FruitTrop Magazine n°243

- Publication date : 22/09/2016

- Price : Free

- Detailled summary

- Articles from this magazine

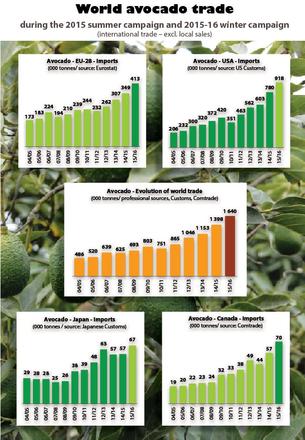

“Faster, higher, stronger”. The avocado professionals seem to be following to the letter this ancient call to surpass oneself, which was adopted as the motto of the modern Olympic movement by Baron De Coubertin. By the by, we might even add that they are outdoing the athletes in Rio since they are setting new records every year. 2015-16 undeniably saw a gold medal performance: by exceeding a trade volume of 1.6 million tonnes, the world market went up by more than one quarter of a million tonnes from the previous season, confirming the acceleration trend in growth registered since 2014-15.

The procurement profile proved to be very different during the two main trade seasons covered by the period analysed (from spring 2015 to late winter 2016). Unlike in previous seasons, the production available in the countries supplying the world market during the summer campaign proved no more than stable in 2015 (see FruiTrop 240). On the one hand, while the South African harvest achieved a good level, it was less plentiful than during the record season 2014. On the other hand, and above all, Peru did not play its usual driving role. Climate vagaries counterbalanced the entry into their production prime of the vast surface areas planted since the end of the last decade. This stability contrasts with the distinctly rising volumes available during the winter season. However, Mediterranean production proved limited. The heatwave of spring 2015 hit all the Mediterranean exporter countries hard, with the zone’s meagre planting dynamic only able to slightly mitigate the adverse effects of this climate vagary. However, the supply from the Latin American supplier countries was at very high, or even record levels. Chilean producers regained a normal production level, and in so doing, their good cheer after a long period of difficulties, especially because of a recurrent drought. In addition, the rather clement weather helped boost the very strong growth of the Mexican cultivation stock, with production exceeding 1.6 million tonnes (i.e. one third of the worldwide harvest). Meanwhile Colombia emerged from the shadows, with exports exceeding the symbolic 10 000 t mark for the first time.

The more you eat, the hungrier you become? This paradoxical saying actually seems to be right on the mark if we analyse the evolution of the US market, growing ever bigger and more dominant (with a consumption of nearly 1.1 million tonnes in 2015-16). US consumers have not been sated, despite a decade of a steeply rising supply, and are continuing to demand more and more avocado, as is demonstrated by the annual growth, which went from 10 % on average for recent seasons to an exceptional 20 % in 2015-16. The promotion system set up by the Hass Avocado Board, with its budget now set to approach 50 million USD, is definitely a formidable selling machine, from which many industries should take inspiration. Weekly consumption saw several completely new peaks at more than 20 000 t in the 2nd half of 2015, and even at more than 25 000 t during the 1st half of 2016, a figure which represents half of the total seasonal exports of a country like Israel or South Africa.

While procurement by the big US market of Californian avocados was mixed (rather high during the first half of 2016, but limited during the latter half of 2015), procurement from Mexico was extremely high. With more than 850 000 t exported to the United States in 2015-16, this source alone accounted for more than 80 % of the total market procurement, and for 93 % of imports! The constant rise of this market share shows how difficult it is for competing exporter countries just to hold steady against the Michoacán steamroller, despite the strong growth in consumption. Chile has plateaued out for the past two seasons at 10 000 t, i.e. one tenth of what it was a decade ago. The Peruvian Hass has still not managed to take root, with shipments on a constant decline after the fine performance achieved in 2014, the first full season that the US market was opened. This provides food for thought, while the Mexican giant is seeing its production rise at an increasingly rapid tempo, and the US market is opening its doors ever wider (see following article).

This relentless rise in volumes placed on the US market has of course not been without consequence for prices. The scale of Mexican shipments put the market under pressure from early August 2015 to early June 2016, especially since the proliferation of small operators in recent years is an additional factor for instability. Rates slipped below the 7 euros per 4-kg box mark (less than 20 USD/25-pound box or “lug”) in October, December, February and late April. So the end of the 2015 season and the first part of the 2016 season were particularly difficult for Californian producers, especially since the lucrative large fruits segment was not spared, with the Mexican Hass achieving above-average sizing. The market average price of 1.45 USD/kg (calculated by the California Avocado Commission), during the period running from November to April, is certainly close to the red zone, if not in the red, for certain producers especially in the south of the State, where the irrigation costs are highest (average production costs of around 15 000 to 17 000 USD/ha for an average yield of around 11 tonnes/ha). Fortunately, the excellent prices charged during the second half of the season, when the majority of Californian fruits are sold, helped restore the balance. Mexican operators also suffered from this long period of low prices, though without endangering their financial balance, since its production cost structure is very different from that of California (production cost estimated at between 4 500 and 5 500 USD/ha for an average yield of around 10 t).

Unlike the United States, the Community market enjoyed an unblemished record for the 2015-16 season. First of all, the volumes on the market were exceptional (nearly 420 000 t). This new year of strong growth confirms a change of gear for the European market, with a consumption gain of more than 200 000 t since the beginning of the decade, i.e. an annual growth rate of 14 to 18 %. The spread of pre-ripening has definitely radically changed the face of the market! Just for once, it was the winter campaign which provided the bulk of the growth in 2015-16, and more specifically the South American Hass specialists, in the context of the Mediterranean production shortfall mentioned above. Chile remained the number one supplier to the Community market, with record volumes of close to 80 000 t. Furthermore, Colombia joined the big league, by exporting more than 10 000 t to Europe for the first time. Yet most of all, Mexico did much more than confirm a trend of returning to the Old Continent, apparent since 2012-13. Without abusing the expression, we might say that the Hass shipments from Michoacán and Jalisco have exploded, going from less than 13 000 t in 2014-15 to more than 45 000 t in 2015-16.

Unlike the US market, the big increase in volumes in the European Community did not come at the expense of prices. Conversely, our performance indicator (based on the import rates for the size 18) exceeded the 10-euros mark for the first time. Again, the winter season provided a surprise with the price index climbing by 2 % in a context of a 30 % increase in volumes (more than 240 000 t on the market)! According to our indicator, Hass rates maintained an exceptional level, of between 9 and 10 euros from October to December, and then 11 to more than 12 euros from January to May (with peaks at 13 euros in April, just as in 2015). So this season the Community market achieved an even better performance than the US market, in terms of both volumes and price.

While it is still the same quartet leading the dance in Europe, it is increasingly clear that not all the musicians are playing at the same tempo. France remains undeniably the lead soloist, with consumption for the first time in excess of the symbolic 100 000-t mark. Nonetheless, the UK is now hot on its heels, with volumes on the market rising by more than 20 000 t between 2014-15 and 2015-16. This is a phenomenal boom, largely due to the much greater attractiveness of the pound compared to the euro throughout most of the season, until the Brexit referendum. Scandinavia retained its third place, but is tending to level out. Norway and Denmark confirmed their position as European leaders in terms of consumption per capita (more than 2.4 kg/year) and are continuing to rise. Conversely, Sweden, with its population of 10 million, saw a decrease for the second consecutive year. Germany remained in fourth place, but is rapidly making up ground with another great performance this season (rising by approximately 7 000 t for the second year). The awakening of Italy to the avocado has also been confirmed, with consumption exceeding 10 000 t for the first time. Conversely, the high price of the fruits has destroyed the fine growth dynamic in place since the beginning of the decade in Eastern Europe. This new year of a fine Community market dynamic will doubtless pave the way for others: the average consumption is still barely more than 900 g/capita in Western Europe, a level far removed from the 1.5 to 2.5 kg seen in the established consumer countries. To mention only the country with the biggest growth margin, the 8o-million population of Germany currently consumes barely more than 500 g/capita, with the pre-ripened revolution just underway. The European market still has some fine times ahead!

Among the four main gateways to the Community market, through which 90 % of volumes from the production zones pass, some are tending to open ever wider. The Netherlands, which handles approximately 40 % of volumes, remains by far the main route. France is still a major access point via which nearly 100 000 t of avocado (i.e. approximately its consumption level) enter, though its share of overall imports is on the wane. Conversely, two countries are exhibiting a fine dynamic and have seen their share go from approximately 10 % to 15 % in recent years. The growth of imports into the UK will come as a surprise to no-one, given the country’s exceptional consumption dynamic. It now directly imports slightly less than its annual consumption level. The growth in Spanish imports is only due in part to its local market. Indeed, certain supermarket chains now prefer to work with the South American Hass, more attractive in terms of price than the produce from Axarquia. Yet most of all, the big private Spanish operators are increasingly tending to position themselves as global players on the European market, no longer solely during the summer season but also during the winter. By way of example, Spain imported nearly 18 000 t of avocado from Mexico in 2015-16, i.e. one third of the total volumes into Europe.

Outside of North America and Western Europe, are there any alternatives for an avocado exporter? True, these two enormous markets continue to absorb more than 85 % of world flows, with North America carving out the lion’s share with approximately 60 %. Nonetheless, the Asian markets are now a long way from being marginal. Total imports exceeded 100 000 t for the first time in 2015-16, mainly thanks to the dynamic of two big countries. On the one hand, the Japanese market is back on the growth trail after three completely flat seasons. On the other hand, China is now visible on the international trade radar. This is a noteworthy development, especially since it is starting to be backed up by investment from big players in the worldwide avocado trade (construction of a ripening plant in Shanghai by the Mission group). Yet nor should we start dreaming, since while imports tripled between 2014 and 2015, volumes remain less than 25 000 t (combined for China + Hong Kong + Macao).

There is plenty of good news: 20 % annual growth in the United States, 30 % during the winter season in the EU-28, resumed consumption dynamic in Japan, the emergence of a market in China, etc. Yet we should not forget that the world cultivation area is not static (see next article). Promotion efforts must not be relaxed, and the World Avocado Group, dedicated to worldwide promotion of the avocado, must not be left at the stage of a great idea.

Click "Continue" to continue shopping or "See your basket" to complete the order.