Banana monthly review: April 2019

- Published by Cirad

- Free

European market dipping despite a moderate supply

Informations

- Product(s) : Banana

- Rubrique / Thématique : Review and Forecasts

- Country : French west indies , Cameroon , Colombia , Costa rica , Cote-d'ivoire , Ecuador , Europe , Ghana

- Keywords : Import , Price , Production

Côte d’Ivoire began its climb toward its May production peak, with volumes 13 % above average, though only 3 % up on 2018. Ghanaian structural growth is continuing (22 % above average), with approximately one-third organic volumes. This surge from Africa was curbed by the Cameroonian shortfall. Although a slight rise in volumes was observed in April, the supply remained 14 % below average. While the shortfall seems to be narrowing, it is no artefact; since the average now incorporates the 2018 data (start of the shortfall). Shipments from the French West Indies were also up slightly, following the same trend as in 2018.

As regards the dollar banana, the scenario is very different, although the supply from Ecuador was 5 % above average. The Colombian production peak wound down at the beginning of the month (week 14), at near-average levels. Volumes then very rapidly reverted to below-average levels (-3 %). Furthermore, because of the severe drought hitting the country, Costa Rican exports were very limited (approximately - 15 %). Hence the overall supply in April was rather moderate.

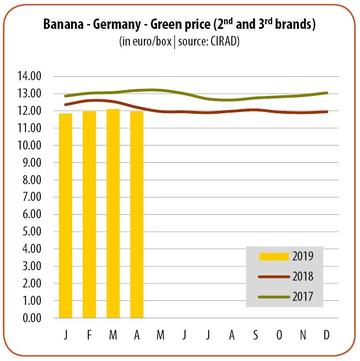

From the beginning of the month, there was a feeling of saturation on the East European markets, followed by large-scale speculation in the run-up to the Easter weekend (fears of drastic fall in prices as in 2018), causing a dip in prices across all European markets. However, prices were 6 % above their 2018 levels, and near-average (- 2 %).