FruitTrop Magazine n°243

- Publication date : 22/09/2016

- Price : Free

- Detailled summary

- Articles from this magazine

After the turbulence of Q1 2016, the plantain banana rate saw a quieter period in Q2. The yam and cassava market conditions were more troubled given the more irregular imports. The other products followed a linear trend.

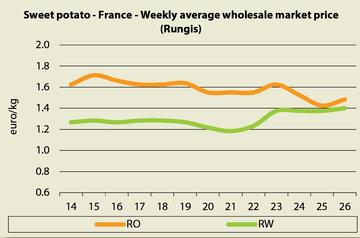

A major white-fleshed sweet potato supplier, Egypt was present until early June, thus registering a campaign a half-month shorter than the previous year. The rate for this produce remained steady throughout the period. South Africa and Honduras also shipped white-fleshed sweet potatoes throughout Q2. Sales of South African produce were stable at around 1.40 euro/kg on average. Honduran produce was better valued (1.60 euro/kg) from April to mid-May, when its price dipped close to that of South African produce.

Israel, the United States and Honduras shared the orange-fleshed sweet potato supply, with some price differences in favour of Israel, which earned the highest value. The fall in Israeli shipments and the temporary suspension of US shipments in May helped rates for the Honduran produce recover somewhat. Usually a marginal presence on this market sector, South Africa too supplied orange-fleshed sweet potatoes, enabling it to vie with Israeli produce in April, May and at times in June.

Puna or white yams from Ghana sold steadily until mid-May at the usual prices. Rates then took off, reaching particularly high levels in June, in excess of 2.00 euros/kg. This rapid rise seems to be due to the combination of a smaller supply from Ghana, which came at the end of the commercial campaign, and to a resurgence in demand during Ramadan. As Ghanaian produce became rare and of mediocre quality, the market made its procurements from other sources such as Brazil, with white yams and couscous selling at high prices. The new Ghanaian harvest should make its appearance in July.

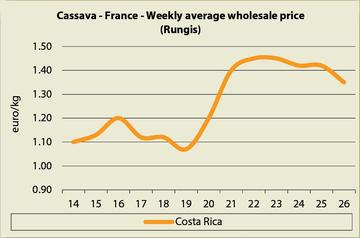

Ranging between 1.10 to 1.20 euro/kg until mid-May, the cassava rate from Costa Rica, the main supplier of this product, increased considerably to in excess of 1.40 euro/kg until the second half of June. It then subsided, but remained high. This increase in the cassava rate visibly followed the same trend as the yam, with a fall in supply as demand became more insistent.

The Costa Rican eddoe rate was particularly stable during Q2, with an average price of 2.00 euros/kg. This average conceals a big price gap of between 1.80 and 2.50 euros/kg, depending on the size and freshness of the produce on the market. Some Ecuadorian and Chinese batches were also sold, though at distinctly lower prices.

Click "Continue" to continue shopping or "See your basket" to complete the order.