FruitTrop Magazine n°241

- Publication date : 12/06/2016

- Price : Free

- Detailled summary

- Articles from this magazine

Just like for the grapefruit and lemon, the market will be particularly clear from the start of the summer season, with the early end of the Northern Hemisphere campaigns. Prices should be high, given the supply which is set to be average for Navel and distinctly in shortfall for Valencia and similar varieties.

As an inevitable consequence of the production shortfall, the Spanish orange campaign wound down early. The last limited volumes of Navelate should be sold around the beginning of June. The season for Valencia and similar varieties, which got off to an early start and a lean one in terms of production, should also end early.

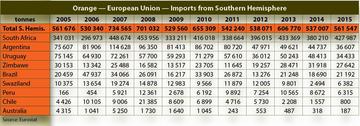

Meanwhile, the volumes from the Southern Hemisphere supplier countries are set to be stable or below average, depending on the varieties. South Africa, which provides approximately three-quarters of the supply to the Community market, is set for a normal export potential for Navel (25 million boxes, i.e. + 2 % on 2015 and within the four-year average). The good harvest level from the big production zones in the south of the country, where the majority of the cultivation area is located (Sundays River, Western Cape, Patensie) is helping make up for the shortfall from the more northern provinces hit by the drought (especially Senwes). The situation is completely different for Valencia, with the main cultivation zones located in the north of the country (especially Limpopo). The production shortfall is reportedly around +10 % on 2015 and the four-year average. The fall is particularly marked in the number one zone, Letsitele, but also in Senwes and even more so in Hoedspruit, which are among the country’s main production regions. While prices are still at a decent level, the EU-28 could perhaps take advantage of some volume transfers from other more fragile markets (Russia, which absorbs just over 10 % of total exports, and the Middle East, a strategic market which receives approximately one quarter of South African shipments, though probably more difficult this season).

Argentina and Uruguay remain in the leading trio of supplier countries to the EU-28 during the summer season, but they have lost a lot of ground (volumes primarily comprising Valencia, going from 60 000-80 000 t until the beginning of the decade to less than 40 000 t in 2015). These two countries could well fail to regain any ground in 2016. Their harvest, heavily concentrated in the coastal region, as it is for easy peelers, has been weakened by rain. Furthermore, the sanitary inspections will be even stricter for this late orange, highly susceptible to black spot, than for the rest of the range. Finally, the competitiveness problems are the same as those already mentioned for easy peelers (Customs duty, etc.).

Click "Continue" to continue shopping or "See your basket" to complete the order.