from neighbouring sources. Burkinese exporters supplemented their range with some Valencia shipments from mid-April to mid-May. Received at the same time as the Kent, they generally sold fairly badly, with prices falling from 4.00 euros/kg to 2.50 euros/kg.

Concentrated from mid-May to mid-June, sea-freight shipments from Burkina Faso underwent strong competition from the other West African sources. From 5.00 to 6.00 euros/box in the second half of May, prices dropped to between 4.00 and 4.50 euros/box in the first half of June, under the weight of Ivorian and Malian tonnages which were still available. The logistical handicap on intercontinental exports contributed to curbing shipments to Europe, in spite of volumes progressing in 2015. Hence Burkinese operators switched to other seemingly advantageous commercial opportunities, such as the organic label, but above all the dried mango and regional trade, which has rocketed in recent years.

The Dominican Republic set a new record in 2015 with its exports increasing by 2 000 t from 2014, for a total of 13 000 t of exports to Europe. The closure, in spring, of US borders to Dominican mangoes because of risks of infestation by the Mediterranean fly (which has since been lifted) could have hinted at a massive switch of tonnages to the European market. Yet this event had little or no influence on the volumes split, as the US traditionally imports only marginal quantities. The increase in Europe-bound volumes arose from a desire to expand on this market. Present from late May to late August, Dominican mangoes reinforced the available supply during the summer period. The Puerto Rican primarily comprised Keitt, mainly aimed at the integrated distribution circuits, on which they provided an alternative to the end-of-campaign mangoes from West Africa, Brazil and Israel. Bit by bit, and in spite of phytosanitary and logistical problems, Dominican mangoes consolidated their market share on the European markets. After selling at around 5.50 euros/box from late May to mid-July during the competition period with African mangoes, they achieved stronger prices from mid-July to mid-August, at between 6.00 and 6.50 euros/box. At the end of the campaign in the second half of August, their rates rose in a context of waning supply, with the end of the Senegalese season and the dip in Israeli shipments. Less changeable than the previous year, Dominican mango rates maintained a higher level throughout the campaign, at between 5.50 and 7.00 euros/box.

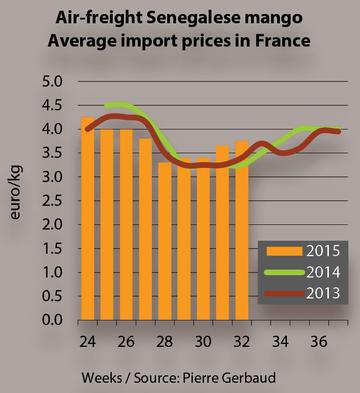

In 2014, Senegal exceeded the threshold of 10 000 t exported to Europe (10 300 t), a historical record for the source. Given the 6 000 to 8 000 t traditionally shipped, this rise could be considered either an exception due to a particularly favourable year, or as the sign of longer-term progress - which seems to be the case. The 11 500 t exported in 2015 confirmed the progress of the Senegalese industry. True, the rise was not as great as between 2013 and 2014, but the trend is there. The quantities shipped have risen constantly for six years, and have actually doubled. Hence Senegal has hoisted itself up into the top ten mango supplier sources for the European market.

In 2015, the Senegalese campaign was a bit earlier, starting in the second week of June, i.e. a week earlier than in 2014. The campaign was kicked off by air-freight shipments, with volumes rapidly rising. Their rates held up at around 3.50-4.00 euros/kg throughout the campaign, which extended until early August. The risks of fungal development at the end of the campaign encouraged operators to suspend their shipments.

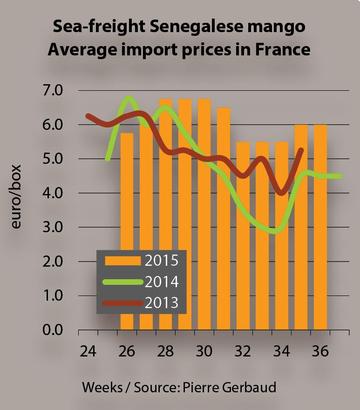

In 2014, air- and sea-freight shipments from Senegal were simultaneous and distinctly early. In 2015, the first containers went onto the market only two weeks after the air-freight shipments. Hence sea-freight mangoes were available from late June. This slightly later arrival was rather beneficial, since stocks from Côte d’Ivoire were still available in June and their deteriorated quality generated a downward price trend. The Senegalese fruit arrived as the market was easing, enabling prices to reach around 6.00 euros/box. The moderation of Kent imports at this period helped the Senegalese mango rates strengthen rapidly, nearing the 7.00 euros/box mark throughout July. In August, they dipped to around 5.50 euros/box on average, a distinctly higher price than at the same period of the previous campaign, when it plunged to 4.00 euros/box, and then 3.00 euros/box. August is a sensitive period for Senegalese produce, with the arrival of rains, which are synonymous with fungal attacks. This resulted in a widening price range, with high prices for fruits of superior quality and low prices for those of deteriorated quality. Between August and September, the absence of Kent led prices to strengthen to around 6.00 euros/box for the last batches available.

The Senegalese campaign was characterised not only by an increase in exported volumes, but also by better economic results than the previous year. Its marketing period remains difficult, hemmed in upstream by large volumes from the end-of-season West Africa sources and the more or less intense competition from Israel. Hence the launch of the Senegalese campaign is often uncertain. The supposed fall in mango consumption during the summer and the risk of quality deterioration in the latter part of the campaign are other obstacles. It seems that the quality improvement seen on the recipient markets is derived from an improved approach by Senegalese operators in terms of fruit selection, harvest method and packing.

The continuous fall in volumes shipped by Mexico to Europe for the last four years looked like a gradual withdrawal by the source. 2015 brought this process to a halt, with just over 3 000 t of shipments, as opposed to barely 2 200 t in 2014. This upturn, as modest as it might be, shows that Mexico is still part of the European supply. True, Mexican exporters are primarily focused on the North American markets, and more particularly the US market, which captures the vast majority of their volumes. Seen from Europe, Mexico is still a Kent supplier in the summer period (June to August). Yet this picture reflects only the tip of the iceberg, since the country has a very wide-ranging campaign in view of its size and its numerous zones suited to mango cultivation. It extends from January to October, across the production regions and the varieties cultivated. The Southern states (Chiapas, Oaxaca, Veracruz), Mid-West states (Guerrero, Michoacán) and North-West states (Nayarit, Sinaloa) account for 85 % of Mexican production. This is partly consumed locally, and in large part exported to the neighbouring United States, from 350 000 to 400 000 t depending on the year. The trade agreements between the two countries of course favour the flow of Mexican produce, which finds substantial outlets there, backed up by well-worn logistical systems. In addition, the Mexican mango industry enjoys in the United States a captive audience, due to the large-scale immigration of Latin American populations, but also to strong communication to promote the product, like the avocado.

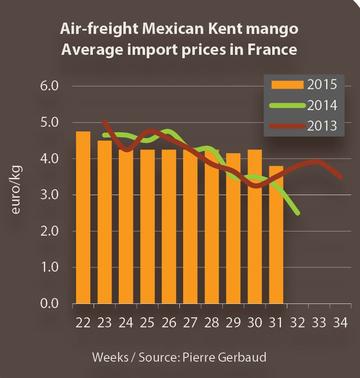

Under these conditions, the European market remains of secondary concern to Mexican professionals. Exports are limited to a period from June to August, and are focused on Kent. In 2015, the campaign was particularly early, with the first air-freight batches received from late May. It also halted more rapidly in late July, whereas previously it extended into the second half of August. Sales were steady and prices stable, at between 4.00 and 4.50 euros/kg on average. The quality was deemed uneven, with many batches lacking coloration and exhibiting fungal growth, especially at the end of the campaign. Mexico however remains a source to monitor given its enormous export potential and its varietal range. This giant, though hesitant in Europe, remains alert to any market opportunities which it might be offered.

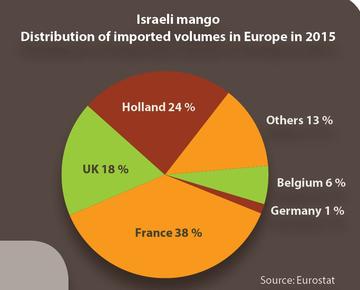

In 2015 Israel was unable to repeat its record shipments from 2014 (nearly 16 000 t). The less favourable weather conditions restricted its shipments to the European market. Nonetheless, Israel remained an essential supplier during the summer period. With approximately 13 800 t exported in 2015, the source consolidated its position among the leading pack of European market supply sources.

The first Israeli air-freight batches were sold in late July, three weeks later than the previous year. The campaign was more concentrated, finishing two weeks earlier. The first varieties shipped were Maya and Aya, rates of which climbed after the first sales before rapidly returning to their initial level after three weeks of the campaign. These small-size varieties enjoy varying popularity on the European market. Israeli exports were then packed into a period from mid-August to mid-September with Kent, the price of which increased from 3.80 to 4.20 euros/kg in the absence of competition, with Senegal and Mexico having finished their campaign. The other varieties provided by Israel (Omer, Shelly) made up for the relative shortfall in air-freight mango, and also enjoyed buoyant prices.

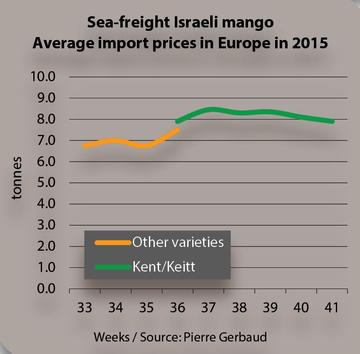

The first sea-freight shipments, in moderate volumes, started from July, though they did not go onto the market until later. They mainly comprised Haden, Omer and Shelly, and sold steadily at between 6.50 and 7.50 euros/box on a moderately supplied market. In late August, these varieties gave way to Kent and Keitt, which kept well in spite of mediocre coloration. Given the lateness of the Brazilian campaign and the declared shortfall in Spanish production, Israeli mangoes met with little competition. Hence they sold at high prices (around 8.00 euros/box) until the end of the campaign, with few fluctuations.

Israel’s position as a summer period mango supplier appears difficult, if we consider that consumption of this fruit slows down at this time of year, with the summer holidays and the profusion of seasonal fruits. Yet if we observe, on the one hand, the overall quantities on the market in July and August, and on the other hand the price levels charged on the various European markets, we cannot help but observe that this well-established rationale is shaky. The apparent fragility of the summer market window has been contradicted by the consolidation or even rise of the sources in place at this time of year, especially Israel.

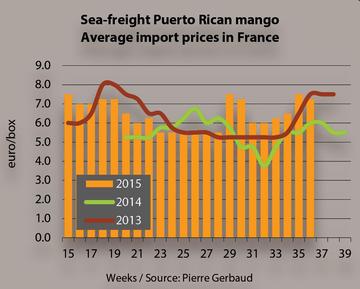

This source, after asserting itself on the European market for two years, with exports exceeding 10 000 t, reverted in 2015 to its 2012 level, with a total of 7 400 t. The 2015 campaign had the same duration as 2013, but was earlier, as in 2014. It actually began in mid-April, i.e. one month earlier than 2014. This longer and less abundant campaign enjoyed steadier and stronger rates. In April, Puerto Rican Keitts took advantage of the relative under-supply of the transition period between Peru and West Africa. The average rates were around 7.00 euros/box, and then dipped gradually, as the West African supply progressed, reaching their lowest levels from June to mid-July (5.50 euros/box). Thereafter, prices recovered their early-campaign level for a fortnight due to a moderate supply of quality produce sought by the supermarket sector. With Israel beginning its campaign in late July, prices dropped temporarily, before strengthening in the second half of August, which marked the end of the source’s campaign.

Although quantitatively less significant, the Puerto Rican campaign was able to satisfy the distribution sector with produce of standard but fairly stable quality, and above all was able to take advantage of supply variations from competing sources.

Europe’s only mango producer has definitely not lost the ability to surprise. With its dazzling rise over the last few years, Spain has hoisted itself up into the top 10 suppliers to the European market. The Spanish campaign may differ in its profile and proceedings every year, but we cannot help but observe that it keeps generating revenue for the industry operators. A happy combination of circumstances helped make 2015 a good campaign. It was also identical to the previous one, except for a considerable change in volumes on the market.

As in 2014, the particularly mild spring weather conditions enabled flowering which heralded abundant production. Yet this good flowering in the end brought a leaner fruit-bearing period in the first days of summer. The very high temperatures in July and August ensured that a promising production potential translated into a harvest volume which was ultimately in shortfall. A few weeks before the beginning of the first harvests, Spanish professionals were talking of a 50 to 70 % fall from the previous year, which radically altered the commercial strategies of the market traders. While the summer heatwave compromised the volume of production, it also contributed to the good fruit quality. Conversely, the harvest mainly comprised large sizes, which are not always the most popular, especially in the supermarket sector which sells individual fruits. But in the absence of alternatives, the Spanish supply made itself essential.

In 2014, the initial harvest forecasts were around 24 000 t, and the actual figure was 18 000 t, a new record for this source, propelling it to fourth place in the European market suppliers ranking. In 2015, the forecasts were based on 2014 (18 000 to 20 000 t) but ultimately yielded shipments of around 9 000 to 10 000 t. This distinct downturn, however, did not compromise either Spain’s predominance in the mango trade, nor above all the highly positive economic balance of the campaign.

A large, steep fall in Israeli exports from early September and a significant delay to the start of the Brazilian winter campaign in late October left the European market without any real competition during the Spanish production period. With no other major sources present, Spanish operators were completely free to earn maximum value from their own scarce product.

Osteen mangoes, the mainstay variety of Spanish production (approximately 80 %) launched the campaign from mid-August, with weather conditions accelerating their maturation. But it was only from mid-September that the supply took off. Shipments continued until late October. Particularly high until late September, their rates dropped gradually until the end of the campaign, while maintaining unprecedented levels. A comparison of the average price curves for the last two campaigns (see graph) barely requires any comment. In parallel, Spain was providing limited quantities of Kent from mid-September to mid-October, which sold steadily at between 4.00 and 4.50 euros/kg, while Brazil was beginning its air-freight campaign. Both sources achieved high and stable prices, given the moderate overall supply, with no real interference between them, as has sometimes been the case. Already present in previous years, Spanish Irwins confirmed their solid footing, especially on the wholesale markets where they regularly obtained strong prices. Available from September to mid-October, they expanded the Spanish supply in a top-end air-freight quality niche of ready-to-consume fruit. More modestly sized than the other Spanish varieties, they also constituted a diversification of the range during this under-supplied period. Finally, the Spanish campaign ended with Keitt in the first half of November. The 2015 Keitt campaign was cut short in comparison to previous years, with limited volumes also selling at high prices. Some Tommy Atkins batches topped up by the Spanish varietal range at the beginning of the campaign; though they were more aimed at the domestic market and Portugal, where this variety is more popular than on other European markets.

Besides the favourable circumstances which Spain took advantage of, we should add a factor which has doubtless magnified the success of this campaign. The production shortfall considerably reduced the role of the alternative trading circuits, which generally deal in lower-quality merchandise auctioned locally. Hence the majority of the fruits were marketed by solid and professional structures, with all that entails in terms of involvement in fruit cultivation and processing.

Spanish production is continuing its growth, going by the intensification of planting in the Malaga region where the smaller plots available are terraced for planting with mango trees. In certain zones, this spread has been to the detriment of avocado orchards, another flagship crop of the region. Plantations are being set up at increasingly high altitudes, on the valley slopes, relegating avocado trees to the wetter valley bottoms.

Osteen, which is well suited to the local conditions and highly productive, remained the number one variety in terms of the market but also planting. It provided the bulk of the campaign in terms of volume, and consolidated its position in European trade. Yet varietal diversification remains a topical theme for arboriculture in Southern Spain. The good results of the Irwin campaign are encouraging certain operators to step up planting. Though less productive than Osteen, this fairly early variety has opened up new market slots. Nonetheless, its production should remain limited, if the objective is to keep to the top-end segment. The extension of the Spanish cultivation area would instead be based on Keitt, a later and more productive variety, which above all can extend the campaign into November. Some planting is in progress, though the risk of coming up against the massive Brazilian supply at this time of years makes its marketing more fraught.

The success of this campaign will probably encourage Spanish operators to continue expanding their orchards. The inherent risk of this development is going through less easy campaigns, with overabundant production coming up against strong competition (Israel and Brazil). In the knowledge that the Spanish cultivation area is established at the edge of the optimum zone for the plant, production remains fragile and subject to major variations.

Click "Continue" to continue shopping or "See your basket" to complete the order.