FruitTrop Magazine n°239

- Publication date : 5/04/2016

- Price : Free

- Detailled summary

- Articles from this magazine

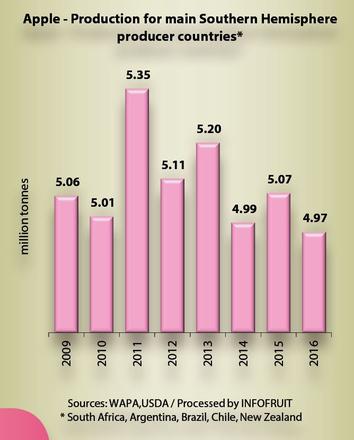

The 2016 campaign started on the same footing as the previous one, with the overall upstream potential not overly abundant. However, local produce still has a fairly big presence downstream. Yet exchange rates are fairly favourable, giving the operators hope of a better campaign than in 2015, or at least of consolidating their export levels.

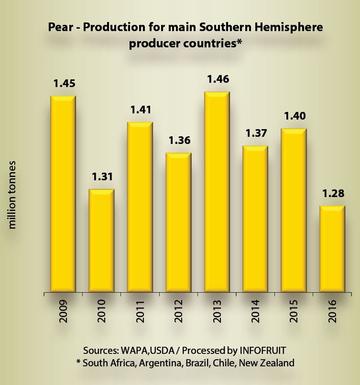

The previous campaigns appear to have left their marks on production. The high tensions within the industry, due to the economic conditions, again had particularly damaging effects in Argentina. The strikes resulted in a further increase in labour costs, but were also highly detrimental to the harvest, causing production losses. So pear exports fell considerably by 335 000-360 000 t, depending on the sources, i.e. approximately - 23 % on 2014, especially to the European market (- 34 %), as well as toward most other outlets (- 25 %). However, export levels to the US market were good (47 000 t, i.e. + 22 %). Apple exports also dipped steeply in 2015 (120 000 t, i.e. - 18 %), except again to the North American market (13 800 t, i.e. + 50 %). Europe-bound exports fell to just 14 000 t (110 000 t in 2007). And there are no expectations of better results this year, since although the Argentinean peso has been slightly devalued, the fall has been less significant than for other South American countries.

In 2016, the apple and pear harvest should not much exceed the previous one, and so should be well below previous years. This is down to a number of small producers abandoning the trade, and to poor climate conditions in spring (rain, hail, low temperatures) which generated in certain sectors physical losses, but also economic losses due to the impact of hail and diseases. In addition, the flowering came late, resulting in smaller fruit sizing.

In Brazil, surface areas have been on the wane since 2014 (- 3 % per year), whether in Santa Catarina or Rio Grande do Sul. So apple production should at best be stable this year, since the climate conditions (mild winter, late frosts, hail and excessive humidity in spring) have affected the harvest level and sizing, which should be average. Nonetheless, exports from this source climbed in 2015 (+ 36 %), after the steep downturn registered in 2014, though without regaining previous levels (60 000 t as opposed to 85 000 t in 2013 and 112 000 t in 2008). Shipments to the European Community rose by just 17 %. However, exporters hope this year to consolidate the export level regained in 2015, or even claw back more of the export market share (65 000 t, or even 70 000 t).

2015 was a very disappointing year for the Chilean apple industry, with the exports slowdown taking them to their lowest level since 2009 (628 300 t, i.e. 22 % below the 3-year average). Conversely, pear shipment levels were very good (143 500 t, i.e. + 9 % on the 3-year average), back to their 2013 level, after a particularly difficult 2014 campaign.

The fall in apple shipments was particularly marked to Europe (111 600 t of imports in 2015, i.e. - 32 %) and the United States (78 700 t, i.e. - 34 %). Thus more volumes were sent to Russia (26 000 t, i.e. + 72 %). European pear imports, however, practically returned to their peak level (+ 35 % on 2014 and + 20 % on the three-year average), which had not been the case since 2009. Similarly, US imports regained their previous level (+ 21 % on 2014).

Surface areas fell slightly for the apple (36 200 ha, i.e. - 1% on 2015), but increased further for the pear (8 300 ha, i.e. + 15 %), with Abate making particular progress. The production potential should be fairly similar to last year, or even slightly down because of the somewhat chaotic climate conditions brought by El Niño, although the phenomenon has been less intense than feared. The spring cold spell affected pollination and fruit-setting, while the heat reduced the sizing. Exporters are hoping for an increase in their apple and pear shipments of at least 10 % on 2015, or even up to 15 %. However, the poor sizing and uncertainty over the coloration could limit the exportable potential to the European and North American markets.

Although the planting tempo has now slowed down (high marketing costs and market uncertainty), South African surface areas are continuing to grow, reaching nearly 12 000 ha for the pear and 23 150 ha for the apple (+ 1 to 2 % per year). Growth is still significant for Packhams (+ 4 %), the number one variety in the cultivation stock, as well as for Abate Fetel and Forelle, though now at a slower tempo (+ 1 %). The ageing Williams stock is continuing to fall (- 1 %), although noteworthy progress has been made by the Early Bon Chrétien supply. Production was slightly below expectations in South Africa last year, given the storms at the beginning of the season which delayed the campaign and reduced the potential. Purchasers also exhibited differing degrees of prudence, which limited marketing. Hence pear exports ended up falling slightly (- 6 % on 2014), in spite of the outlet diversification over the past few years. Shipments to the Community market fell the furthest (90 000 t, i.e. - 9 %), while Asia-bound shipments were also hard hit (27 100 t, i.e. - 8 %). The Middle East (31 500 t, i.e. + 14 %) and Africa (7 800 t, i.e. + 37 %) however continued to absorb increasing volumes. Conversely, after a lacklustre 2014, apple exports rose slightly (+ 3 %), thanks to better tonnages to the European market, though without regaining their 2013 level (150 000 t), still less their 2003 level (180 000 t).

The initial figures for 2016 indicate a fairly good potential for this source, of around 398 000 t (+ 3 % on 2015) for the pear and 880 000 t for the apple (+ 2 %). Yet this will probably be revised downward due to the persistent drought which is affecting sizing and has already caused fruit droppage, reducing the exportable potential in the earliest sectors, especially early-season varieties. The parity of the rand however is allowing operators to anticipate a better export level in 2016, with a 3 to 4 % gain according to initial estimates.

New Zealand production surface areas are stable, though planting activity, especially of modern varieties aimed at the Asian markets, is on the rise. This overhaul of the cultivation stock has been made possible by several lucrative campaigns, on the strength of increased yields and the fall of the NZ dollar. Hence the range of Pacific apples is continuing to develop, and new varieties such as Rockit are also taking their place in the mix. As regards the pear, the cultivation stock is also increasing for certain varieties such as Corella and Josephine. This growth is in response to demand from Asia, which now represents 40 % of the outlets for this source, and enabled a 6 % increase from 2014 in total apple exports, although shipments fell to the European market (- 9 %) and the US market (- 21 %). Exporters are even reckoning on a further 4 % increase in shipments for 2016, since there should be a good production level, similar to last year, thanks to climate conditions favourable for flowering which have offset the negative alternate bearing effect. Conversely, in 2015 pear exports, which are primarily aimed at the historical markets, fell by 24 % to Europe and by 53 % to the United States. However, exporters are hoping to be able to reverse the trend somewhat in 2016, to achieve 4 600 t.

Although exporters are hoping to increase their export volumes, the European market could be unreceptive again this year. Like last campaign, the Community market could open fairly late, because while the 2015 European campaign got off to an auspicious start with few leftovers from the previous one, in bicolored varieties at least, it fell behind schedule in the autumn. Although large-scale exports started quicker than last year, sales were well below expectations during the first half of 2015, including during the apple fairs which usually invigorate the market. The blame probably lies with the mild weather, under-sized fruit and the events which marked the end of 2015.

Nonetheless, the Gala campaign should finish at a similar time to last year, although with large-scale export shipments stopping from early March, the leftover stocks could take more time to sell off on the internal market alone (205 000 t as at 1 February 2016, i.e. + 7 % on 2015). Furthermore, volumes of other bicolors such as Braeburn, Fuji or Jonagold/Jonagored will still be present, with a stock level similar to or less than last year on a Europe-wide level. Yet this stock will weigh very heavily at a local level, especially in France: + 30 % for Braeburn, + 2 % for Pink Lady, + 31 % for Fuji and + 114 % for Jonagold. Similarly, sales are slow for Granny due to the poor sizing. The European stock is up 7 %, and the French stock by 32 %.

The situation is fairly similar for the pear, though for somewhat different reasons. The campaign fell behind schedule from the start, since the Guyot season finished late in September, for lack of export outlets, particularly to Russia with the embargo and given the poor sizing. All this delayed the market launch of Williams, and then of the autumn/winter varieties (Comice, Conference or Abate), especially since there were also still leftovers of small varieties such as Alexandrine or Beurré Hardy. As with the apple, the market then followed a very routine pattern for the end of 2015, making it difficult to maintain price levels at certain times, such as during school holidays. So January was a mediocre month. The competition intensified among small sizes, and shelf-life concerns started to appear for late-season varieties such as Comice, because of the high sugar level this year, which drove rates downward in Northern Europe. However, the market seemed to settling down somewhat in February, in spite of the school holidays, with the fall in small size availability, especially for Abate and Conference. However, the stock level was still very high on 1 February 2016 (617 000 t, i.e. + 17 % on 2015), whether for Abate (127 000 t, i.e. + 16 %) or Conference (411 000 t, i.e. + 11 %), while the Comice season was winding down.

Click "Continue" to continue shopping or "See your basket" to complete the order.