Roots and tubers - Q3 2019

- Published on 21/10/2019 - Published by GERBAUD Pierre

- Free

Quarterly Market Review

Informations

- Product(s) : Eddoe , Ginger , Yam , Cassava , Sweet Potato , Roots & tubers

- Rubrique / Thématique : Review and Forecasts

- Country : South africa , Brazil , China , Egypt , Spain , Ghana , Guatemala , Honduras , Israel , Portugal

- Keywords : Export , Import , Price , Production

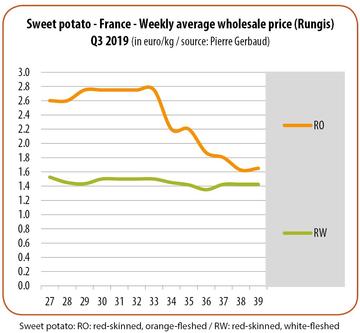

Sweet potato

Carrying on from Q2, and more particularly since the second half of May, rates for the orange-fleshed sweet potato maintained particularly high levels until late August. The market then took on a different profile, with a distinct deterioration in sale prices, which fell back to a level more usual for the first half of May. Guatemala and Honduras dominated the supply in Q3, followed in late August by the Mediterranean origins (Egypt, Israel, Spain and Portugal). The rise in quantities entering the market in a context of stable demand led to a drop in prices of nearly one euro per kilo. This year we could observe smaller quantities of white-fleshed Egyptian sweet potatoes, while this origin further stepped up its shipments of orange-fleshed tubers. White-fleshed sweet potatoes supplied by Honduras, Brazil and South Africa simultaneously traded at lower but stable prices, at between 1.40 and 1.60 euro/kg until late August. In September, prices dipped slightly, and became more variable.

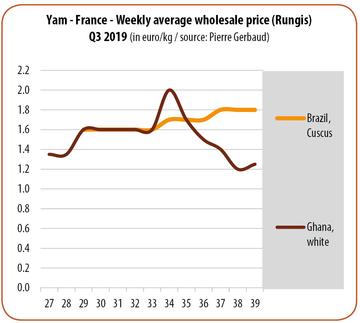

Yam

The transition to the new Ghanaian yam harvest in July somewhat changed the marketing of this product. In the first half of July, rates maintained the same level as the previous month. From the second half, they took an upturn due to the availability of the new harvest. The produce from the previous harvest sold at around 1.20 euro/kg, while the produce from the new harvest traded at around 2.00 euros/kg. The end of the old harvest stock in late August caused a short-lived price increase, because of the rise in incoming shipments from the new harvest. With moderate demand in September, rates collapsed thereafter, returning to their original level, or even lower. Meanwhile, Brazil supplied Cuscus yams, which sold on an upward footing from mid-August to late September, with steady but moderate volumes.

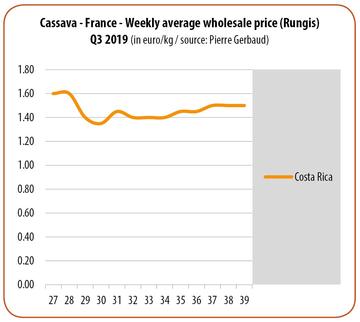

Cassava

After a spectacular phase in price terms in Q2, due to supply not covering demand, Costa Rican cassava rates took a distinct downturn in Q3. From the second half of July, prices took a downturn at the end of the month, under the combined effect of a bigger supply and waning demand. Rates stabilised in August at around 1.40 euro/kg, and then rallied in September to reach 1.50 euro/kg, below their initial mark. These price variations seem to be due to the fluctuations in volumes shipped, and to logistical disruptions in the origin.

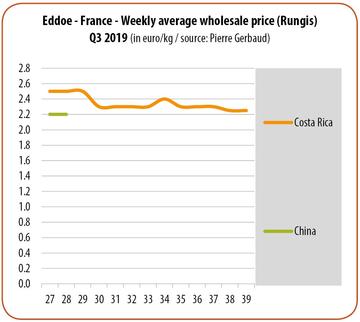

Eddoe

The better eddoe supply level from Costa Rica during the summer period led to stop-start reductions in rates. The first price downturn, in late July, was caused by a return to supply conditions more in line with the average, after the May-June shortage. The second downturn, in the second half of September, can rather be attributed to sluggish market conditions. The supply was topped up by some batches from China at the beginning of the period, obtaining lower prices given the lower quality.

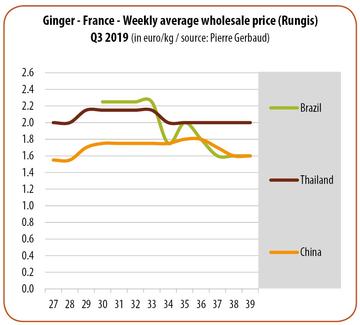

Ginger

Prices for Chinese and Brazilian ginger were fairly high from mid-July to late August. Chinese shipments dwindled during this period, helping keep prices steady. There was a notable price differential between the ginger from these two origins, with Brazilian produce better off. Taking advantage of favourable market conditions, Thailand shipped some batches of ginger from the end of July, which sold at high prices; though they dropped from the second half of August, with Chinese shipments once again stepping up.