Mango monthly review: August 2023

- Published on 7/09/2023 - Published by GERBAUD Pierre

- Free

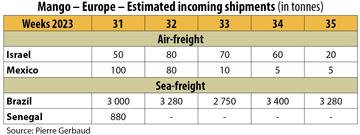

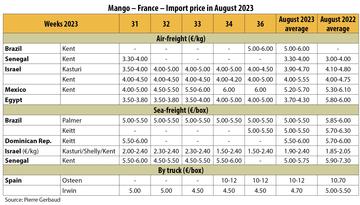

A moderate mango supply

August brought a moderate mango supply, because of the Senegalese campaign ending early. The suspension of export permits by the Senegalese public authorities resulted in the last shipments from this origin being received in week 31. So the sales which continued beyond then involved increasingly small quantities of stored produce. This restricted supply helped prices hold up, in spite of the proliferation of quality problems. Hence Brazil provided the bulk of the market supply, as the Israeli supply progressed with the Omer/Kasturi, Shelly and then Kent varieties, with prices for the latter variety a bit higher given the absence of competition. Mexico also shipped a few Kent containers, which sold on the same price footing in smaller quantities. Brazil mainly shipped Palmer throughout the month, which mostly sold at €5.00-€5.50/box, before being joined at the end of the period by Keitt at the same price.

On the air-freight mango market, the supply, initially comprising Mexican Kent, was fairly limited. It was subsequently boosted by the increase in Israeli shipments. The Aya, Maya, Shelly and Kent varieties came onto the market in succession, selling at stable prices of between €4.00 and €5.00/kg. Given the relative shortage of produce, Egypt stepped up its shipments, with a wider range of varieties than in previous years. Batches of Mabrouka mangos were followed by Kent shipments, and then local varieties less well-known to European consumers. Generally presenting good taste quality, though with unappealing coloration, this fruit sold at between €3.50 and €5.00/kg. The first Brazilian Kent batches were received at the end of the month, obtaining high prices.