Roots and Tubers review: Q1 2023

- Published on 18/04/2023 - Published by GERBAUD Pierre

- Free

The ethnic products market had an uneventful Q1 2023. Supply levels were for the most part regular and balanced in relation to demand.

Informations

- Product(s) : dasheen , Eddoe , Ginger , Yam , Cassava , Sweet Potato

- Rubrique / Thématique : Review and Forecasts

- Country : Brazil , China , Colombia , Costa rica , Egypt , Spain , United States , France , Ghana , Honduras , Martinique , Peru , Saint Vincent , Thailand

- Keywords : Export , Import , Price , Production

Sweet potato

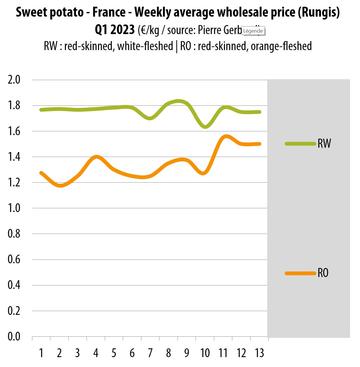

In Q1 2023, the white-fleshed sweet potato market was fed by Egypt, Brazil and Honduras. Egyptian tubers sold steadily on a footing of €1.10/kg. Honduran and Brazilian tubers were better valued, with sale prices of around €2.00/kg. After fairly stable prices for this merchandise in January and February, it then encountered choppier market conditions in March. The lower quality of Honduran produce at this time weighed down on rates. Conversely, Brazilian sweet potatoes took advantage of this situation, with stronger prices from mid-February to mid-March.

The orange-fleshed sweet potato market was dominated by Spain and Egypt. Prices of these products slowly strengthened between early January, when it was fixed at around €1.20-€1.30/kg, and late March with an average price of close to €1.50/kg, due to a slump in supply levels. There were some occasional top-up batches from Honduras and the USA.

Some batches of violet-fleshed sweet potatoes, and also white-fleshed & white-skinned sweet potatoes, from the USA/Honduras and Brazil respectively, obtained higher price levels (€2.50/kg) for limited quantities.

Yam

In Q1 2023, white yams were shipped primarily by Ghana, which remained the number one market supplier for this product. Their sale price remained fairly stable, though there was a slump from mid-February. Cuscus yams sold steadily, on a footing of €2.30/kg for Brazilian produce, and €1.80/kg for Colombian produce, a less well-known yam supplier origin. The French produce trading campaign, which began in mid-November, continued throughout Q1 2023, with rates seeing little change, remaining fixed at around €3.80/kg.

Eddoe

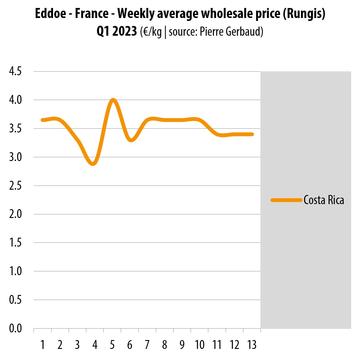

The Costa Rican eddoe market remained stable in Q1 2023. Some price variations were observed in late January/early February, because of occasional quality problems at the ends of certain batches, and the stop-start supply.

Dasheen

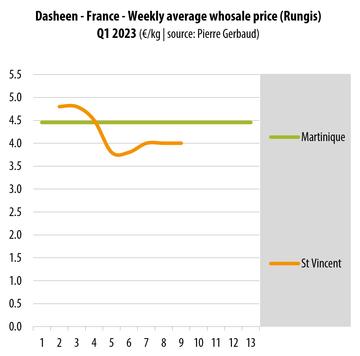

Air-freight Dasheens from Martinique maintained constant rates. Sea container shipments from Saint Vincent were more haphazard, with a suspension in late February/early March. The high rates registered in January deteriorated in February, though they remained high.

Cassava

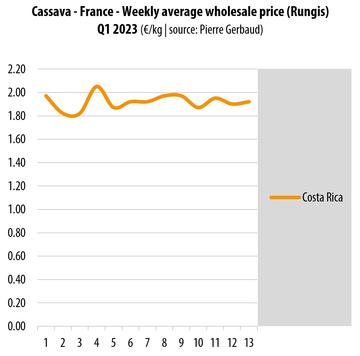

Costa Rican cassava prices saw little variation during the period in question, with an average of around €1.90/kg. The variations registered remained minor, manifesting some supply irregularities in the face of becalmed demand.

Ginger

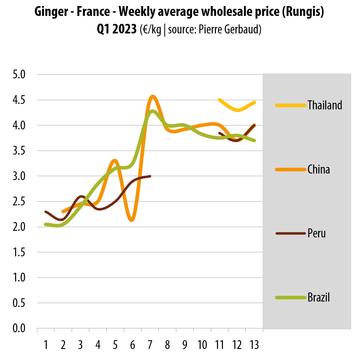

The ginger market was characterised by a significant upward trajectory from early January to mid-February. Sale prices stabilised thereafter, or even dipped slightly at the end of the period. This remarkable trajectory can be explained by the intervention of several factors. The supply transition to China, which was supposed to take over from the hitherto dominant Brazilian supply, was not completed, causing a supply trough likely to generate a price increase. Brazil tried to remain on the market to take advantage of the food sale conditions. But the availability of products in-situ was not able to satisfy demand. Brazil did continue its shipments, but by air-freight, which made them more expensive. At the end of the period, Thailand partially made up the product shortfall, also taking advantage of good sale conditions. The supply was topped up by Peruvian exports, though in moderate and irregular quantities, in particular because of the weather disruptions to which the country was subjected in March.