FruitTrop Magazine n°243

- Publication date : 22/09/2016

- Price : Free

- Detailled summary

- Articles from this magazine

The soothing succession of commercial success on the world avocado market, year on year, almost leads us to forget that the world cultivation area is not static. Planting is continuing, and on a massive scale in Mexico, to the point that annual growth has now been measured in tens of thousands of hectares for at least the past four years. Is this massive trend in the Mexican cultivation area something to be feared, given that its proportions are already so impressive that it can call the shots on the international trade?

Mexico was dealt a good hand to play a leading role on the world avocado market. This is rooted first of all in the country being the birthplace of one of the three races from which all currently cultivated varieties originated. Indeed, it is from a Mexican vernacular language, Nahuatl, that the avocado draws its name. It also enjoys cultivation characteristics, with particularly suitable pedoclimatic conditions in the central part of the country: rich and well-drained volcanic soils, temperatures ensuring excellent photosynthesis and preventing frost risks, and good availability of high quality water. With such a potential and such a long pedigree, it is no surprise that this country plays such as predominant role in the world avocado industry, controlling nearly one third of production (with approximately 1.6 million tonnes) and two thirds of exports (coming very close to the one-million tonne mark in 2015-16). If Mexico is important for the avocado, the avocado is also important for Mexico, with the sector currently a heavyweight of its economy. The country’s 18 000 producers and forty or so packing stations generate nearly 100 000 direct jobs and an export turnover expected to be around 2 billion USD in 2015-16.

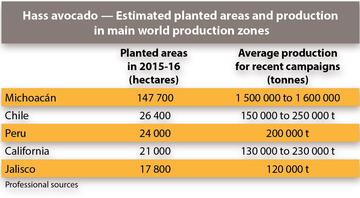

This massive industry has been put together in a matter of only around fifty years. Its foundations were laid in the late 1950s, with the introduction in Michoacán of improved varieties such as Fuerte and Hass from California. The growing demand from the local market, rapidly converted to Hass, and the support measures proposed under the national fruit cultivation promotion plan (CONAFRUT), led to a boom in surface areas from the early 1970s. A broad production base comprising investors or farmers often new to the crop emerged, with each individual setting up mainly small to medium-sized orchards, with generally very basic cultivation systems. The activity, unprofitable in the mid-1980s, became extremely lucrative the following decade, with the start of exports and above all the gradual lifting, from 1997, of the ban on exporting to the big US market, which had been in place since 1917. The Mexican cultivation area, which amounted to less than 10 000 ha in the early 1960s, now extends over nearly 190 000 ha. More than 80 % is packed into the State of Michoacán, on the western foothills of the Sierra Madre Occidental, especially in Uruapan and the neighbouring districts.

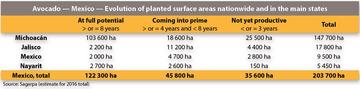

The boom in Mexican production is far from over. As huge as it is, Michoacán has not stopped growing. On the one hand, the existing cultivation area is a long way from expressing its full potential. More than 25 000 ha planted in the past three years has not yet entered production, while nearly 20 000 ha of young trees less than eight years old are coming into their prime. On the other hand, while the surface area expansion trend could well ease back, it should not stop altogether. True, the historic cultivation zone of Uruapan is at saturation point, while public opinion no longer sees only the economic lifeblood derived from this crop, but also its negative externalities: the outrageous clearance of the primary forest, tension over water and contamination of water tables, and insecurity due to cartel wars to gain control over the juicy business of extorting funds from producers. However, planting of new orchards should continue at a more moderate rate, especially in zones situated on the eastern and western margins of the avocado zone.

Furthermore, the dynamic of the other States in the Mexican Confederation should not be under-estimated, especially since the promulgation in late June 2016 of an APHIS decree authorising exports from all the country’s production zones to the United States, subject to compliance with strict phytosanitary constraints. Surface areas have expanded by 1 500 ha per year on average in Jalisco, where producers had banked on this measure and started early. With more than 17 000 ha, this State neighbouring Michoacán is now home to the fourth largest Hass cultivation area in the world. Surfaces areas should increase even more substantially over the coming years, given the comparative advantages enjoyed by this region: a production calendar supplementing that of Michoacán, thanks to the possibilities of cultivating the early clone Mendez, land reserves with favourable characteristics, and more advanced cropping techniques than in Michoacán, making it possible to obtain average yields of approximately 18 t/ha. Other producer States should also expand their surface areas, although their potentials probably cannot rival that of Jalisco. So overall, a scenario of Mexican production maintaining for the next five years an annual growth rate similar to that seen since 2012, around 100 000 t per year, is not far-fetched.

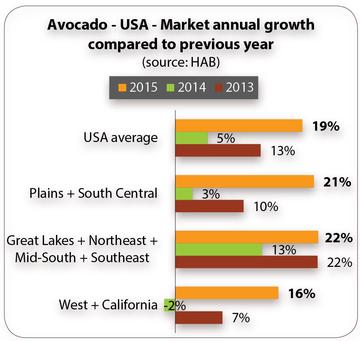

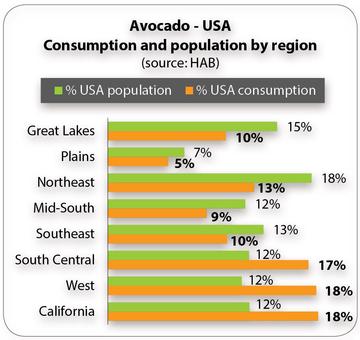

True, these are colossal volumes, but the appetite of the US market, the natural destination for Mexican exports, is no less huge. Consumption doubled in ten years, to approach the one-million tonne mark in 2014-15. This was an exceptional performance based on a foundation of nearly 320 million potential purchasers increasingly keen on the avocado, and on the promotional efforts, unrivalled in the world of fruits and vegetables, developed by the HAB, an ad hoc organisation created by the professionals and backed by a budget in excess of 50 million USD in 2015. Nonetheless, can we imagine a continued growth dynamic of 10 % per year, the figure registered over the past decade, when consumption per capita is already in excess of 3 kg/year? The answer to this question is yes, which could lead us to think that the sky really is the limit for the avocado… True, the sudden slump in growth to 5 % in 2014 sowed some seeds of doubt, with the over-consuming zones of the Western USA seeing stability for the first time, or in some parts a decline. Yet it is the supply rather than demand which was to blame, and things got back to normal in 2015 with growth returning to 19 %! As long as the volumes are there, consumption can still take giant steps forward, even in the parts of the country which were thought to be close to saturation. So the prospects are extremely reassuring, though a lot of fuel will be required: an additional 100 000 t per year will be required to satisfy the needs of the market, if we reckon on a growth rate of 10 % per year. This is an apparently conservative hypothesis, if we consider the sales from previous seasons and the growing share of imports in the supply, given the structural problems facing the Californian industry, which is somewhat on the wane.

While the US market retains a phenomenal capacity for growth, it lacks the magic powers to prevent prices from being eroded by the increase in volumes. Might this trend, combined with the opposite trend of strengthening rates seen in Europe, profoundly alter the trade-offs by Mexican exporters and lead to a green tide rolling onto the Old Continent? The answer is clearly no, since the United States has a number of assets for Mexico. The most obvious is that of proximity. Being less than one day by lorry from the Texan border of course limits logistical costs, but most of all operators can feel unconcerned about trading in avocados produced in a subtropical climate, with cropping techniques that are often still basic, and with a possibly heterogeneous maturity level, since the fruits come from small or medium-sized orchards (less than 5 ha for 75 % of them). Furthermore, contrary to certain preconceived ideas, the USA is less demanding in terms of external quality or size than Europe, and far less so than Japan. According to certain professionals, the packing yield for the USA is around 95 %, i.e. 10 to 15 points higher than for the other markets mentioned. We also need to take into account the fact that Mexican exporters are, to a significant degree, American. All the big names in the US avocado trade have a long-standing presence in Michoacán, sourcing fruits aimed at the United States (West Pack since 1996, Calavo since 1998, Mission since 1991). These transnational structures controlled 40 % of exports in 2015-16.

While the increase in Mexican production should above all be aimed at feeding the growth in US consumption, the diversification markets will probably receive some additional volumes. The EU has enjoyed a highly visible rise since 2012: Mexican shipments, which had plummeted to 3 000 t in the early 2010s, exceeded 12 000 t in 2014-15 and practically quadrupled in 2015-16 to reach a historic level of 45 000 t: which is mere crumbs for Mexico, representing less than 0.5 % of its overall exports, but is far from insignificant for the Community market, making up approximately 20 % of the winter market supply last campaign. Might these volumes endanger the balance of the Community market? Again, the answer is clearly no, since the European importers can only trade in Mexican fruit if the prices are good. Wooed on all sides, Mexican producers have the power and are laying down the law for the rest of the industry. Mexican exporters, who purchase their fruits at strong prices (often “on the tree”), assume all the commercial risks, and in turn demand cash payment by the importers before releasing their precious merchandise. The growth in production has not altered these relationships of power, very much in favour of the upstream segment, and that should not change, at least in the medium term. Certain European importers are simply seeing a little more flexibility from the Mexican exporters in case of damage. Furthermore, it should also be considered that the European market is not the only one doing well, whereas volumes allocated outside of the USA remain limited. Volumes to Japan are not really on the rise, but it remains a high lucrative market, while China, a market guaranteeing even higher returns, is taking off.

This wave of Mexican production, of which the European Union will probably only receive the froth, will on the other hand have indirect effects that will affect the Community market. While the borders of the United States are opening up and will open up increasingly widely to Mexican avocados, the door could well close, at least partially, to fruits from other sources. They will need to find new targets on a world market, though increasingly globalised, where the EU will for a long time to come remain the sole large-scale alternative. The example of Chile, the historic and key market supplier to the United States during the winter season, when faced with a more competitive Mexico, is extremely revealing. The upstream segment of the industry had to switch to the EU-28 and the local market. The figures show the scale of the turnaround: the USA, which absorbed approximately three quarters of export volumes at the end of the last decade, received just 10 % in 2015-16, while Europe became the central market, capturing more than 70 % of shipments. Might this precedent be repeated in countries which have planted on a massive scale with view to feeding the US market? The case of Peru, whose export potential should rapidly double to reach 400 000 t, is raising questions. The same is true for Colombia, which at present still has a low profile on the international market, but which has a young cultivation area of 10 000 ha, expanding rapidly.

Should we be concerned at these potential turnarounds? Like the US market, the Community market also needs large additional volumes to ensure its continued progress. The average price has kept on climbing, despite the growth in supply of between 14 and 17 % for the past four campaigns. A rise of only 10 %, a highly conservative scenario, would require an additional 40 000 t per year, i.e. the production of approximately 4 000 ha of orchards of average yield. True, the rate at which the Peruvian production is coming into its prime might raise questions over the coming campaigns (see FruiTrop 240). Conversely, neither the Mediterranean suppliers nor Chile are able to provide these volumes, at least in the medium term, during the winter season when the under-supply is most acute. So the big “crumbs” from Mexico and the additional volumes from Colombia will be welcome

Click "Continue" to continue shopping or "See your basket" to complete the order.