Mango monthly review: February 2021

- Published on 10/03/2021 - Published by GERBAUD Pierre

- Free

Disrupted shipments and a heavily laden market at the end of the month

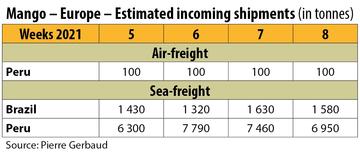

Incoming Peruvian shipments were disrupted in the first half of the month by shipping delays. In the end, the sudden falls and deferred volumes did not cause any major impacts on sales, which remained steady. Peru was reaching its campaign peak, with the last harvests from the Piura region. The load on the market, swollen by increasing Brazilian shipments, nonetheless weighed down on prices in the second half of February. Brazilian fruit, more particularly aimed at Northern Europe, sold at slightly lower prices than those charged for Peruvian produce.

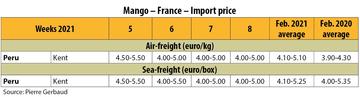

The air-freight mango market presented a more mixed picture, with substantial Peruvian imports. Some of the customer base was put off by the particularly high retail prices. Sales were made mainly on a footing of €4.50-€5.00/kg, a cost price level for the merchandise given the high purchase prices from production and persistently high air-freight rates. The small sizes struggled to earn value, selling at below €4.00/kg. Conversely, the large sizes, which were scarce in the supply, sold at higher prices of up to 5.50 €/kg. Furthermore, sales were also weighed down by the placement of sea-freight merchandise of air-freight quality (presentation and coloration), which attracted a small group of purchasers. This fruit sold at around €3.00-€3.50/kg.