FruitTrop Magazine n°241

- Publication date : 12/06/2016

- Price : Free

- Detailled summary

- Articles from this magazine

For the fourth consecutive campaign, the Madagascan litchi industry has registered a positive balance, especially thanks to reinforced fruit quality, allied with its well-developed logistics. However, the well-oiled mechanism seems to be slowing somewhat on its road to success...

In 2015, the question of organisation of the Madagascan litchi export campaign was not raised. The results of the previous campaigns having been to the general satisfaction of the operators, there were no grounds for altering this winning strategy. Hence they retained equivalent volumes, the same logistical organisation, even chartering the same conventional ships! Thanks to relatively early production for the third successive season, the departure and therefore arrival dates of the conventional ships were also more or less the same. Behind this apparent immobility, fruit quality monitoring was intensified, through the renewal and upgrading of the certifications, and stepped-up analysis of residual sulphur levels. However, in view of the repeated good results from recent campaigns, there could have been a great temptation to increase volumes shipped to the European market. And this was the case, though to a limited extent. With an estimated total of 18 477 tonnes, the 2015-16 campaign beat the previous one by 687 tonnes.

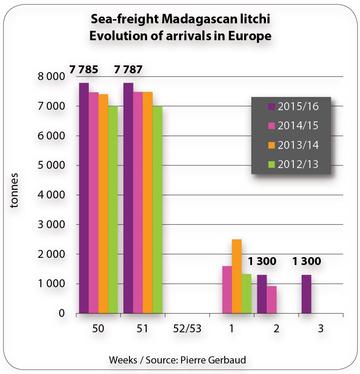

These quantitative results indicate a slight downturn in air-freight volumes, continuing the trend observed for the past several years, and an increase in sea-freight tonnages on conventional ships and container ships. The main rise has come from litchis arriving by conventional ships, with an additional 600 tonnes, whereas container volumes have gone up by only 80 tonnes or so.

The downward trend in air-freight volumes over the past few years has been confirmed, although it was distinctly less marked. Does the 300 tonnes of air-freight represent the only shipping route for this type of produce? Apparently so, since volumes have tended to evolve toward that equilibrium point.

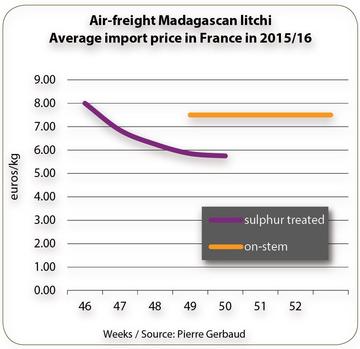

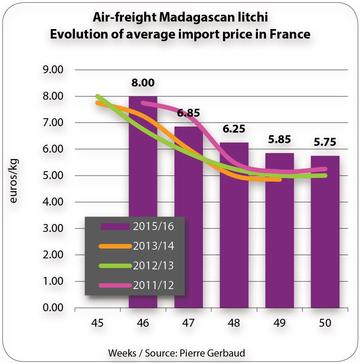

If we refer to the average price curve for the Madagascan air-freight litchi for recent campaigns, the general trend is the same, though at higher or lower levels. The 2015 campaign appears to be one of the best, with prices gradually following a downward trend as the supply progressed, though remaining on a higher footing. And this was in an equivalent situation in terms of the overall air-freight supply, which varies little from year to year, representing 1 200 to 1 300 tonnes of imports from across the Indian Ocean, and over the same five to six-week period. The price differences appear to be derived more from the positioning of the sources in the fruit marketing calendar and from their respective cost prices.

A comparison of recent campaigns seems to indicate that the massive early imports from Madagascar favour better sales results. This is what happened in 2015. The campaign started in week 46 with large volumes, while the competing Indian Ocean sources were practically absent. However, the campaign began in France in a gloomy context, the wave of attacks on 13 November logically reducing shop footfall. In week 47, volumes were already reaching their peak. Sales were fairly fluid, with moderate remaining volumes across Europe, and prices remained high. In weeks 48 and 49, the quantities received dwindled steeply, while the supply from other sources progressed. Although on a downward trend, prices stabilised at around 6.00 euros/kg on average. Incoming shipments in week 50 were small, helping bridge the gap to the first sea-freight litchis which were only available at the end of the week.

Madagascan litchi rates were also high due to the fruit quality. We are not talking here about the size, always heterogeneous, but the shelf life of the litchis, a factor which doubtless contributed to their satisfactory market performance. This unanimously highlighted point, though difficult to explain, was particularly important throughout the campaign.

During the air-freight campaign, some batches of on-stem fresh fruits were also sold at high and stable prices. Even though marginal, these shipments show the possibility of segmenting the previously monolithic Madagascan supply. South Africa has already taken this seemingly promising path.

The sea-freight campaign should have proceeded in roughly the same way as the previous one. Encouraged by previous results, operators increased volumes shipped to a moderate degree. The rehabilitated food safety image of Madagascan produce since the poor 2010-11 campaign, and the assurance of reinforced monitoring, could raise hopes of an increase in the supply to the European market and a quest for new outlets on other markets. The relatively early production was also pushing in this direction. Yet while the theoretical conditions seemed to have been fulfilled, the reality of the market proved more difficult than predicted.

The official opening of the campaign was declared on 19 November, i.e. two days later than in 2014, to ensure that sufficient volumes of fruits had reached maturity in order to fully load the first conventional ship. This apparently minimal difference would alter the marketing of this first cargo. Despite a rapid and efficient loading operation, the two days’ difference from the previous campaign could not be offset, and the first ship left Tamatave on 23 November. Passing the Cape of Good Hope and sailing up the African Coast at its maximum cruising speed, the first ship docked in Zeebrugge on 11 December, i.e. one day later than the previous year. Yet the vagaries of the calendar meant that 11 December 2015 was a Friday. Even the rapid unloading operation did not enable delivery to the stores for this big commercial weekend, unlike the previous year when unloading of the first ship began on Wednesday, enabling the merchandise to go on sale early. Apart from some shipments to nearby markets, sales only really began on Monday 14 December.

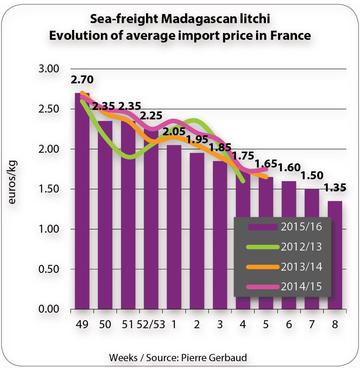

The cargo of the first conventional ship sold fluidly, driven by demand which was boosted by numerous promotions in European supermarket chains, scheduled during the preparation for the campaign. The weekend of 19 and 20 December, and then the days preceding the Christmas holidays, were favourable for massive sales. The sea-freight Madagascan litchis, alone on the market, were free from competition, which helped sales establish more attractive prices than the air-freight litchis still available.

The second conventional ship was loaded right after the first, though the operation proved more laborious because of multiple stoppages due to precipitation, which required the temporary closure of the ship’s holds. Topping up its cargo with containers on deck, this second ship finally took to sea on 26 November. It was received in Zeebrugge on Wednesday 16 December. The litchis were unloaded and stored in-situ to replenish the stocks of distributors for the New Year period.

In recent campaigns, the cargo of the second ship has helped supply the markets after Christmas, and bridge the gap with the first incoming shipments of container litchis, generally received at the end of the first ten days of the New Year. This pattern did not recur on the same terms this time around. While the cargo of the first ship sold fairly rapidly, the second cargo sold more slowly. The fall in demand following Christmas was more marked than usual. The fruit longevity was essential to avoid considerable damage. Demand kept dipping, in spite of the satisfactory quality of litchis, the attractive prices charged and a 53rd week in the calendar which extended the marketing period.

The supply expanded with the arrival of container litchis on 9 and 18 January, which swelled stocks, and with South African shipments reaching their peak. The slight jump in rates traditionally observed upon the first container litchis entering the market did not occur this year. Instead, prices followed a continuous linear slump. The downturn in demand was affecting sales of Madagascan litchis, but also of South African fruits, despite their greater freshness and overall size. The launch of promotions in mid-January in an attempt to revitalise consumption misfired, and prospects for invigorating the market conditions for the Chinese New Year proved disappointing. True, some chains continued selling the product, but outdoor markets closed for good, and the still substantial stocks were slow to disseminate through the French market, now congested and alone.

The campaign had a difficult end in a sluggish atmosphere where the spectre of the cycle of poor sales/qualitative deterioration/falling rates from the bad old years returned to haunt this final marketing period.

The overall economic balance of this campaign was positive, though probably less profitable for the industry players. Did pride came before a fall, in the form of believing in the possibility of increased tonnages? This does not seem to be the case, in the knowledge that the results of the previous campaigns were encouraging for development, and that they were well below the 24 000 tonnes from 2008-09. Perhaps the result of disregarding the economic situation still in crisis, and which has ended up falling into a kind of routine? Or could it be that this campaign is a reminder that the absorption capacities of the European market for the Madagascan litchi still seem fixed at around 17 000 tonnes?

We might also note the exceptional shelf life of the fruits, though again, no rational explication can be provided. Should the improved valuation of Madagascan litchis in future not be based on targeting fruit quality, and in particular size? This factor remains the main criticism from supermarkets and consumers. Though for the moment held back by the attractive sea-freight price levels, it could however encourage professionals to seek remedies, especially for the air-freight period and the end of the campaign. Could the concerted efforts made in the field of food safety or organic/Fairtrade certification not be reproduced for the purpose of improving fruit sizing?

Click "Continue" to continue shopping or "See your basket" to complete the order.