Q3 2020 Other Exotics review

- Published on 21/10/2020 - Published by GERBAUD Pierre

- Free

Q3 2020 was a commercially quiet period for Other Exotics, with summer traditionally a slow time for these products. Sale prices saw rather a downward trend.

Informations

- Product(s) : Chayote , Christophine , Chili , Plantain

- Rubrique / Thématique : Review and Forecasts

- Country : Colombia , Costa rica , France , Dominican republic

- Keywords : Export , Import , Price , Production

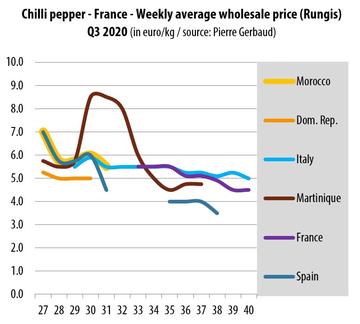

Chilli pepper

Chilli pepper prices fell gradually and continuously throughout Q3 2020, thereby following the trend from the end of Q2. The shortfall in volumes, which had driven prices to particularly high levels in April/May, was partially offset in June, leading to a substantial fall in prices. This trend continued in the summer, with the combined incoming shipments of European and Mediterranean produce, in tandem with the disappearance of Dominican peppers. From mid-August, the supply was dominated by domestic production, which bit by bit edged out competing produce or reduced its sale prices to a common level, incomparable to those seen in the previous quarter.

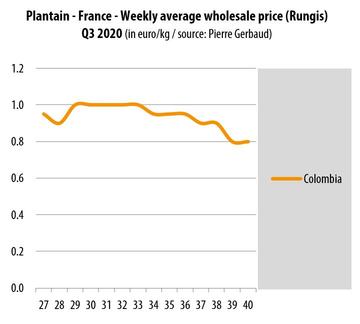

Plantain banana

Colombian plantain banana prices held up at around 1.00 euro/kg on average until mid-August. They steadily dipped until the end of the period. In September, price ranges widened greatly, due to the substantial volumes in a context of limited demand. Certain batches sold from 0.45 euro/kg.

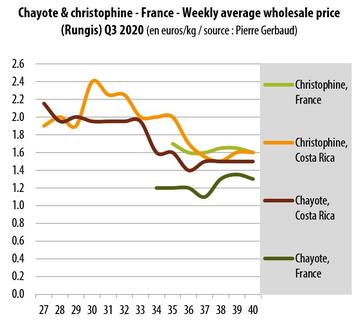

Chayote and christophine

Until mid-August, the only chayote and christophine supply came from Costa Rica, with relatively stable prices for moderate volumes. The start of the French campaign weighed down on prices, which came undone in late August, before stabilising in September. French chayote prices saw a drop in relation to the competition, while christophine prices proved to be higher, with similar levels to its Costa Rican counterpart. These different price trends can probably be explained by smaller volumes of French christophines.