FruitTrop Magazine n°244

- Publication date : 3/11/2016

- Price : Free

- Detailled summary

- Articles from this magazine

Sweet potato (SP)

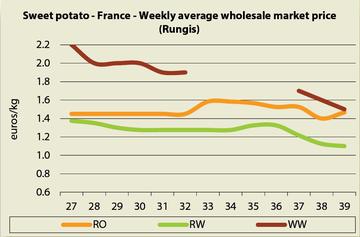

Shipments of white-fleshed Egyptian SPs, after being suspended in early June, resumed in mid-September, with rates dipping after the first incoming shipments. During the summer, South Africa and Honduras provided the white-fleshed SP supply. While prices were stable overall, Honduran produce sold at slightly higher prices, strengthening somewhat from mid-August.

Orange-fleshed SP from Honduras, Israel and the United States earned fairly constant prices. However, Israeli produce sold for at least 0.20 euro/kg more. Rates strengthened in the second half of August, especially for Honduras, the biggest and most regular procurement source.

The Spanish orange-fleshed SP campaign got off to an early start at the beginning of September, nearly one month ahead of the 2015 campaign. A marginal source a few years ago, it has rapidly become important to the European market, which should be further underlined this year with varietal diversification. Jerew supplemented the shipments, hitherto comprising only the Beauregard variety.

In July, and up until mid-August, Honduras shipped white-skinned and white-fleshed SP, previously hardly if at all exported by this source, which underlines the product’s expansion on European markets. Italy took over in mid-September with its typical Veneto varieties.

Yam

The market saw major variations, primarily due to fluctuations in shipments from Ghana, the main source for the European market. By June they were already dwindling, representing the last stocks from the previous campaign. Prices saw a distinct rise, whereas paradoxically, the quality of produce was becoming increasingly uncertain. The late arrival in mid-July of batches from the new harvest further strengthened prices. In mid-August shipments, hitherto limited, were stepped up and drove prices into a marked fall until the end of the period. White or Puna yams followed the same trend. The shortage of produce at the beginning of the period encouraged operators to find an alternative, with Brazil able to supply white yams and Cuscus. They sold fairly steadily throughout the period, with rates dipping in September due to the magnitude of shipments from Ghana and quiet demand.

Cassava

The price for Costa Rican cassava fell in August, a time when incoming shipments remained steady, but when demand dipped. In September, the trend reversed with a more modest supply whereas demand picked up.

Eddoe

The dwindling supply from Costa Rica, the main supplier to the European market, caused a price increase, limited in July and then more marked in August. Price differences were considerable, depending on the size, with some sales at as much as 2.70 euros/kg, a level rarely attained. Those batches that were received from China in July and August, and from Ecuador in July, obtained lower prices.

Click "Continue" to continue shopping or "See your basket" to complete the order.