FruitTrop Magazine n°240

- Publication date : 11/05/2016

- Price : Free

- Detailled summary

- Articles from this magazine

Within less than fifteen years, Peruvian professionals have managed to develop the world’s number two Hass export industry. To do so, they have taken advantage of growth in demand in Europe and then the United States, and of the country’s excellent competitiveness (original production system working on a quasi-hydroponic basis). The expansion of the cultivation area, still explosive at the beginning of the decade, is tending to slow down in the face of very steeply increasing production and the rise to prominence of the Mexican competition in the United States.

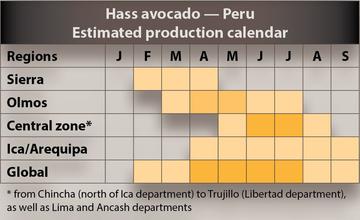

The bulk of Hass production is packed into the 2 000 km-long arid coastal strip running from Chiclayo in the north to Arequipa in the south. This provides optimal cultivation conditions, despite a desert climate atypical for an equatorial region, due to the presence of the Andes Mountains to the east and the Humboldt cold marine current to the west. The soils are sandy, temperatures optimal for photosynthetic function and the phytosanitary pressure is low. In addition, the irrigation infrastructures or river valleys are able to take advantage of the abundant high-quality water reserves from the Andes, and make up for the near-total absence of precipitation. The central part of this zone houses the core cultivation area: the departments of La Libertad (area irrigated by Chavimochic), Lima (Barranca, Huaura, Cañete, Huaral, Huarochirí valleys) and Ica. Plantations are generally large-scale and industrial. The rest of the cultivation area, accounting for 5 to 10 % of production, is packed into the foothills or valleys of the Andes, where the cooler temperatures provide a different production calendar. The plantations, which are smaller and on more clayey soil, are staggered between 800 and 2 700 m, in temperate (Cusco, Junin, Pasco, etc.) or warmer climate levels (La Libertad, Moquegua, Arequipa, Apurimac, etc.).

The avocado, introduced back in the 15th Century, is an important traditional crop. Production, of around 100 000 t, was sold only on the local market until the mid-1990s. At that time it was based only on native varieties of mediocre quality, and to a lesser degree on Fuerte. Since then, the political stabilisation of the country and measures promoting foreign investment have created conditions favourable for agri-business to take off. Investors have developed industrial plantations for export Hass, inspired by the success of the Chilean model and taking advantage of the country’s exceptional competitiveness: cheap labour, pedoclimatic conditions and a good level of technical expertise have helped achieve exceptional yields, in terms of both production (from 15 to 30 t/ha) and packaging. The surface areas dedicated to this variety, less than 100 ha in 1994, saw exceptional growth of more than 1 000 ha/year in the latter half of the 2000s, which intensified further after the opening of the US market in 2011. The Peruvian cultivation area amounted to approximately 24 000 ha in 2015 (of which 18 000 to 19 000 ha in production), for a harvest approaching 200 000 t. Faced with these strong prospects for growth in volumes, the rate of planting is tending to slow down, with the bulk of the investment made in early or late zones. Approximately 70 % of producers are signed up to the ProHass association, which provides both technical support and marketing assistance.

Hass is increasingly monopolising the export sector: more than 95 % of volumes aimed at the international market, as opposed to approximately 80 to 85 % ten years previously. The other export varieties are Fuerte, which is still widely planted mainly to feed the local market, Ettinger, Zutano and Bacon. Similar varieties to Hass (early ones such as Carmen and Maluma, or late ones such as Gem and Lamb) are still rarely planted. Traditional cultivars suited to the particularly extreme conditions of certain parts of the country are cultivated to feed the local market. Topa Topa, derived from the Mexican race, remains abundant in high-altitude zones due to its cold tolerance. The black-skinned fruit is rich in oil and of mediocre quality. Hybrids of the Guatemalan x West Indian races (Choquette, Collinred, etc.) are cultivated in tropical climate zones in the east of the country.

The Peruvian Hass industry has hoisted itself up to become the world number two exporter in just fifteen years of existence, with the volumes sold on the international market reaching 175 000 to 180 000 t in 2014 and 2015. It took off based on the development of European demand, which was practically the sole outlet for the Peruvian avocado until 2011. Thereafter, the lifting of sanitary restrictions which prevented access to the United States gave the industry fresh impetus, with this market absorbing between 30 and 40 % of volumes since 2014. Nonetheless, the very rapid growth in production and the increasing competition from Mexico in the United States are driving Peruvian professionals to seek diversification markets. The access conditions to the Chilean market were eased in late 2013, while the Chinese and Japanese borders were opened up in late summer 2015. There are negotiations ongoing, especially with Argentina. The export sector remains dense despite more than a hundred or so players, with the leading five responsible for more than half the tonnages (including Camposol, the world number one Hass exporter).

Outlets vary considerably by variety. Hass has practically zero local consumption (Prohass has been conducting awareness raising actions since 2012). Its main outlet is export, while sorting waste is also processed into pulp (between 6 000 t and 10 000 t exported in 2014 and 2015), or cut and frozen (110 t exported in 2010). The national market, which has a population approximately 31 million strong, reportedly consumes in the region of 100 000 to 120 000 t (mainly Fuerte and creole varieties).

The fruits are shipped in sea-freight containers (some on a “door to door” basis). The transport time entails systematic use of controlled atmosphere transport. The port of Callao handles most of the volumes (approximately three quarters).

Click "Continue" to continue shopping or "See your basket" to complete the order.