FruitTrop Magazine n°243

- Publication date : 22/09/2016

- Price : Free

- Detailled summary

- Articles from this magazine

As volume and price remain on a simultaneous upward trend, we draw ever closer to perfection. Yet when the fall inevitably comes, it will be all the harder! Some are predicting it for the autumn. Since the worst is never certain, we have to savour this moment, draw the lessons from it and in future gather together the factors which have underpinned the success of the past few years.

In 2016, European consumption should reach the symbolic 6-million tonnes mark! There is little risk of falling short, since it has practically reached this mark over the past twelve months (2nd half of 2015 and 1st half of 2016). Over the first six months of 2016, the market was up 4 % by volume. This fine dynamic has now been ongoing for some time. Over the past 42 months, annual consumption (12-month sliding scale) has slipped back only seven times. The EU has been steadily consuming more and more bananas, back to early 2013. If this trend is confirmed, at the end of the year the world’s biggest market will have been through a continuous growth period of four years. Alongside France’s post-War Golden Decades, these four years might seem like a tiny moment of fortune; yet on the banana time-scale, this is close to an eternity.

If things have been very good on the volumes side, wouldn’t they have been very bad on the price side? Since, according to the most conventional economic theory, one always comes at the expense of the other. Very fortunately, as is often the case in the banana sector, reality does not match theory. The market works in an unorthodox fashion, to say the least. The more consumption volumes increase, the more prices, at certain stages, increase too, or at the least remain stable.

First, let’s look at retail prices. Many European countries are seeing inflation. In both Germany and France, prices in the conventional distribution sector and the discount stores (Germany) or even promo prices (France) gained between 3 and 4 % (1st half of 2016 as compared to 2015). The trend is the same for the Canaries platano, which exceeded the 2 euros per kilo mark in retail (+ 3.4 %), while volumes supplied by Spanish producers were at record levels. Indeed, we need to go back twelve years to find trade activity as high as in the 1st half (more than 200 000 tonnes). Conversely, the dollar banana retail price was down, by just 1 %. In Italy, retail prices also saw a modest decrease (-1.2 %). In the Czech Republic, there was a more considerable drop than elsewhere, doubtless due to the effect of very lively competition from the apple and orange, prices of which have been particularly competitive since autumn 2015.

The situation in the United Kingdom is infinitely more complex to decode. Recent developments (1st half) could be the result of various forces: monetary considerations (pound down by nearly 20 % against the dollar and the euro under the effects of the Brexit referendum campaign and result), a high average import price in the Eurozone, close to the records of 2015 and also 2012 (see Cirad barometer), as well as the desire by the various distributors to continuously bring down prices for the consumer, as they have been doing for years. While the first two factors tended to push sterling banana prices in the UK, it was the latter factor, commonly known as the “price war”, which apparently told on the trend. True, retail prices remained stable for the loose banana, but dropped dramatically by 11 % for the pre-packed category.

The situation is clearer for import prices. The excellent situation in 2015 was confirmed in the 1st half of 2016. The indicator produced by Cirad (barometer) registered an import price of 14.3 euros/box in 2016, as opposed to 14.4 euros/box in 2015, again for the 1st half. The summer of 2016 after this half (July and August) was fine in terms of price, although the period came to a more difficult end. Nonetheless it appears that the summer, a time of high commercial risk for the banana, is no longer the spectre that it used to be. For years, operators have trimmed their procurement programmes, and the biggest crises were back in 2011 and 2012. So much for the general picture.

Looking at each market close-up, the situations reveal some interesting particularities. Let’s examine various European markets, especially the United Kingdom and Germany. These two countries have a high degree of contractualisation between traders and the supermarket sector. This trend of aiming to set a delivery price to the distributor in advance (up to one year ahead) is taking hold throughout Europe. Hence looking into the behaviour of these contractualised systems is essential for the decision makers. As we will see, it is difficult to decide between the contractualised mode and spot mode. First let’s take the German market, on which we can measure, going back several years, the relative evolution between “contract” green banana prices and so-called “free market” prices. Looking at the 1st half of 2016 alone, we might categorically conclude that the operators who opted out of contractualisation with the distribution sector made the better economic decision for their business. Indeed, they would have increased their takings by approximately 1 euro per carton. However we should be wary of seeing this as a fixed rule, since the bonus was just 11 eurocents in the 1st half of 2015, though 43 eurocents for the same period of 2014. 2013 saw the reverse trend, since the contract market earned 75 eurocents more per box than the spot market. Hence if we excluded 2013 from the analysis, we might easily conclude in the benefits of the free market.

Yet that is only true for the 1st half, since the same analysis for the 2nd half completely reverses the conclusions. Over the last three years (2013 to 2015), there has been a major shortfall. The spot rate is 0.5 to 2.8 euros/box below the contract rate. The annual average confirms the effectiveness of the contract market, which brings in at least the same as the spot market (2014), and up to 9 % more, as in 2015. Hence drawing a conclusion based on the exceptional results of the 1st half of 2016 would be to ignore the annual dynamic of the European banana market. Especially as the market conditions in 2016 created a particularly favourable cycle, according to some even historically favourable, for the banana sector. In short, the dollar banana supply was restrained, demand very lively and competition from seasonal fruits moderate. We should recall that in France, for instance, fruit retail prices increased by 70 % between 2015 and 2016!

Let’s finish our analysis of the German market by looking at the consumption level, in order to check whether there is a positive link between market contractualisation and growth of volumes. We cannot help but observe that, if there is a cause-effect relationship, it is adversely affecting consumption. While European imports in the 1st half of 2016 increased by 5 %, German consumption ebbed by 5 % from the same period in 2015. Of course, it is too simplistic to seek a categorical link between contracts and consumption, such is the number and variety of influences to which the markets are subjected. In addition, Germany already has a high banana consumption per capita. However, to explain this rather worrying phenomenon, we might propose the hypothesis that in wanting to structure its market excessively (difficult for ACP bananas, calls for tenders which benefit only large-scale operators, long-term contracts, etc.), Germany is snuffing out any potential dynamic. It has slipped into a routine discouraging risk taking, especially in terms of volume, to protect a price and market share for the benefit of the players already in place. Unfortunately, this model is being imitated, especially in the Czech Republic, whereas this country is exhibiting a great consumption dynamic (+ 30 % in three years).

The French market, for other reasons, also seems to be losing momentum in terms of volumes consumed, which have been stagnating at around 290 000 tonnes in the 1st half, for three years. Yet on the other hand, it is no longer Europe’s ugly duckling, which used to export its imbalances to other Member States. Its main operators have realised that they needed to stop eroding value, not to mention the in-depth marketing work carried out, especially by the producers themselves. Of course, particular market conditions (supply shortfall, competition from seasonal fruits, protective effect of the fall in the euro against the US dollar, etc.) have contributed to getting things back on an even keel. However, we might once more underline that this was done in large part by sacrificing the volume growth dynamic. It is perfectly clear that it is still difficult to reconcile protection of added value with increased volumes. Indeed, this is the challenge facing France’s new Banana Interprofessional Association (AIB).

Italy is without doubt a perfect opposite of the German model. Increased competition between operators (due to the end of an association contract between two big players) has been brought about by increased volume availability, without green banana or retail prices being sacrificed. As proof, consumption in the 1st half saw a strong 9 % increase between 2013 and 2016.

It would be too easy to take the view that a high degree of market structuring prevents any rise in volumes consumed. It may also have differing effects. The United Kingdom, which has been a highly contractualised market for a very long time, has seen rising volumes. The analysis for the 1st half shows that between 2013 and 2016, volumes consumed climbed by 3 %, the same as between 2015 and 2016 (an atypical year). Yet we should beware hasty conclusions, since we are a long way from the economists’ principle of “all other things being equal”. What distinguishes the United Kingdom from Germany is the very different behaviour of its supermarket sector. Over the period of interest, the 1st half of 2016, pre-packed banana retail prices collapsed by 11 % in the United Kingdom, whereas they increased by 3 to 4 % in Germany. To put it in economic jargon, the land of Brexit seems to have high elasticity.

Besides the volume analysis, there is nonetheless the impression that the British market is in deadlock in terms of value. NGOs such as Oxfam or Bananalink did not wait for 2016 to condemn the value slashing operations by the supermarket sector, and its repercussions on the upstream segment. Since the anticipation and confirmation of the Brexit vote sent the pound sterling plummeting against both the euro and the US dollar, with a depreciation of around 20 %. Furthermore, the European green banana price maintained very decent levels. So suppliers to British distributors suffered a double blow. Paid in pounds by the distributors (the currency in which the contracts are set), the importers & ripeners purchase their merchandise in euros or US dollars from the producers. So there are three ways for an intermediate operator to take this hit. It may either increase its sale price if the contract permits (revision clause), see its accounts deteriorate, or pass the cost upstream, to the producers. In April 2016, Fyffes, one of the big operators concerned, indicated that it wanted the distributors to accept a price increase, even if it meant passing on the increase to the retail price. In view of the figures, it seems clear that this was not the case, since pre-packed prices collapsed. Since Fyffes did not announce a deterioration in its accounts, everything seems to indicate, as in practically all value chains, especially commoditised ones, that the bill will ultimately be paid by the most fragile members of the industry — the producers.

After an idyllic first half and a summer spared the often ravaging crises of the past, what are the prospects for the banana market in the short term? Late August indisputably marks a change in the campaign profile. Demand seems slower (heatwave, stronger competition from seasonal fruits, etc.) and the supply is expanding. Colombia is making a comeback. Ecuador, seemingly down slightly at the end of the summer, still retains a massive potential. Costa Rica is back with a vengeance. Guatemala is beating record after record. The autumn and winter are set to be difficult.

To that we need to add the conjecture over the African supply level. We know that the export banana cultivation area is expanding in Côte d’Ivoire, and that there are projects (extension or relaunches) in the planning or development stages in Cameroon and also Ghana. We also know that, over the months and years to come, the potential availability from Africa will be almost entirely aimed at the European market alone. Although the regional markets are setting out to expand, their rise to the fore will be painfully slow.

However, we should not lose sight of the relative importance of the forces in play: if there are thousands of hectares in Africa, there are hundreds of thousands in Ecuador. Every week, Guatemala exports 1.8 million boxes, i.e. more than Colombia, though the figure was barely 1 million in 2013. So yes, the market balance over the coming months and years will be down to Africa’s ability to manage its growth as best it can. However, the potential is also growing elsewhere, often more rapidly and with more scope.

While the supply is dynamic, demand is too, as could be observed in certain EU countries. Furthermore, this is one of the main factors helping the green banana price stabilise at decent levels. Since, without strong demand, we would have ended up consuming the entire supply produced, but in that case prices would have been revised downward. What is extraordinary here is that both indicators (price and volume) were both revised upward: a miracle which has not happened everywhere. In the United States, although prices have maintained a positive trend — as far as we know — volumes consumed have not risen (+ 1.2 % in the 1st half of 2016), in any case barely more than the population growth rate (+ 0.8 %). The same has been true over the past three years. Should we see in this yet another example of a market fossilised by contractualisation?

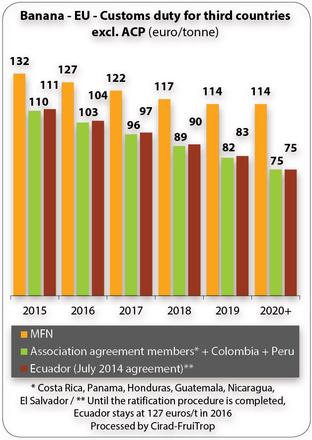

As for external factors, there will be very traditional fears over the European apples and pears campaign, which opens in September and is set for a record practically throughout Europe (see “European apples and pears in 2016” article in this edition of FruiTrop), and the end of the seasonal fruits campaign, which should be leaner than usual. Away from the market itself, there will be interest in whether the Russian embargo on European fruit will be lifted, but also in the evolution of exchange rates, with a possible rise in the US dollar if the FED implements its monetary stringency plan by increasing official US interest rates. Climate vagaries may once more change the hand, with cyclone activity set to be highly dense, but the La Niña phenomenon expected to have very little effect on the banana zones. In terms of regulations, we are still awaiting the entry into force of the reduction in customs duty for Ecuadorian fruits. From 1st January 2017, the customs duty for the main Latino-American suppliers (including perhaps Ecuador) will fall below 100 euros/tonne to 96 euros (or 97 euros for Ecuador).

In this highly changeable context, it is difficult to find the right path. According to the operators questioned on this subject, they are all aware that we have just been through an exceptional period when the planets were perfectly aligned and that they will need to very quickly kick the habit of the prices charged during the 1st half of 2016 and of constantly increasing consumption volumes in Europe. And that is never an easy exercise for anyone.

Click "Continue" to continue shopping or "See your basket" to complete the order.