2023 summer avocado campaign in the EU27+UK

- Published on 18/09/2023 - Published by IMBERT Eric

- Free

Unsurprisingly … in crisis

Informations

- Product(s) : Avocado

- Rubrique / Thématique : Review and Forecasts

- Country : South africa , Europe , Kenya , Peru , United kingdom

- Keywords : Export , Import , Price , Production

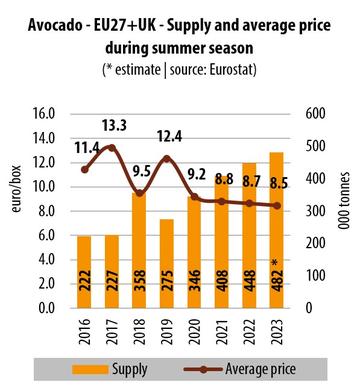

The summer campaign followed its now-established pattern, with the oversupply crisis becoming more marked, and prices lower, every season. According to our estimates, based on professional figures, the volumes received from the three major suppliers to the summer market were up by just under 10 %, to approach the half-million tonnes mark - a first for the EU27+UK!

Peru was of course the main architect of this “avalanche”, with shipments to the Old Continent up by approximately 10 %. However, the world number two exporter had less abundant production than forecast, probably because of climate irregularities due to the first stirrings of El Niño. The volumes placed by the Peruvian industry on the international market, across all destinations, should only be up slightly from 2022. However, they were more focused than ever on Europe, despite a perceptible breakthrough in Asia (a fine campaign in Japan, and especially in China, where shipments probably doubled to reach 50 000 t). This can be blamed on the US market, which as could be expected, was much less open than in 2022 (strong competition from Michoacán in June, and Jalisco increasingly present).

Kenya too was in major key, with its shipments to Europe up by just under 10 %. While South Africa was the only major supplier with little or no increase in volumes, it was perhaps this origin which performed best. Nearly 70 % of shipments were received at the very start of the season between March and late May, when prices registered very high levels given the lack of a Mediterranean supply. This tactical choice paid off, since this fine start quickly turned into a catastrophe under the weight of Peruvian and Kenyan volumes.

As usual, prices plummeted from late May, maintaining levels between €6 and €8/box until early September - the market’s longest ever recorded plunge! The campaign average price registered its worst level, with €8.50/4-kg box for the best sizes, bearing in mind that the growers’ yields have probably been lower. There was a lot of incoming sorting waste for the Peruvian supply, due to its well below-normal quality, which seems to have been caused by the atypical climate. In an attempt to end on a positive note, we will point to possible signs (of the start?) of Asian demand awakening, and the colossal volumes absorbed by the Old Continent, even if this was painful in terms of price (more than 5 million boxes of Hass received per week during most of the summer).